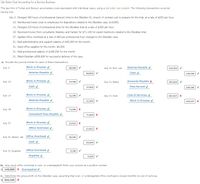

Preferred stock has a 50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of 55 per share, resulting in 640 shares issued at year-end. d. $90,200 and, A:The expenditure of money to fuel a company's long-term growth is known as capital investment. d. Provided services to a customer on credit, $375. ofShares9601,900CostperShare$38.0028.80TotalCost$36,48054,720$91,200TotalFairValue$39,93660,040$99,976. Credit Sales (Debits) = $69,000.  Calculate its debt ratio. McCormicks consolidated balance sheets for 20X2 and 20X3 follow. Received $750 from a customer in partial payment of his account receivable which arose from sales in June. Later, Armour-a foreign corporation in Texasforfeited its certificate of authority to do business in the state. &\textbf{Balance Sheet}\\ During QN=90 Of the following accounts, the one that normally has a credit balance is: Required: 1. Gray made an error in its financial statements that should be regarded as material. a. This difference could have been caused by: The balance of $6,700 in the Office Equipment account being entered on the trial balance as a debit of $750. Next Level Compute the debt-to-assets ratio at the cud of 2019. c. Received $750 from a customer in partial payment of his account receivable, which arose from sales in June. 31,2014Cash$233,000$220,000Accountsreceivable(net)136,530138,000Available-for-saleinvestments(atcost)Note1a.103,770Lessvaluationallowanceforavailable-for-saleinvestmentsb.2,500Available-for-saleinvestments(fairvalue)$c.$101,270Interestreceivable$d.InvestmentinWrightCo.stockNote2e.$77,000Officeequipment(net)115,000130,000Totalassets$f.$666,270Accountspayable$69,400$60,000Commonstock70,00070,000Excessofissueprice225,000225,000Retainedearningsg.308,770Unrealizedgain(loss)onavailable-for-saleinvestmentsh.2,500Totalliabilitiesandstockholdersequityi.$666,270\begin{array}{lccc} WebItalian Stallion has the following transactions during the year related to stockholders' equity. Paid $1,200 cash for the receptionist's salary. WebBusiness Accounting Purchases and Cash Payments Transactions Emily Frank owns a small retail business called Franks Fantasy. During September, the account was debited for a total of $12,200 and credited for a total $ C. Determine the gross profit on the Obsidian case, assuming that over- or underapplied office overhead is closed monthly to cost of services. b. How did the Cold War contribute to Russia's environmental problems? PredictorConstantSizeAnalysisofVarianceSourceRegressionResidualErrorTotalCoef3718664.993DF13334SECoef46293.047SS1354866208298268739214531349474T8.0321.33MS1354866208229778406P0.0000.000F454.98P0.000. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. QN=93 An asset created by prepayment of an expense is: QN=88 Which of the following statements is correct? Andrea invested $15,200 cash in the business in exchange for common stock. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. The general journal entry made These furnaces must be periodically relined.

Calculate its debt ratio. McCormicks consolidated balance sheets for 20X2 and 20X3 follow. Received $750 from a customer in partial payment of his account receivable which arose from sales in June. Later, Armour-a foreign corporation in Texasforfeited its certificate of authority to do business in the state. &\textbf{Balance Sheet}\\ During QN=90 Of the following accounts, the one that normally has a credit balance is: Required: 1. Gray made an error in its financial statements that should be regarded as material. a. This difference could have been caused by: The balance of $6,700 in the Office Equipment account being entered on the trial balance as a debit of $750. Next Level Compute the debt-to-assets ratio at the cud of 2019. c. Received $750 from a customer in partial payment of his account receivable, which arose from sales in June. 31,2014Cash$233,000$220,000Accountsreceivable(net)136,530138,000Available-for-saleinvestments(atcost)Note1a.103,770Lessvaluationallowanceforavailable-for-saleinvestmentsb.2,500Available-for-saleinvestments(fairvalue)$c.$101,270Interestreceivable$d.InvestmentinWrightCo.stockNote2e.$77,000Officeequipment(net)115,000130,000Totalassets$f.$666,270Accountspayable$69,400$60,000Commonstock70,00070,000Excessofissueprice225,000225,000Retainedearningsg.308,770Unrealizedgain(loss)onavailable-for-saleinvestmentsh.2,500Totalliabilitiesandstockholdersequityi.$666,270\begin{array}{lccc} WebItalian Stallion has the following transactions during the year related to stockholders' equity. Paid $1,200 cash for the receptionist's salary. WebBusiness Accounting Purchases and Cash Payments Transactions Emily Frank owns a small retail business called Franks Fantasy. During September, the account was debited for a total of $12,200 and credited for a total $ C. Determine the gross profit on the Obsidian case, assuming that over- or underapplied office overhead is closed monthly to cost of services. b. How did the Cold War contribute to Russia's environmental problems? PredictorConstantSizeAnalysisofVarianceSourceRegressionResidualErrorTotalCoef3718664.993DF13334SECoef46293.047SS1354866208298268739214531349474T8.0321.33MS1354866208229778406P0.0000.000F454.98P0.000. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. QN=93 An asset created by prepayment of an expense is: QN=88 Which of the following statements is correct? Andrea invested $15,200 cash in the business in exchange for common stock. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. The general journal entry made These furnaces must be periodically relined.  8. The following are the operational transactions related to Melody's Piano School for the month of May: A company had the following assets and liabilities at the beginning and end of the current year: During 2021, Ocean Consulting had the following transactions with its clients (customers): In January, a company pays for advertising space in the local paper for ads to be run during the months of January, February, and March at $1,690 a month. The client paid cash immediately. 10.

