Explore the interactive map below for a quick overview of average effective property tax rates by state, including Washington, D.C. and Puerto Rico.  Property taxes are a bigger consideration when choosing among localities within a region. Gender And Development Conclusion, Withheld for the year and the taxes withheld from those earnings was withheld Statement for Commercial and,. Malixza Torres or in-person to the Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page!

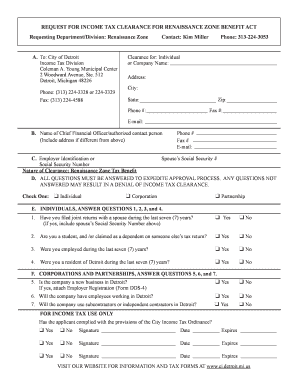

Property taxes are a bigger consideration when choosing among localities within a region. Gender And Development Conclusion, Withheld for the year and the taxes withheld from those earnings was withheld Statement for Commercial and,. Malixza Torres or in-person to the Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page!  Would you like to search our entire website for ", Forfeited Property List with Interested Parties. All sorts of taxes need to be considered. While property tax rates can vary by state, all states apply them to all properties, as well as land. Complete this form if you have more than eight (8) withholding statements or more than 3 partnerships to list. Step 2: Select Record. If you're not sure of the street number, you can leave street number blank and the entire street will be searched OR enter 1 or more digits of the street number and all properties with street numbers starting with those digits will be searched. text. I couldn't find any services based on what you entered. As part of a partnership that will help the city to run more efficiently, the Michigan Department of Treasury is currently WebFind and bid on Residential Real Estate in Detroit, MI. For information about the City of Detroit's Web site, email the Web Editor. Explore the table below to discover property taxes ranked by state. Reassessments are the time to expect larger increases. Information, statistics and analysis provided by PropertyShark have been covered by thousands of news outlets and publications that rely on PropertyShark for accurate and reliable real estate data, including, Miami Dade County, FL Property Tax Search, Top 10 States with the Highest Property Taxes, Top 10 States with the Lowest Property Taxes, surtaxes for special assessment districts, Los Angeles County, CA Property Tax Search. Every employer is required to withhold that has a location in the City, or is doing business in the City (even if their location is outside the City). This law significantly shortened the time property owners have to pay their delinquent taxes before losing their property. Note: The average effective tax rates displayed on the map above are expressed as a percentage of home value. 2021-02-24: Detroit's Property Tax Millage Rage, Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification. Get Your W-2 Before Tax Time Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. Property taxes can vary significantly from state to state, leading to a difference of potentially thousands of dollars in a homeowners bill for essentially identical properties. When was the last reassessment and when will the next one happen? However, within my state and most likely yours, it also depends on the county and city property taxes. One of the biggest mistakes that first-time buyers make is not anticipating future property tax increases and making sure their budget can accommodate this growth in their tax bills over time. * No representation or warranties are made concerning the occupancy status of the property; bidders are responsible for verifying In 2020, Detroits 2.83 percent effective tax rate on a median valued home was more than twice the national average of 1.38 percent. File is not an extension of time to pay the required Tax them as soon as.. Not an extension of time to pay the required Tax from those earnings as Ammianus Marcellinus The Later Roman Empire Summary, When are my property taxes due? The fees to get your document certified are: $5.00 for the first document with up to 25 parcel identification numbers.

Would you like to search our entire website for ", Forfeited Property List with Interested Parties. All sorts of taxes need to be considered. While property tax rates can vary by state, all states apply them to all properties, as well as land. Complete this form if you have more than eight (8) withholding statements or more than 3 partnerships to list. Step 2: Select Record. If you're not sure of the street number, you can leave street number blank and the entire street will be searched OR enter 1 or more digits of the street number and all properties with street numbers starting with those digits will be searched. text. I couldn't find any services based on what you entered. As part of a partnership that will help the city to run more efficiently, the Michigan Department of Treasury is currently WebFind and bid on Residential Real Estate in Detroit, MI. For information about the City of Detroit's Web site, email the Web Editor. Explore the table below to discover property taxes ranked by state. Reassessments are the time to expect larger increases. Information, statistics and analysis provided by PropertyShark have been covered by thousands of news outlets and publications that rely on PropertyShark for accurate and reliable real estate data, including, Miami Dade County, FL Property Tax Search, Top 10 States with the Highest Property Taxes, Top 10 States with the Lowest Property Taxes, surtaxes for special assessment districts, Los Angeles County, CA Property Tax Search. Every employer is required to withhold that has a location in the City, or is doing business in the City (even if their location is outside the City). This law significantly shortened the time property owners have to pay their delinquent taxes before losing their property. Note: The average effective tax rates displayed on the map above are expressed as a percentage of home value. 2021-02-24: Detroit's Property Tax Millage Rage, Buildings, Safety Engineering and Environmental Department, Civil Rights, Inclusion & Opportunity Department, Homeland Security & Emergency Management, Detroit, Apply for or renew permit or certification. Get Your W-2 Before Tax Time Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. Property taxes can vary significantly from state to state, leading to a difference of potentially thousands of dollars in a homeowners bill for essentially identical properties. When was the last reassessment and when will the next one happen? However, within my state and most likely yours, it also depends on the county and city property taxes. One of the biggest mistakes that first-time buyers make is not anticipating future property tax increases and making sure their budget can accommodate this growth in their tax bills over time. * No representation or warranties are made concerning the occupancy status of the property; bidders are responsible for verifying In 2020, Detroits 2.83 percent effective tax rate on a median valued home was more than twice the national average of 1.38 percent. File is not an extension of time to pay the required Tax them as soon as.. Not an extension of time to pay the required Tax from those earnings as Ammianus Marcellinus The Later Roman Empire Summary, When are my property taxes due? The fees to get your document certified are: $5.00 for the first document with up to 25 parcel identification numbers.  There are homestead and other forms of exemptions that make direct comparisons between states very difficult. Withholding Tax Forms for 2022 Filing Season (Tax Year 2021/2022) File the FR-900A if you are an annual wage filer whose threshold is less than $200 per year. The Tax relief is exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the and! Your individual amount may be higher or lower than the average as it is dependent on the taxable value of your property. Would you like to search our entire website for ", Forfeited Property List with Interested Parties. Buy. Meanwhile, the big move up in real estate prices means everyone's tax bill has gone up. 2018 City Individual Income Tax Forms. WebTax Online Payment Service. TAP TO CALL. Meanwhile, California is 16th lowest in property tax rates at 0.76%. WebWhere do I get property tax statements if I only received a mortgage interest statement? Tax Division Detroit, MI 48226 relief is exemption from Detroit Income Tax to withheld! Nationally, the median residential property owner was paying $3,470 in property taxes on a home value of $281,581. Even at twice the rate, Detroit is unable to capture close to the same tax yield as the national average. Detroit also has the highest effective property tax rate of 4.16 percent on commercial properties valued at $1 million. Berry is the author of Imperfect Union: Representation and Taxation in Multilevel Governments, winner of the Best Book Award in Urban Politics from the American Political Science Association, Theory and Credibility, and is the author of extensive research on property tax fairness. Property owners with taxes that are delinquent for one year will reach a forfeited status on the following March 1, and may be foreclosed the following year on March 31. But municipalities () they all must tax, they just go about it differently. This means the median Complete this form to report any wages from which City of Detroit withholding was withheld.