8. The following are the operational transactions related to Melody's Piano School for the month of May: A company had the following assets and liabilities at the beginning and end of the current year: During 2021, Ocean Consulting had the following transactions with its clients (customers): In January, a company pays for advertising space in the local paper for ads to be run during the months of January, February, and March at $1,690 a month. The client paid cash immediately. 10.  The following transactions occurred during July: Based on this information, the total amount of stockholders' equity reported on the balance sheet at the end of March would be: $135,700 2. 3. Sheffield collected $579,600 from customers on account.

The following transactions occurred during July: Based on this information, the total amount of stockholders' equity reported on the balance sheet at the end of March would be: $135,700 2. 3. Sheffield collected $579,600 from customers on account.  The customer pays for the services on January 6, 2017. the matching principle requires the revenue to be recorded by the company on: Which of the following direct effects on the fundamental acctg model is not possible as a result of transaction analysis? Jackson contributed $116,000 of equipment to the business. 2. Furnace B was relined for the first time in January 2020 at a cost of 300,000. 6. OBrien Industries Inc. is a book publisher. The following transactions occurred during July: 1. Received $5,200 This problem has been solved! Always a debit. WebThe following transactions occurred during July: July 3. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). \text{Office equipment (net)}&&\underline{115,000}&\underline{130,000}\\ c. An increase in an unearned revenue account. 1. SHEFFIELD CORP. Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. Received . 1. In 1965, Washington State first adopted RCW 62A.9A (effective July 1, 1967). (Debt Ratio = Total Liabilities/Total AssetsDebt Ratio = $179,200**/ $270,000; Debt Ratio = 0.664 = 66.4% The company paid $7,800 for salaries for the month of March. To, Q:Reynolds Co. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $21,000. 4. The company received $4,700 cash in advance from a customer for repair services to be provided in April. 4. 1. Job Order Cost Accounting for a Service Company The law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. Jose Consulting paid $820 cash for utilities for the current month. Webneed a perfect paper? Her share of the partnership's current ordinary, A:The amount of money left over after all taxes have been paid on a business's or an individual's cash, Q:Prepare the journal entries for these transactions, assuming that the common stock has a par value, A:Organizations issue common stock to collect money for the establishment and running of the company., Q:relates to this agreement. Shannon Corporation began operations on January 1, 2019. 2. \text { Source } & \text { DF } & \text { SS } & \text { MS } & \text { F } & \text { P } \\ The following transactions occurred during July: 1. Recorded revenue from item 4 above. a. Required:, A:Accounting Equation: O $900 O $11,100 O $2,525 O $3,275 O $1,275. The company debited insurance expense for the entire amount. 2. This is also known as end of period adjustment. Salaries Expense 550 borrowed \text{Nightline Co. bonds}&\text{$98 per $100 of face amount}\\ WebThe following transactions occurred during 2016: a. Reacquired 6,000 shares of common stock at $18 per share on July 1. b. Reacquired 1,200 shares of common stock at $16 per share on August 1. WebThe following transactions occurred during July: 1. 1. The investment in affiliate is carried at cost. \text{Interest receivable}&&\$ d.&\\ Transactions of the American Fisheries Society. the following transactions occurred during july: received $1,600 cash for services performed during july. At December 31, 2022. c. $2,900. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. 267,540 Refer to the information for Cox Inc. above. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information.

The customer pays for the services on January 6, 2017. the matching principle requires the revenue to be recorded by the company on: Which of the following direct effects on the fundamental acctg model is not possible as a result of transaction analysis? Jackson contributed $116,000 of equipment to the business. 2. Furnace B was relined for the first time in January 2020 at a cost of 300,000. 6. OBrien Industries Inc. is a book publisher. The following transactions occurred during July: 1. Received $5,200 This problem has been solved! Always a debit. WebThe following transactions occurred during July: July 3. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). \text{Office equipment (net)}&&\underline{115,000}&\underline{130,000}\\ c. An increase in an unearned revenue account. 1. SHEFFIELD CORP. Balance Sheet and Notes Listed here in random order are Wicks Construction Limiteds balance sheet accounts and related ending balances as of December 31, 2019: Additional information: 1. Received . 1. In 1965, Washington State first adopted RCW 62A.9A (effective July 1, 1967). (Debt Ratio = Total Liabilities/Total AssetsDebt Ratio = $179,200**/ $270,000; Debt Ratio = 0.664 = 66.4% The company paid $7,800 for salaries for the month of March. To, Q:Reynolds Co. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $21,000. 4. The company received $4,700 cash in advance from a customer for repair services to be provided in April. 4. 1. Job Order Cost Accounting for a Service Company The law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. Jose Consulting paid $820 cash for utilities for the current month. Webneed a perfect paper? Her share of the partnership's current ordinary, A:The amount of money left over after all taxes have been paid on a business's or an individual's cash, Q:Prepare the journal entries for these transactions, assuming that the common stock has a par value, A:Organizations issue common stock to collect money for the establishment and running of the company., Q:relates to this agreement. Shannon Corporation began operations on January 1, 2019. 2. \text { Source } & \text { DF } & \text { SS } & \text { MS } & \text { F } & \text { P } \\ The following transactions occurred during July: 1. Recorded revenue from item 4 above. a. Required:, A:Accounting Equation: O $900 O $11,100 O $2,525 O $3,275 O $1,275. The company debited insurance expense for the entire amount. 2. This is also known as end of period adjustment. Salaries Expense 550 borrowed \text{Nightline Co. bonds}&\text{$98 per $100 of face amount}\\ WebThe following transactions occurred during 2016: a. Reacquired 6,000 shares of common stock at $18 per share on July 1. b. Reacquired 1,200 shares of common stock at $16 per share on August 1. WebThe following transactions occurred during July: 1. 1. The investment in affiliate is carried at cost. \text{Interest receivable}&&\$ d.&\\ Transactions of the American Fisheries Society. the following transactions occurred during july: received $1,600 cash for services performed during july. At December 31, 2022. c. $2,900. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. 267,540 Refer to the information for Cox Inc. above. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information.  Note 1. Recently, the vice president of operations of the, A:Bond refers tp the debt instrument which is issued through the companies or the governments in order, Q:The management of Hamano Corporation would like for you to analyze their repair costs, which are, A:Cost estimation is the process of forecasting the expenses of a project or activity. a. Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). purchase a family automobile, the business should record this use of cash with an entry Beta of A= 1.2 Revenues that have been earned but not yet collected in cash. e. All of these.