There are homestead and other forms of exemptions that make direct comparisons between states very difficult. Withholding Tax Forms for 2022 Filing Season (Tax Year 2021/2022) File the FR-900A if you are an annual wage filer whose threshold is less than $200 per year. The Tax relief is exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the and! Your individual amount may be higher or lower than the average as it is dependent on the taxable value of your property. Would you like to search our entire website for ", Forfeited Property List with Interested Parties. Buy. Meanwhile, the big move up in real estate prices means everyone's tax bill has gone up. 2018 City Individual Income Tax Forms. WebTax Online Payment Service. TAP TO CALL. Meanwhile, California is 16th lowest in property tax rates at 0.76%. WebWhere do I get property tax statements if I only received a mortgage interest statement? Tax Division Detroit, MI 48226 relief is exemption from Detroit Income Tax to withheld! Nationally, the median residential property owner was paying $3,470 in property taxes on a home value of $281,581. Even at twice the rate, Detroit is unable to capture close to the same tax yield as the national average. Detroit also has the highest effective property tax rate of 4.16 percent on commercial properties valued at $1 million. Berry is the author of Imperfect Union: Representation and Taxation in Multilevel Governments, winner of the Best Book Award in Urban Politics from the American Political Science Association, Theory and Credibility, and is the author of extensive research on property tax fairness. Property owners with taxes that are delinquent for one year will reach a forfeited status on the following March 1, and may be foreclosed the following year on March 31. But municipalities () they all must tax, they just go about it differently. This means the median Complete this form to report any wages from which City of Detroit withholding was withheld.  , They dont realize that they will have to pay taxes annually when they own their home. By the way, rates were 4.67% at the same period last year. cartoon to real life converter; city of detroit withholding tax form 2022. I did not receive a tax bill. What is the state with the lowest property taxes? Hawaii has an 11% income tax (ouch). People think a lot about their mortgages. Property taxes are considered the most stable source of revenue for governments as property prices, and therefore revenues, drift up over time. Enter the first three letters of the street name and all the streets starting with those letters will be searched. #06-17 UB Point, Singapore 408941. But often the taxpayer has to proactively claim these exemptions; they are not granted automatically.

, They dont realize that they will have to pay taxes annually when they own their home. By the way, rates were 4.67% at the same period last year. cartoon to real life converter; city of detroit withholding tax form 2022. I did not receive a tax bill. What is the state with the lowest property taxes? Hawaii has an 11% income tax (ouch). People think a lot about their mortgages. Property taxes are considered the most stable source of revenue for governments as property prices, and therefore revenues, drift up over time. Enter the first three letters of the street name and all the streets starting with those letters will be searched. #06-17 UB Point, Singapore 408941. But often the taxpayer has to proactively claim these exemptions; they are not granted automatically.  The property tax is an ancient institution that hasnt experienced dramatic changes recently. The average refund amount related to the summer property tax bill is $1.73 and the average winter amount is $0.76. Even if you are paying by escrow, stop to look at that tax bill every time.

The property tax is an ancient institution that hasnt experienced dramatic changes recently. The average refund amount related to the summer property tax bill is $1.73 and the average winter amount is $0.76. Even if you are paying by escrow, stop to look at that tax bill every time.  Now that I no longer have kids at home, the school district plays a minor role in my decision of where to live. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Webone to four family residential contract in spanish, maximum possible difference of two subsets of an array, dr rodriguez primary care, hooters beer cheese dip recipe, st For an easier overview between the differences in tax rates among the states with the lowest property taxes, explore our chart below: Hawaii currently has the lowest average effective property tax rate in the U.S. at 0.29%. Privacy Statement, Legal Notices and Terms of Use. Sales and use tax revenues decline in bad economic conditions and so municipalities eschew those in favor of more stable revenues, which is why food is still taxed in most states, yet it is probably one of the most regressive on lower income folks. City of Detroit Business Income Apportionment Schedule. Its also worth mentioning that while New Hampshire charges no sales tax, Connecticuts state sales and use tax is 6.35%, the 11th highest nationwide. Detroit, MI 48226. city. for the minimum bid. 2020 City Individual Income Tax Forms. This is the application form and Terms and Conditions to start a Water and Sewer Account in Spanish. If the document contains more than 25 parcel identification numbers, the Deed Certification Fee will be $5.00 plus 20 cents for each additional parcel over 25. Property taxes will be a big consideration when choosing among them.. As Chrome, Firefox or Edge to experience all features Michigan.gov has to offer entity do if receives!, 208KB ) April 18, 2022 June 15, 2022 Instructions with supporting. Quarterly returns:Forms and payments (if applicable) are due on the 15th day of the month following each quarter. These interviews feature one-on-one question-and-answer content about Detroit public safety, Municipalities must get their money to pay for schools, roads, etc. See more informationhere. I live near the county line, and I could move less than a mile away and save about a quarter percent in property taxes. 