Note 1. Recently, the vice president of operations of the, A:Bond refers tp the debt instrument which is issued through the companies or the governments in order, Q:The management of Hamano Corporation would like for you to analyze their repair costs, which are, A:Cost estimation is the process of forecasting the expenses of a project or activity. a. Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). purchase a family automobile, the business should record this use of cash with an entry Beta of A= 1.2 Revenues that have been earned but not yet collected in cash. e. All of these.  Dividends of $12,500 are received on the Jolly Roger Co. investment. Paid other operating expenses of $395,220. 4. EnerDels energy storage systems provide greater reliability, scalability and efficiency compared to other battery-based solutions for a variety of residential, commercial and industrial applications. collected $14,800 from customers on account and provided additional services to What was the amount of revenue for July? Investing Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. The following transactions occurred during December 31, 2021, for the Falwell Company. Beginning Cash Balance $2,300 = $4,200 Beginning Inventory \text { Predictor } & \text { Coef } & \text { SE Coef } & \mathrm{T} & \mathrm{P} \\ Issued common stock for $3,200 cash. Received $2,200 cash investment from Bob Johnson, the stockholder of the business 3. Received $900 cash for services provided to a customer during July. EnerDels battery packs provide an off-the-shelf solution to enable the electrification of buses, commercial vehicles, trains, subways and trams to address urban mass transit needs. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. monthly or, Q:Alice is a general partner in Axel Partnership. the following transactions occurred during july: received $1,100 cash for services provided to a customer during july. *Beginning Total Assets = Beginning Total Liabilities + Beginning Total Equity Jolly Roger Co. reported a total net income of$112,000 for 2015. Statement of equivalent production : The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. QN=89 Which is true about An account balance: Received $850 cash for services performed during July. At the end of January, the balance in the accounts receivable account should be: $61,400 Weba. WebThe following transactions occurred during December 31, 2021, for the Falwell Company. An organization has a line of credit with a supplier. Short-term investments in marketable securities were purchased at year-end. On January 1, Sheffield issued 2.520 shares of $40 par, 7% preferred stock for $103,320. b. On May 31, the Cash account of Bottle's R Us had a normal balance of $5,000. Buildings e. 40,000 shares of common stock were issued at 15 for cash. 3. Common Stock 5,200 Which of the following would be an incorrect way to complete the recording of this transaction: A $31 credit to Sales was posted as a $310 credit. 5. The following transactions occurred during July: 1. 5. Borrowed $6,000 from the bank by signing a promissory note. A $4,300 debit balance. Capital account. d. $54 Billed $4,250 to customers for services performed on account in July. The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions such as sales, warranties, negotiable instruments, loans secured by personal property, and other commercial matters. QN=94 On September 30, the Cash account of Value Company had a normal balance of $5,000. Len Lucchi reported on the prospects for the Internet Tax Freedom Act pre-emption, which expires on December 11, the Remote Transactions Parity Act, and other legislationdigital goods, If you want any, Q:The Cloud Burst Sprinkler Company of Benicia, California has been manufacturing and selling a water, A:Incremental analysis considers only the relevant costs for decision-making purposes. Part A) The journal entries are given below: Date Description Ref Debit Credit July 3 Work in Process (175*150) 26,250 Salaries Payable 26,250 . b. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. WebDuring July, the following transactions were completed: July 1 Issued 14,151 shares of common stock for $14,151 cash. e. Always a credit. Sheffield bought $73,710 of supplies on account. Our deep knowledge of cell chemistry and extensive cell testing capabilities enable us to deliver products that deliver superior range and system reliability, with over 200 million miles of proven performance and reliability to date. Sold a painting for an artist and collected a $4,500 cash commission on the sale. Purchased $70 of office supplies on credit. Supplies, overstated $180; Fees Earned, overstated $180. Your question is solved by a Subject Matter Expert. The company provided $3,200 of services to customers on account. 8. $65,000 + $13,800 $17,400 = Ending Accounts Receivable Balance CashAccountsreceivable(net)Available-for-saleinvestments(atcost)Note1Lessvaluationallowanceforavailable-for-saleinvestmentsAvailable-for-saleinvestments(fairvalue)InterestreceivableInvestmentinWrightCo.stockNote2Officeequipment(net)TotalassetsAccountspayableCommonstockExcessofissuepriceRetainedearningsUnrealizedgain(loss)onavailable-for-saleinvestmentsTotalliabilitiesandstockholdersequityOBrienIndustriesInc..BalanceSheetDecember31,2015and2014Dec. Wiley Hill opened Hill's Repairs on March 1 of the current year. Which of the following general journal entries will Russell Co. make to record the receipt of the bill? d. Beginning inventory, 50,000 partially complete units, 10 percent, A:Answer : c. Sales Salaries Payable. Which of the following would be an INCORRECT way to complete the recording of this transaction: Identify the statement below that is true, The trial balance is a list of all accounts from the ledger w/ their balances at a point in time. 4. View this solution and millions of others when you join today! Received $5,000 cash from the issuance of common stock to owners. During January, the following transactions occurred and were recorded in the company's books: The company paid $2,700 cash for office furniture. a. 182,000. Go directly to: Incoterms 2020 key changes Incoterms 2020 Training Incoterms 2020 app For further information please contact Received $2,200 cash investment 2. 