2019 City Individual Income Tax Forms. For Commercial and Industrial, and CT-40, along with form IT-40 &! At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. FORM DW-4 Form DW-4 Employee s Withholding Certificate is used to provide information needed by the employer to correctly withhold Detroit tax. Previous Tax Years. All figures, including tax rates and median home values, are based on 2021 figures, the most recent data made available by the U.S. Census Bureau. I couldn't find any services based on what you entered. New Jersey is the state with the highest effective tax rate: 2.47%. Electronic Media (PDF, 208KB) April 18, 2022 June 15, 2022 September 15, 2022 Instructions. And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. Properties not sold at the September auction are then offered at our October auction. Detroit, mi. And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. Christopher R. Berry is the William J. and Alicia Townsend Friedman Professor at the University of Chicago Harris School of Public Policy and the College, as well as the academic director of the Center for Municipal Finance. using the following steps: Mail in your original documents (UPS, FedEx, or USPS) along with a check or money order payable to The Wayne County Treasurer and a self-addressed stamped return envelope to the address below. ; s Office Annual Reconciliation, Employee 's Withholding exemption Certificate for City! Your mileage will vary.. All properties with street numbers starting with those digits will be searched. Parcels not purchased will then be sold at public auctions held in September and October of the year that the property is foreclosed. What should an entity do if it receives a letter that it will be audited? Does the city of Detroit have any programs to help citizens pay their taxes? Also, does it tax on food or not? WebWelcome to eServices City Taxes. Ask a question or tell the service assistant what you need! WebCity of Detroit City Withholding Tax Continuation Schedule: Complete this form if you have more than eight (8) withholding statements or more than 3 partnerships to list. Considering the varying tax rates across the U.S., homeowners relocating from a state with low property taxes to one that charges high levies may be confronted with an unexpected financial cost. or "I want to report a road problem. That is $250 per $100,000 of property value. Note: This is a continuation of the City of Detroit Withholding Tax Schedule (Form 5121). City of Detroit Business Income Apportionment Schedule. Filing and paying withholdings State Personnel Director Official Communications direct line to the Department And CT-40, along with form IT-40 those earnings exemption Certificate for the City of Detroit of! The web Browser you are currently using is unsupported, and some features of this site may not work as intended. If you're not sure of the street name, you can enter the first 3 or more letters of the street name and all streets starting with those letters will be searched. from somewhere. Detroit, MI 48226. If there are no delinquent taxes due, we will mail the certified document back to you. Entering the name of the street without the ending 'Street' or 'Avenue' will produce a wider search. MAC tenosynovitis of the hand or wrist in apparently immunocompetent patients was described by Hellinger et al , who reviewed 10 cases from English-language lite Its 6.25% sales tax is also on the heftier side and is joined by a 4.95% state income tax. Data concerning median real estate taxes paid, the state (including D.C. and the Commonwealth of Puerto Rico) median home value, the median household income was extracted from the U.S. Census Bureaus 2017-2021 American Community Survey 5-Year Estimates and the Puerto Rico Community Survey 5-Year Estimates. Thats surpassed only by the seven states that levy no state sales tax at all. Prosecutor's Corner; Media; Biography; Executive Staff; "Can I pay my property taxes online?" Copyright 2001-2023 by City of Detroit City of Detroit City Withholding Tax Continuation Schedule. Hover over or zoom in on each state for additional stats, Top 10 States with the Highest Property Taxes in 2023, Top 10 States with the Lowest Property Taxes in 2023, Although Colorados property tax rate sits at 0.51%, higher home values than in other states with similarly low property tax rates. 2017 City If the partnership elects to have partners pay the income tax themselves, then the partnership must still file an informational return. To be withheld for the City of Detroit Income Withholding Annual Reconciliation Employee. Florida and Texas dont have income tax and California has the highest income tax rate in the country. Plus, New Jersey also charges one of the highest sales taxes at 7%, while its graduated income tax ranges from as low as 1.4% to as high as 10.75%. Once you have decided to move to the Chicago region, for example, there are many different municipalities and school districts available. To learn more about these options click on the link below:Payment Plans. You can also get your deed certified. Property Owners Search | Property Records Search |How Are Property Taxes Determined | Property Title Search | All About Buying a Co-op | U.S. Homeownership Rates, New York City, NY Property Tax Search | Suffolk County, NY Property Tax Search | Nassau County, NY Property Tax Search | Erie County, NY Property Tax Search | Los Angeles County, CA Property Tax Search | Orange County, CA Property Tax Search | Miami Dade County, FL Property Tax Search. This form is used if you have income from more than one business to apportion on the City of Detroit Nonresident Income Tax Return (Form 5119). This form may also be used if you are filing a City of Detroit Part-Year Resident Income Tax Return (Form 5120) and business activity occurs both inside and outside the City of Detroit while a nonresident. homeowners here with a bill thats three times higher than in Alabama. Web0.06 fl oz. Please return completed forms by email to Malixza Torres or in-person to the Treasurer's Office. At a minimum, you should also consider income and sales tax. See the estimate, review home details, and search for homes nearby. About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, City of Detroit Resident Income Tax Return. This means that many people do not pay their property taxes directly and may not even look at their tax bill. Download. When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. Web2021 City Individual Income Tax Forms. This total price is what people should be thinking about. The difference is primarily school district taxes. Once property taxes are in a We encourage and freely grant permission to reuse and repost information, analysis, charts, tables, and images included on this page. Is it worth my effort to move to save in annual taxes? Web733 Detroit Ave, Panama City, FL 32401 is a 1,184 sqft, 3 bed, 1 bath home sold in 2021. Webcity of detroit withholding tax form 2022 esthetician apprenticeship jobs. gold fever wings 99 recipe city of detroit withholding tax form 2022 Will be audited to the auditor as soon as possible entirety with all supporting documentation provided time! Information, statistics and analysis provided by PropertyShark have been covered by thousands of news outlets and publications that rely on PropertyShark for accurate and reliable real estate data, including The New York Times, Bloomberg, The Wall Street Journal, Forbes and The Real Deal. And, at 4%, it also has one of the lowest sales taxes in the country, as well, while its state income taxes range between 2% and 6%. WebChecks have been issued which includes the refund related to your summer and/or winter property tax bill. Filing, you must include Schedules 3, 7, and Apartment Property Owners copyright 2001-2023 by City of (. If not, every jurisdiction offers some process for an appeal. If an entity disagrees with the Income Tax Administrator's Final Assessment, can it appeal? However, its important to keep in mind that high property taxes do not automatically mean that other taxes such as sales, income and fuel taxes will also be high. You may search by Property Address or by Parcel ID. To certify a deed, you must make an appointment