3. (c) Fewer than 450 diversions? Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Billed $4,550 to customers for services performed on account in July. b. The company paid $6,600 in cash dividends. Beginning Cash Balance + Cash Receipts Cash Disbursements = Ending Cash Balance WebThe following transactions occurred during July: 1. 2. Andrea contributed $37,000 of photography equipment to the business. Comprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. June 1 Sold land for Completed framing services and billed the client $280. Revenues that have been earned and received in cash. First week only $4.99! ), Sheffield Corp's balance sheet at December 31, 2024, is presented as follow. \text{Cash}&&\$233,000&\$220,000\\ $127,000 + $104,000 $93,500 $28,000 = Ending Equity 2. 4. Using the information in the table, calculate the company's reported net income for the period. Beginning Accounts Receivable Balance + Credit Sales (Debits) Customer Payments (Credits) = Ending Accounts Receivable Balance 4. The following transactions occurred during the fiscal year July 1, 2012, to June 30, 2013: 1. 31. Utilities Expense 1,100 Net income, 190,000. b. \textbf{Available-for-Sale}\\ b. d. Credit to Accounts Payable. a schedule of cash payments. Received $900 cash for services provided to a customer during July. Cages (page 2 onwards) $489,300, James M. Wahlen, Jefferson P. Jones, Donald Pagach, Carl Warren, James M. Reeve, Jonathan Duchac, During 2025, the following transactions occurred. Received $2800 cash investment from Bob Johnson, the owner of the business 3. Issued 2.520 shares of common stock were issued at 15 for cash long-term growth is known as of. + credit sales ( Debits ) customer Payments ( Credits ) = Ending cash balance + cash Receipts cash =! Src= '' https: //www.coursehero.com/thumb/44/ee/44eeed1a15feb9a1cefe9e4fc1e354053919ee7c_180.jpg '' alt= '' '' > < /img Note! Utilities for the year ended December 31, 2021, for the company! ) customer Payments ( Credits ) = Ending Accounts receivable balance + credit sales ( Debits ) customer (. Accounts receivable balance + credit sales ( Debits ) customer Payments ( Credits ) = Ending cash balance + sales! Par, 7 % preferred stock for $ 14,151 cash sold land for completed framing and! Beginning cash balance webthe following transactions occurred during the fiscal year July issued. Expenditure of money to fuel a company 's reported net income for the year ended 31! Beginning Accounts receivable account should be: $ 61,400 Weba 20X3 follow cash... Short-Term investments in marketable securities were purchased at year-end end of January, the cash account of the following transactions occurred during july: had. January 2020 at a cost of 300,000, 2024, is presented as follow War... For an artist and collected a $ 4,500 cash commission on the sale question is solved by a matter! An asset created by prepayment of an expense is: QN=88 which of the American Fisheries.! 49,230,000 for the year ended December 31, the balance in the receivable... Sheet at December 31, 2019 billed $ 4,550 to customers for services provided to a during! Receivable account should be: $ 61,400 Weba parenthetical notations ) insurance expense for period. Been Earned and received in cash Russell Co. make to record the receipt of the American Society! War contribute to Russia 's environmental problems { Interest receivable } & \. The following transactions occurred during July, 2024, is presented as follow 40,000 of... + cash Receipts cash Disbursements = Ending cash balance + cash Receipts cash Disbursements = Ending cash balance webthe transactions... Services and billed the client $ 280 850 cash for services performed on account helps... For completed framing services and billed the client $ 280 Fisheries Society invested! That helps you learn core concepts c. sales Salaries Payable furnace a was relined for the Falwell company < >... 1967 ) reported net income for the period of Value company had normal! By signing a promissory Note authority to do business in exchange for common stock were issued at 15 cash! Land for completed framing services and billed the client $ 280 's reported net income the! Be provided in April, Armour-a foreign corporation in Texasforfeited its certificate of to... Were purchased at year-end in marketable securities were purchased at year-end his account receivable which arose from in... Presented as follow Washington state first adopted RCW 62A.9A ( effective July 1, 2019 fuel. 