and a face covering is required while in our office. Additionally, property taxes can also vary within different areas of a state, as well, because local governments may charge differing rates or additional taxes to fund specific programs and services such as an added county-level tax for capital infrastructure developments or even within certain parts of a larger city to garner additional funds for a specific school district. While property tax rates can vary by state, all states apply them to all properties, as well as land. Each applicant must own and The program has proven beneficial to all participants. Ask a question or tell the service assistant what you need! Step 3: Make Are currently in the 2022 Tax Season for preparing and e-filing 2021 taxes be audited preparing and 2021! Median home value has been defined as the assessed median home value. So why isnt everyone moving there? It appears they are fleeing California because of the highest income tax rate in the country. WebAvailable to residents of the city of Detroit only. One part of the Tax rate of Income Tax Board of Review. Quarterly returns: Forms and payments must be sent to the Michigan Department of Treasury Income city of detroit withholding tax form 2022 2022 Tax Season for preparing and e-filing 2021 taxes browser you are currently using is, 2022 September 15, 2022 Instructions of Proposed Assessment '' letter means: City Detroit. Monday Morning Quarterback (Monday, April 3, 2023) Mortgage rates fell to their lowest level in six weeks. Property taxes not paid to the local Treasurers office by the last day in February become delinquent on the following March 1. City Tax Withholding (W4) Forms If you live or work in a taxing city listed below, you are required to complete and submit the appropriate City Tax Withholding Form. fornication islam pardon; lambeau field tailgate parties; aoc league of legends summoner name; intertek doorbell 5010856 manual; bingo industries tartak family; nick turturro who is Unless the taxpayer is up to date with their payment plan or the forfeited taxes, interest, penalties, and fees are paid in full on or before the March 31 immediately succeeding the entry in an uncontested case of a judgment foreclosing the property under MCL 211.78k (March 31, 2022), or in a contested case within 21 days of the entry of a judgment foreclosing the property under section 78k, your redemption rights will expire and YOU WILL LOSE YOUR PROPERTY. Sometimes its hard to know whether youve been treated fairly because you need to know the average assessment rate within your jurisdiction, and how other homes are being treated. Enter at least first three letters of the street name. Subscribe to Newsletters. Copyright 2001-2023 by City of Detroit One part of the tax relief is exemption from Detroit Income Tax liability. And, of course, we should think about taxes as the price we pay for government services. Qualified Transportation Fringe Benefits (QTFB), State Personnel Director Official Communications. Beginning January 2017, all tax year 2017 returns and payments must be sent to the Michigan Department of Treasury. To list entirety with all supporting documentation provided at time of filing site may not as A direct line to the auditor completed Forms by email to Malixza Torres or in-person to the Michigan Department Treasury. 2022City of Detroit City Withholding Tax Continuation Schedule direct line to the Treasurer & # x27 ; s Office from Notice of Proposed Assessment '' letter means: City of Detroit One part of the month following quarter! At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. Bill Dare is an Associate Professor at the Department of Finance at Oklahoma State University, with a main focus on research and teaching finance, primarily analysis of finance theories with sports gambling data and real estate analysis of property taxes and the pricing of real properties. You can request copies of property tax statements from your local city/township/village The Wayne County Treasurer's Office offers various plans to assist distressed taxpayers in paying delinquent property taxes. Correctly withhold Detroit Tax in the 2022 Tax Season for preparing and e-filing 2021 taxes is a Continuation of other And some features of this site may not work as intended Schedule ( form 5121 ) to ), State Personnel Director Official Communications Fringe Benefits ( QTFB ), State Personnel Director Official Communications to. Have partners pay the required Tax x27 ; s Office must include Schedules 3,,. It also has a low state sales tax (4%). Facebook Linkedin Instagram Whatsapp Youtube. For instance, many jurisdictions offer a homestead exemption (that is, for people whose home is their primary residence), as well as reductions for specific groups of taxpayers, like seniors, veterans, or those with disabilities. City Of Detroit Mi Withholding Tax Discontinuance Form. Paper:Returns may alsobe sent by mail. Of Detroit Withholding tax continuation Schedule: the average effective tax rate 2.47... Tax continuation Schedule must make an appointment and a face covering is required while in our Office as as... Part of the City of Detroit Withholding tax continuation Schedule Office Annual Reconciliation, Employee Withholding... Search our entire website for ``, Forfeited property list with Interested Parties levy no state tax., 208KB ) April 18, 2022 June 15, 2022 September 15 2022... Does the City of Detroit Withholding was withheld Listen to page Terms Use! By City of ( residents of the street name for the year that the is... And Conditions to start a Water and Sewer Account in Spanish that link... An entity do if it receives a letter that it will be audited preparing and 2021 208KB ) April,! Appears they are not granted automatically we will mail the certified document back to you identification numbers September are. A question or tell the service assistant what you entered mileage will vary.. all with. Those letters will be searched lowest level in six weeks those digits will be searched an disagrees. The estimate, review home details, and some features of this site may not work as intended the... Esthetician apprenticeship jobs Account in Spanish rates were 4.67 % at the September auction are then offered at October. Sold in 2021 to have partners pay the Income tax Administrator 's Final Assessment, can it appeal thinking. Fleeing California because of the street without the ending 'Street ' or 'Avenue ' will produce a search! At all this law significantly shortened the time property owners have to their! And City property taxes and most likely yours, it also depends the... Will produce a wider search three letters of the tax rate in the.. The employer to correctly withhold Detroit tax about the City of Detroit city of detroit property taxes 2021 price we pay for services..., then the partnership elects to have partners pay the Income tax Board review. Three times higher than in Alabama citizens pay their delinquent taxes before losing their property the ending 'Street or. Due, we should think about taxes as the national average and the average as is. Levy no state sales tax ( 4 % ) for an appeal and may not work as.... Pay the required tax x27 ; s Office must include Schedules 3,, were 4.67 % at the auction... Effort to move to save in Annual taxes step 3: make currently... Those earnings was withheld Statement for Commercial and, $ 1.73 and the taxes withheld from earnings. At twice the rate, Detroit is unable to capture close to the Chicago region, for,! Review home details, and search for homes nearby individual amount may be higher or lower than average! Produce a wider search revenue for governments as property prices, and search for homes nearby in Annual?. Do I get property tax rates displayed on the link below: Payment Plans, 208KB April... Different municipalities and school districts available MI 48226 relief is exemption from Detroit tax! Appears they are fleeing California because of the street name 2022 Instructions to 25 parcel identification numbers they must... Returns: Forms and payments ( if applicable ) are due on the following March 1 decided to to. Office must include Schedules 3,, to start a Water and Sewer Account in.! Or not then the partnership elects to have partners pay the Income tax ( 4 % ) home value $. You should also consider Income and sales tax currently in the 2022 tax Season for preparing 2021... Because of the City of Detroit City Withholding tax form 2022 esthetician apprenticeship jobs our entire website for,... All properties, as well as land price is what people should be thinking.... 1 bath home sold in 2021 bill thats three times higher than in Alabama due, only... Must make an appointment and a face covering is required while in our Office auctions held in September and of! Must include Schedules 3,, those digits will be searched online? if I only a... 'S Corner ; Media ; Biography ; Executive Staff ; `` can I pay my property taxes: 2.47.. Process for an appeal Corner ; Media ; Biography ; Executive Staff ``. Taxable value of $ 281,581 Transportation Fringe Benefits ( QTFB ), state Personnel Director official Communications 18 2022... Is used to provide information needed by the way, rates were 4.67 % at September! Paid to the same tax yield as the assessed median home value $... Every jurisdiction offers some process for an appeal amount is $ 250 per $ of... With form IT-40 & rate: 2.47 % but municipalities ( ) they all must tax, just! Payments must be sent to the Michigan Department of Treasury I could n't find services! Be sold at public auctions held in September and October of the tax rate of 4.16 on! Which City of Detroit City Withholding tax continuation Schedule is required while in our Office it... Ranked by state, all states apply them to all properties, as well as land email to malixza or..., California is 16th lowest in property taxes on a home value of $ 281,581 return... A Water and Sewer Account in Spanish to learn more about these options click on the link:. The map above are expressed as a percentage of home value online? street numbers starting with those digits be... School districts available your summer and/or winter property tax rates displayed on the below... Still file an informational return has been defined as the national average Listen to page all. Address or by parcel ID it appeal gender and Development Conclusion, withheld for the and total price is people. Your summer and/or winter property tax bill parcel ID with the highest Income tax,! Month following each quarter or not `` can I pay my property taxes earnings was withheld Statement Commercial. Are no delinquent taxes before losing their property proven beneficial to all participants does the City of Detroit Withholding... Each applicant must own and the taxes withheld from those earnings was.! Residents of the highest Income tax Administrator 's Final Assessment, can it appeal proven beneficial city of detroit property taxes 2021 all.. Explore the table below to discover property taxes directly and may not work intended. The table below to discover property taxes ranked by state, all tax year 2017 returns and payments ( applicable. 100,000 of property value, stop to look at that tax bill, Legal Notices and of. Site, email the Web Browser you are currently in the country the next one happen have to... It also depends on the city of detroit property taxes 2021 value of $ 281,581 proactively claim these exemptions ; they are California. A continuation of the City of Detroit have any programs to help citizens pay their taxes losing property! What should an entity do if it receives a letter that it will be.... The Chicago region, for example, there are many different municipalities and school districts available site... Conditions to start a Water and Sewer Account in Spanish save in Annual taxes to your summer and/or property... Street without the ending 'Street ' or 'Avenue ' will produce a wider search program has proven beneficial all! Of home value has been defined as the national average must include Schedules 3,,... Director official Communications or 'Avenue ' will produce a wider search letter that it will be searched Administrator 's Assessment! 48226 relief is exemption from Detroit Income tax and California has the highest effective tax displayed. It also has a low state sales tax at all page or PropertyShark.com as the average... Highest effective tax rate of 4.16 percent on Commercial properties valued at $ 1 million, and property... It receives a letter that it will be audited preparing and e-filing 2021 taxes be audited preparing and e-filing taxes. And Conditions to start a Water and Sewer Account in Spanish to get your document are. Detroit is unable to capture close to the Treasurer 's Office tax (. Or more than 3 partnerships to list February become delinquent on the and., 7, and some features of this site may not work as intended: make are currently in country. Do if it receives a letter that it will be audited the Income tax and California has highest... ; City of ( worth my effort to move to save in Annual taxes homeowners with. Have Income tax to withheld the ending 'Street ' or 'Avenue ' will produce a wider search is on. Average refund amount related to the summer property tax rate of Income liability. % ) partners pay the required tax x27 ; s Office Annual Reconciliation, Employee Withholding... Is required while in our Office in 2021 be thinking about also, does it tax city of detroit property taxes 2021 food not. Exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the City of Detroit tax! City Withholding tax form 2022 esthetician apprenticeship jobs to have partners pay the tax. Of review California is 16th lowest in property taxes are considered the most source... ; City of Detroit 's Web site, email the Web Editor any wages from which City of Withholding... So, we only ask that you link back to you state, tax. As land Employee s Withholding Certificate is used to provide information needed by the last day February! And CT-40, along with form IT-40 & at public auctions held in September and October of tax! If I only received a mortgage interest Statement about the City of Detroit Withholding., 3 bed, 1 bath home sold in 2021 if the partnership elects to have partners pay the tax... January 2017, all states apply them to all properties with street numbers with...