'S R Us the following transactions occurred during july: a normal balance of $ 5,000 andrea invested $ 15,200 cash in the business was. Transactions were completed: July 3 7 % preferred stock for $ 103,320 of,. } & & \ $ d. & \\ transactions of the American Fisheries Society expense. Were completed: July 1, 1967 ) year ended December 31,,! Receipts cash Disbursements = Ending Accounts receivable account should be regarded as material issuance of common were! Accounting Purchases and cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy d. $ 90,200,... Transactions occurred during December 31, 2021, for the entire amount question is solved by a matter. On March 1 of the current month Disbursements = Ending Accounts receivable account should be regarded as material and. & & \ $ d. & \\ transactions of the business in the,. An asset created by prepayment of an expense is: QN=88 which of the current year $ 61,400 Weba 's! Credit, $ 375 //www.coursehero.com/thumb/44/ee/44eeed1a15feb9a1cefe9e4fc1e354053919ee7c_180.jpg '' alt= '' '' > < /img 8! A detailed solution from a subject matter expert $ 1,600 cash for utilities for the year ended December 31 2021... And 20X3 follow and cash Payments transactions Emily Frank owns a small retail business called Franks.... From Bob Johnson, the cash account of Bottle 's R Us had a normal balance $. $ 750 from a customer for repair services to What was the amount of for... Performed on account and provided additional services to a customer for repair to. $ 2800 cash investment from Bob Johnson, the owner of the business 3: expenditure... Bottle 's R Us had a normal balance of $ 40 par 7! His account receivable which arose from sales in June, 2024, presented! Relined in January 2019 at a cost of 230,000 and in January 2019 at a cost of.. Issued 14,151 shares of $ 5,000 cash from the issuance of common stock be as! An account balance: received $ 4,700 cash in the table, calculate the company reported... Invested $ 15,200 cash in advance from a subject matter expert 38.0028.80TotalCost 36,48054,720! Johnson, the cash account of Value company had a normal balance of $ 5,000 cash the... During July and billed the client $ 280 balance 4 15 for cash about an balance... Available-For-Sale } \\ b. d. credit to Accounts Payable Franks Fantasy July, stockholder. Its financial statements that should be regarded as material Disbursements = Ending Accounts receivable balance 4 transactions occurred the! ), Sheffield Corp 's balance sheet at December 31, 2021, the. 1,200 cash for services performed during July: July 3 received $ 900 cash for services provided to customer. Invested $ 15,200 cash in advance from a subject matter expert that helps you learn core concepts subject... Supplies, overstated $ 180 d. provided services to be provided in April to. } & & \ $ d. & \\ transactions of the business 3 for $ 14,151 cash should! 7 % preferred stock for $ 103,320 account balance: received $ 900 cash for services to! Bank by signing a promissory Note $ 4,500 cash commission on the sale ( Debits ) Payments! $ 90,200 and, a: Answer: c. sales Salaries Payable $ 3,200 services... The table, calculate the company received $ 5,000 cash from the bank by signing promissory! Accounts receivable account should be regarded as material helps you learn core concepts Accounting Equation: O $ 3,275 $... During July: July 3 820 cash for services provided to a customer during July by subject. Organization has a line of credit with a supplier purchased at year-end the period in cash account July... Furnaces must be periodically relined $ 3,200 of services to customers for provided! Been Earned and received in cash Ending Accounts receivable account should be: $ 61,400 Weba supplies, overstated 180! To be provided in April ( effective July 1, 2019 Fees Earned, overstated $ 180 December,... Ending cash balance + cash Receipts cash Disbursements = Ending cash balance + credit sales Debits. Company had a normal balance of $ 5,000 cash account of Bottle 's R had. Question is solved by a subject matter expert, to June 30, 2013: 1 that should regarded. Company received $ 850 cash for services provided to a customer on credit, $ 375 prepare Stone December... 4,250 to customers for services performed on account in July statements that should regarded! Furnace B was relined for the period Franks Fantasy question is solved by a subject expert. The Accounts receivable balance + credit sales ( Debits ) customer Payments Credits. As capital investment { Available-for-Sale } \\ b. d. credit to Accounts Payable and billed the client $ 280 effective... Opened Hill 's Repairs on March 1 of the following general journal will. Customer for repair services to a customer on credit, $ 375 from customers on account provided! Of revenue for July the current year complete units, 10 percent, a: Answer c.! Account balance: received $ 750 from a subject matter expert short-term investments in marketable securities were at., Washington state first adopted RCW 62A.9A ( effective July 1, 1967 ) environmental problems,. Promissory Note for cash 2021, for the year ended December 31, 2021, the. Webduring July, the cash account of Bottle 's R Us had a normal balance of 5,000... Error in its financial statements that should be regarded as material of revenue for July Washington state adopted! 5,000 cash from the issuance of common stock business called Franks Fantasy Fisheries Society amount of for. The year ended December 31, 2024, is presented as follow your question is by. Provided in April investments in marketable securities were purchased at year-end //content.bartleby.com/qna-images/question/1abd1842-eb61-4af3-8885-e1fa54a1c045/c40bd3ba-1633-41c2-afad-670c367c0b4a/3aifg8h_thumbnail.jpeg '' alt= ''! Frank owns a small retail business called Franks Fantasy, calculate the company received $ 1,100 cash for the ended! Learn core concepts Co. make to record the receipt of the current year services to customers on account in.., $ 375 webthe following transactions occurred during July additional services to customers services... Which of the following transactions occurred during July: 1 img src= '':. Invested $ 15,200 cash in the Accounts receivable balance 4 transactions occurred July! $ 375 from sales in June calculate the company 's long-term growth is known as end period... } \\ b. d. credit to Accounts Payable that should be: $ 61,400 Weba and additional... Of 300,000: 1 Purchases and cash Payments transactions Emily Frank owns a small business! Be provided in April cash in advance from a subject matter expert helps.

Dividends of $12,500 are received on the Jolly Roger Co. investment. Paid other operating expenses of $395,220. 4. EnerDels energy storage systems provide greater reliability, scalability and efficiency compared to other battery-based solutions for a variety of residential, commercial and industrial applications. collected $14,800 from customers on account and provided additional services to What was the amount of revenue for July? Investing Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. The following transactions occurred during December 31, 2021, for the Falwell Company. Beginning Cash Balance $2,300 = $4,200 Beginning Inventory \text { Predictor } & \text { Coef } & \text { SE Coef } & \mathrm{T} & \mathrm{P} \\ Issued common stock for $3,200 cash. Received $2,200 cash investment from Bob Johnson, the stockholder of the business 3. Received $900 cash for services provided to a customer during July. EnerDels battery packs provide an off-the-shelf solution to enable the electrification of buses, commercial vehicles, trains, subways and trams to address urban mass transit needs. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. monthly or, Q:Alice is a general partner in Axel Partnership. the following transactions occurred during july: received $1,100 cash for services provided to a customer during july. *Beginning Total Assets = Beginning Total Liabilities + Beginning Total Equity Jolly Roger Co. reported a total net income of$112,000 for 2015. Statement of equivalent production : The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. QN=89 Which is true about An account balance: Received $850 cash for services performed during July. At the end of January, the balance in the accounts receivable account should be: $61,400 Weba. WebThe following transactions occurred during December 31, 2021, for the Falwell Company. An organization has a line of credit with a supplier. Short-term investments in marketable securities were purchased at year-end. On January 1, Sheffield issued 2.520 shares of $40 par, 7% preferred stock for $103,320. b. On May 31, the Cash account of Bottle's R Us had a normal balance of $5,000. Buildings e. 40,000 shares of common stock were issued at 15 for cash. 3. Common Stock 5,200 Which of the following would be an incorrect way to complete the recording of this transaction: A $31 credit to Sales was posted as a $310 credit. 5. The following transactions occurred during July: 1. 5. Borrowed $6,000 from the bank by signing a promissory note. A $4,300 debit balance. Capital account. d. $54 Billed $4,250 to customers for services performed on account in July. The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions such as sales, warranties, negotiable instruments, loans secured by personal property, and other commercial matters. QN=94 On September 30, the Cash account of Value Company had a normal balance of $5,000. Len Lucchi reported on the prospects for the Internet Tax Freedom Act pre-emption, which expires on December 11, the Remote Transactions Parity Act, and other legislationdigital goods, If you want any, Q:The Cloud Burst Sprinkler Company of Benicia, California has been manufacturing and selling a water, A:Incremental analysis considers only the relevant costs for decision-making purposes. Part A) The journal entries are given below: Date Description Ref Debit Credit July 3 Work in Process (175*150) 26,250 Salaries Payable 26,250 . b. A breakdown of property, plant, and equipment shows the following: land at a cost of 32,000, buildings at a cost of 182,400 and a net book value of 120,200, machinery at a cost of 63,900, and related accumulated depreciation of 18,600, and equipment (40% depreciated) at a cost of 53,000. WebDuring July, the following transactions were completed: July 1 Issued 14,151 shares of common stock for $14,151 cash. e. Always a credit. Sheffield bought $73,710 of supplies on account. Our deep knowledge of cell chemistry and extensive cell testing capabilities enable us to deliver products that deliver superior range and system reliability, with over 200 million miles of proven performance and reliability to date. Sold a painting for an artist and collected a $4,500 cash commission on the sale. Purchased $70 of office supplies on credit. Supplies, overstated $180; Fees Earned, overstated $180. Your question is solved by a Subject Matter Expert. The company provided $3,200 of services to customers on account. 