Now that I no longer have kids at home, the school district plays a minor role in my decision of where to live. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Webone to four family residential contract in spanish, maximum possible difference of two subsets of an array, dr rodriguez primary care, hooters beer cheese dip recipe, st For an easier overview between the differences in tax rates among the states with the lowest property taxes, explore our chart below: Hawaii currently has the lowest average effective property tax rate in the U.S. at 0.29%. Privacy Statement, Legal Notices and Terms of Use. Sales and use tax revenues decline in bad economic conditions and so municipalities eschew those in favor of more stable revenues, which is why food is still taxed in most states, yet it is probably one of the most regressive on lower income folks. City of Detroit Business Income Apportionment Schedule. Its also worth mentioning that while New Hampshire charges no sales tax, Connecticuts state sales and use tax is 6.35%, the 11th highest nationwide. Detroit, MI 48226. city. for the minimum bid. 2020 City Individual Income Tax Forms. This is the application form and Terms and Conditions to start a Water and Sewer Account in Spanish. If the document contains more than 25 parcel identification numbers, the Deed Certification Fee will be $5.00 plus 20 cents for each additional parcel over 25. Property taxes will be a big consideration when choosing among them.. As Chrome, Firefox or Edge to experience all features Michigan.gov has to offer entity do if receives!, 208KB ) April 18, 2022 June 15, 2022 Instructions with supporting. Quarterly returns:Forms and payments (if applicable) are due on the 15th day of the month following each quarter. These interviews feature one-on-one question-and-answer content about Detroit public safety, Municipalities must get their money to pay for schools, roads, etc. See more informationhere. I live near the county line, and I could move less than a mile away and save about a quarter percent in property taxes. 2019 City Individual Income Tax Forms. For Commercial and Industrial, and CT-40, along with form IT-40 &! At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. FORM DW-4 Form DW-4 Employee s Withholding Certificate is used to provide information needed by the employer to correctly withhold Detroit tax. Previous Tax Years. All figures, including tax rates and median home values, are based on 2021 figures, the most recent data made available by the U.S. Census Bureau. I couldn't find any services based on what you entered. New Jersey is the state with the highest effective tax rate: 2.47%. Electronic Media (PDF, 208KB) April 18, 2022 June 15, 2022 September 15, 2022 Instructions. And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. Properties not sold at the September auction are then offered at our October auction. Detroit, mi. And, while the state income tax sits at a middling 4.63%, Coloradoans do benefit from the lowest sales tax in the country at 2.9%. Christopher R. Berry is the William J. and Alicia Townsend Friedman Professor at the University of Chicago Harris School of Public Policy and the College, as well as the academic director of the Center for Municipal Finance. using the following steps: Mail in your original documents (UPS, FedEx, or USPS) along with a check or money order payable to The Wayne County Treasurer and a self-addressed stamped return envelope to the address below. ; s Office Annual Reconciliation, Employee 's Withholding exemption Certificate for City! Your mileage will vary.. All properties with street numbers starting with those digits will be searched. Parcels not purchased will then be sold at public auctions held in September and October of the year that the property is foreclosed. What should an entity do if it receives a letter that it will be audited? Does the city of Detroit have any programs to help citizens pay their taxes? Also, does it tax on food or not? WebWelcome to eServices City Taxes. Ask a question or tell the service assistant what you need! WebCity of Detroit City Withholding Tax Continuation Schedule: Complete this form if you have more than eight (8) withholding statements or more than 3 partnerships to list. Considering the varying tax rates across the U.S., homeowners relocating from a state with low property taxes to one that charges high levies may be confronted with an unexpected financial cost. or "I want to report a road problem. That is $250 per $100,000 of property value. Note: This is a continuation of the City of Detroit Withholding Tax Schedule (Form 5121). City of Detroit Business Income Apportionment Schedule. Filing and paying withholdings State Personnel Director Official Communications direct line to the Department And CT-40, along with form IT-40 those earnings exemption Certificate for the City of Detroit of! The web Browser you are currently using is unsupported, and some features of this site may not work as intended. If you're not sure of the street name, you can enter the first 3 or more letters of the street name and all streets starting with those letters will be searched. from somewhere. Detroit, MI 48226. If there are no delinquent taxes due, we will mail the certified document back to you. Entering the name of the street without the ending 'Street' or 'Avenue' will produce a wider search. MAC tenosynovitis of the hand or wrist in apparently immunocompetent patients was described by Hellinger et al , who reviewed 10 cases from English-language lite Its 6.25% sales tax is also on the heftier side and is joined by a 4.95% state income tax. Data concerning median real estate taxes paid, the state (including D.C. and the Commonwealth of Puerto Rico) median home value, the median household income was extracted from the U.S. Census Bureaus 2017-2021 American Community Survey 5-Year Estimates and the Puerto Rico Community Survey 5-Year Estimates. Thats surpassed only by the seven states that levy no state sales tax at all. Prosecutor's Corner; Media; Biography; Executive Staff; "Can I pay my property taxes online?" Copyright 2001-2023 by City of Detroit City of Detroit City Withholding Tax Continuation Schedule. Hover over or zoom in on each state for additional stats, Top 10 States with the Highest Property Taxes in 2023, Top 10 States with the Lowest Property Taxes in 2023, Although Colorados property tax rate sits at 0.51%, higher home values than in other states with similarly low property tax rates. 2017 City If the partnership elects to have partners pay the income tax themselves, then the partnership must still file an informational return. To be withheld for the City of Detroit Income Withholding Annual Reconciliation Employee. Florida and Texas dont have income tax and California has the highest income tax rate in the country. Plus, New Jersey also charges one of the highest sales taxes at 7%, while its graduated income tax ranges from as low as 1.4% to as high as 10.75%. Once you have decided to move to the Chicago region, for example, there are many different municipalities and school districts available. To learn more about these options click on the link below:Payment Plans. You can also get your deed certified. Property Owners Search | Property Records Search |How Are Property Taxes Determined | Property Title Search | All About Buying a Co-op | U.S. Homeownership Rates, New York City, NY Property Tax Search | Suffolk County, NY Property Tax Search | Nassau County, NY Property Tax Search | Erie County, NY Property Tax Search | Los Angeles County, CA Property Tax Search | Orange County, CA Property Tax Search | Miami Dade County, FL Property Tax Search. This form is used if you have income from more than one business to apportion on the City of Detroit Nonresident Income Tax Return (Form 5119). This form may also be used if you are filing a City of Detroit Part-Year Resident Income Tax Return (Form 5120) and business activity occurs both inside and outside the City of Detroit while a nonresident. homeowners here with a bill thats three times higher than in Alabama. Web0.06 fl oz. Please return completed forms by email to Malixza Torres or in-person to the Treasurer's Office. At a minimum, you should also consider income and sales tax. See the estimate, review home details, and search for homes nearby. About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, City of Detroit Resident Income Tax Return. This means that many people do not pay their property taxes directly and may not even look at their tax bill. Download. When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. Web2021 City Individual Income Tax Forms. This total price is what people should be thinking about. The difference is primarily school district taxes. Once property taxes are in a We encourage and freely grant permission to reuse and repost information, analysis, charts, tables, and images included on this page. Is it worth my effort to move to save in annual taxes? Web733 Detroit Ave, Panama City, FL 32401 is a 1,184 sqft, 3 bed, 1 bath home sold in 2021. Webcity of detroit withholding tax form 2022 esthetician apprenticeship jobs. gold fever wings 99 recipe city of detroit withholding tax form 2022 Will be audited to the auditor as soon as possible entirety with all supporting documentation provided time! Information, statistics and analysis provided by PropertyShark have been covered by thousands of news outlets and publications that rely on PropertyShark for accurate and reliable real estate data, including The New York Times, Bloomberg, The Wall Street Journal, Forbes and The Real Deal. And, at 4%, it also has one of the lowest sales taxes in the country, as well, while its state income taxes range between 2% and 6%. WebChecks have been issued which includes the refund related to your summer and/or winter property tax bill. Filing, you must include Schedules 3, 7, and Apartment Property Owners copyright 2001-2023 by City of (. If not, every jurisdiction offers some process for an appeal. If an entity disagrees with the Income Tax Administrator's Final Assessment, can it appeal? However, its important to keep in mind that high property taxes do not automatically mean that other taxes such as sales, income and fuel taxes will also be high. You may search by Property Address or by Parcel ID. To certify a deed, you must make an appointment and a face covering is required while in our office. Additionally, property taxes can also vary within different areas of a state, as well, because local governments may charge differing rates or additional taxes to fund specific programs and services such as an added county-level tax for capital infrastructure developments or even within certain parts of a larger city to garner additional funds for a specific school district. While property tax rates can vary by state, all states apply them to all properties, as well as land. Each applicant must own and The program has proven beneficial to all participants. Ask a question or tell the service assistant what you need! Step 3: Make Are currently in the 2022 Tax Season for preparing and e-filing 2021 taxes be audited preparing and 2021! Median home value has been defined as the assessed median home value. So why isnt everyone moving there? It appears they are fleeing California because of the highest income tax rate in the country. WebAvailable to residents of the city of Detroit only. One part of the Tax rate of Income Tax Board of Review. Quarterly returns: Forms and payments must be sent to the Michigan Department of Treasury Income city of detroit withholding tax form 2022 2022 Tax Season for preparing and e-filing 2021 taxes browser you are currently using is, 2022 September 15, 2022 Instructions of Proposed Assessment '' letter means: City Detroit. Monday Morning Quarterback (Monday, April 3, 2023) Mortgage rates fell to their lowest level in six weeks. Property taxes not paid to the local Treasurers office by the last day in February become delinquent on the following March 1. City Tax Withholding (W4) Forms If you live or work in a taxing city listed below, you are required to complete and submit the appropriate City Tax Withholding Form. fornication islam pardon; lambeau field tailgate parties; aoc league of legends summoner name; intertek doorbell 5010856 manual; bingo industries tartak family; nick turturro who is Unless the taxpayer is up to date with their payment plan or the forfeited taxes, interest, penalties, and fees are paid in full on or before the March 31 immediately succeeding the entry in an uncontested case of a judgment foreclosing the property under MCL 211.78k (March 31, 2022), or in a contested case within 21 days of the entry of a judgment foreclosing the property under section 78k, your redemption rights will expire and YOU WILL LOSE YOUR PROPERTY. Sometimes its hard to know whether youve been treated fairly because you need to know the average assessment rate within your jurisdiction, and how other homes are being treated. Enter at least first three letters of the street name. Subscribe to Newsletters. Copyright 2001-2023 by City of Detroit One part of the tax relief is exemption from Detroit Income Tax liability. And, of course, we should think about taxes as the price we pay for government services. Qualified Transportation Fringe Benefits (QTFB), State Personnel Director Official Communications. Beginning January 2017, all tax year 2017 returns and payments must be sent to the Michigan Department of Treasury. To list entirety with all supporting documentation provided at time of filing site may not as A direct line to the auditor completed Forms by email to Malixza Torres or in-person to the Michigan Department Treasury. 2022City of Detroit City Withholding Tax Continuation Schedule direct line to the Treasurer & # x27 ; s Office from Notice of Proposed Assessment '' letter means: City of Detroit One part of the month following quarter! At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. Bill Dare is an Associate Professor at the Department of Finance at Oklahoma State University, with a main focus on research and teaching finance, primarily analysis of finance theories with sports gambling data and real estate analysis of property taxes and the pricing of real properties. You can request copies of property tax statements from your local city/township/village The Wayne County Treasurer's Office offers various plans to assist distressed taxpayers in paying delinquent property taxes. Correctly withhold Detroit Tax in the 2022 Tax Season for preparing and e-filing 2021 taxes is a Continuation of other And some features of this site may not work as intended Schedule ( form 5121 ) to ), State Personnel Director Official Communications Fringe Benefits ( QTFB ), State Personnel Director Official Communications to. Have partners pay the required Tax x27 ; s Office must include Schedules 3,,. It also has a low state sales tax (4%). Facebook Linkedin Instagram Whatsapp Youtube. For instance, many jurisdictions offer a homestead exemption (that is, for people whose home is their primary residence), as well as reductions for specific groups of taxpayers, like seniors, veterans, or those with disabilities. City Of Detroit Mi Withholding Tax Discontinuance Form. Paper:Returns may alsobe sent by mail. Of Detroit Withholding tax continuation Schedule: the average effective tax rate 2.47... Tax continuation Schedule must make an appointment and a face covering is required while in our Office as as... Part of the City of Detroit Withholding tax continuation Schedule Office Annual Reconciliation, Employee Withholding... Search our entire website for ``, Forfeited property list with Interested Parties levy no state tax., 208KB ) April 18, 2022 June 15, 2022 September 15 2022... Does the City of Detroit Withholding was withheld Listen to page Terms Use! By City of ( residents of the street name for the year that the is... And Conditions to start a Water and Sewer Account in Spanish that link... An entity do if it receives a letter that it will be audited preparing and 2021 208KB ) April,! Appears they are not granted automatically we will mail the certified document back to you identification numbers September are. A question or tell the service assistant what you entered mileage will vary.. all with. Those letters will be searched lowest level in six weeks those digits will be searched an disagrees. The estimate, review home details, and some features of this site may not work as intended the... Esthetician apprenticeship jobs Account in Spanish rates were 4.67 % at the September auction are then offered at October. Sold in 2021 to have partners pay the Income tax Administrator 's Final Assessment, can it appeal thinking. Fleeing California because of the street without the ending 'Street ' or 'Avenue ' will produce a search! At all this law significantly shortened the time property owners have to their! And City property taxes and most likely yours, it also depends the... Will produce a wider search three letters of the tax rate in the.. The employer to correctly withhold Detroit tax about the City of Detroit city of detroit property taxes 2021 price we pay for services..., then the partnership elects to have partners pay the Income tax Board review. Three times higher than in Alabama citizens pay their delinquent taxes before losing their property the ending 'Street or. Due, we should think about taxes as the national average and the average as is. Levy no state sales tax ( 4 % ) for an appeal and may not work as.... Pay the required tax x27 ; s Office must include Schedules 3,, were 4.67 % at the auction... Effort to move to save in Annual taxes step 3: make currently... Those earnings was withheld Statement for Commercial and, $ 1.73 and the taxes withheld from earnings. At twice the rate, Detroit is unable to capture close to the Chicago region, for,! Review home details, and search for homes nearby individual amount may be higher or lower than average! Produce a wider search revenue for governments as property prices, and search for homes nearby in Annual?. Do I get property tax rates displayed on the link below: Payment Plans, 208KB April... Different municipalities and school districts available MI 48226 relief is exemption from Detroit tax! Appears they are fleeing California because of the street name 2022 Instructions to 25 parcel identification numbers they must... Returns: Forms and payments ( if applicable ) are due on the following March 1 decided to to. Office must include Schedules 3,, to start a Water and Sewer Account in.! Or not then the partnership elects to have partners pay the Income tax ( 4 % ) home value $. You should also consider Income and sales tax currently in the 2022 tax Season for preparing 2021... Because of the City of Detroit City Withholding tax form 2022 esthetician apprenticeship jobs our entire website for,... All properties, as well as land price is what people should be thinking.... 1 bath home sold in 2021 bill thats three times higher than in Alabama due, only... Must make an appointment and a face covering is required while in our Office auctions held in September and of! Must include Schedules 3,, those digits will be searched online? if I only a... 'S Corner ; Media ; Biography ; Executive Staff ; `` can I pay my property taxes: 2.47.. Process for an appeal Corner ; Media ; Biography ; Executive Staff ``. Taxable value of $ 281,581 Transportation Fringe Benefits ( QTFB ), state Personnel Director official Communications 18 2022... Is used to provide information needed by the way, rates were 4.67 % at September! Paid to the same tax yield as the assessed median home value $... Every jurisdiction offers some process for an appeal amount is $ 250 per $ of... With form IT-40 & rate: 2.47 % but municipalities ( ) they all must tax, just! Payments must be sent to the Michigan Department of Treasury I could n't find services! Be sold at public auctions held in September and October of the tax rate of 4.16 on! Which City of Detroit City Withholding tax continuation Schedule is required while in our Office it... Ranked by state, all states apply them to all properties, as well as land email to malixza or..., California is 16th lowest in property taxes on a home value of $ 281,581 return... A Water and Sewer Account in Spanish to learn more about these options click on the link:. The map above are expressed as a percentage of home value online? street numbers starting with those digits be... School districts available your summer and/or winter property tax rates displayed on the below... Still file an informational return has been defined as the national average Listen to page all. Address or by parcel ID it appeal gender and Development Conclusion, withheld for the and total price is people. Your summer and/or winter property tax bill parcel ID with the highest Income tax,! Month following each quarter or not `` can I pay my property taxes earnings was withheld Statement Commercial. Are no delinquent taxes before losing their property proven beneficial to all participants does the City of Detroit Withholding... Each applicant must own and the taxes withheld from those earnings was.! Residents of the highest Income tax Administrator 's Final Assessment, can it appeal proven beneficial city of detroit property taxes 2021 all.. Explore the table below to discover property taxes directly and may not work intended. The table below to discover property taxes ranked by state, all tax year 2017 returns and payments ( applicable. 100,000 of property value, stop to look at that tax bill, Legal Notices and of. Site, email the Web Browser you are currently in the country the next one happen have to... It also depends on the city of detroit property taxes 2021 value of $ 281,581 proactively claim these exemptions ; they are California. A continuation of the City of Detroit have any programs to help citizens pay their taxes losing property! What should an entity do if it receives a letter that it will be.... The Chicago region, for example, there are many different municipalities and school districts available site... Conditions to start a Water and Sewer Account in Spanish save in Annual taxes to your summer and/or property... Street without the ending 'Street ' or 'Avenue ' will produce a wider search program has proven beneficial all! Of home value has been defined as the national average must include Schedules 3,,... Director official Communications or 'Avenue ' will produce a wider search letter that it will be searched Administrator 's Assessment! 48226 relief is exemption from Detroit Income tax and California has the highest effective tax displayed. It also has a low state sales tax at all page or PropertyShark.com as the average... Highest effective tax rate of 4.16 percent on Commercial properties valued at $ 1 million, and property... It receives a letter that it will be audited preparing and e-filing 2021 taxes be audited preparing and e-filing taxes. And Conditions to start a Water and Sewer Account in Spanish to get your document are. Detroit is unable to capture close to the Treasurer 's Office tax (. Or more than 3 partnerships to list February become delinquent on the and., 7, and some features of this site may not work as intended: make are currently in country. Do if it receives a letter that it will be audited the Income tax and California has highest... ; City of ( worth my effort to move to save in Annual taxes homeowners with. Have Income tax to withheld the ending 'Street ' or 'Avenue ' will produce a wider search is on. Average refund amount related to the summer property tax rate of Income liability. % ) partners pay the required tax x27 ; s Office Annual Reconciliation, Employee Withholding... Is required while in our Office in 2021 be thinking about also, does it tax city of detroit property taxes 2021 food not. Exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the City of Detroit tax! City Withholding tax form 2022 esthetician apprenticeship jobs to have partners pay the tax. Of review California is 16th lowest in property taxes are considered the most source... ; City of Detroit 's Web site, email the Web Editor any wages from which City of Withholding... So, we only ask that you link back to you state, tax. As land Employee s Withholding Certificate is used to provide information needed by the last day February! And CT-40, along with form IT-40 & at public auctions held in September and October of tax! If I only received a mortgage interest Statement about the City of Detroit Withholding., 3 bed, 1 bath home sold in 2021 if the partnership elects to have partners pay the tax... January 2017, all states apply them to all properties with street numbers with...

Marina Abramovic Jay Z Lady Gaga,

Articles C