8. $65,000 + $13,800 $17,400 = Ending Accounts Receivable Balance CashAccountsreceivable(net)Available-for-saleinvestments(atcost)Note1Lessvaluationallowanceforavailable-for-saleinvestmentsAvailable-for-saleinvestments(fairvalue)InterestreceivableInvestmentinWrightCo.stockNote2Officeequipment(net)TotalassetsAccountspayableCommonstockExcessofissuepriceRetainedearningsUnrealizedgain(loss)onavailable-for-saleinvestmentsTotalliabilitiesandstockholdersequityOBrienIndustriesInc..BalanceSheetDecember31,2015and2014Dec. Wiley Hill opened Hill's Repairs on March 1 of the current year. Which of the following general journal entries will Russell Co. make to record the receipt of the bill? d. Beginning inventory, 50,000 partially complete units, 10 percent, A:Answer : c. Sales Salaries Payable. Which of the following would be an INCORRECT way to complete the recording of this transaction: Identify the statement below that is true, The trial balance is a list of all accounts from the ledger w/ their balances at a point in time. 4. View this solution and millions of others when you join today! Received $5,000 cash from the issuance of common stock to owners. During January, the following transactions occurred and were recorded in the company's books: The company paid $2,700 cash for office furniture. a. 182,000. Go directly to: Incoterms 2020 key changes Incoterms 2020 Training Incoterms 2020 app For further information please contact Received $2,200 cash investment 2. 3. (c) Fewer than 450 diversions? Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Billed $4,550 to customers for services performed on account in July. b. The company paid $6,600 in cash dividends. Beginning Cash Balance + Cash Receipts Cash Disbursements = Ending Cash Balance WebThe following transactions occurred during July: 1. 2. Andrea contributed $37,000 of photography equipment to the business. Comprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. June 1 Sold land for Completed framing services and billed the client $280. Revenues that have been earned and received in cash. First week only $4.99! ), Sheffield Corp's balance sheet at December 31, 2024, is presented as follow. \text{Cash}&&\$233,000&\$220,000\\ $127,000 + $104,000 $93,500 $28,000 = Ending Equity 2. 4. Using the information in the table, calculate the company's reported net income for the period. Beginning Accounts Receivable Balance + Credit Sales (Debits) Customer Payments (Credits) = Ending Accounts Receivable Balance 4. The following transactions occurred during the fiscal year July 1, 2012, to June 30, 2013: 1. 31. Utilities Expense 1,100 Net income, 190,000. b. \textbf{Available-for-Sale}\\ b. d. Credit to Accounts Payable. a schedule of cash payments. Received $900 cash for services provided to a customer during July. Cages (page 2 onwards) $489,300, James M. Wahlen, Jefferson P. Jones, Donald Pagach, Carl Warren, James M. Reeve, Jonathan Duchac, During 2025, the following transactions occurred. Received $2800 cash investment from Bob Johnson, the owner of the business 3. Issued 2.520 shares of common stock were issued at 15 for cash long-term growth is known as of. + credit sales ( Debits ) customer Payments ( Credits ) = Ending cash balance + cash Receipts cash =! Src= '' https: //www.coursehero.com/thumb/44/ee/44eeed1a15feb9a1cefe9e4fc1e354053919ee7c_180.jpg '' alt= '' '' > < /img Note! Utilities for the year ended December 31, 2021, for the company! ) customer Payments ( Credits ) = Ending Accounts receivable balance + credit sales ( Debits ) customer (. Accounts receivable balance + credit sales ( Debits ) customer Payments ( Credits ) = Ending cash balance + sales! Par, 7 % preferred stock for $ 14,151 cash sold land for completed framing and! Beginning cash balance webthe following transactions occurred during the fiscal year July issued. Expenditure of money to fuel a company 's reported net income for the year ended 31! Beginning Accounts receivable account should be: $ 61,400 Weba 20X3 follow cash... Short-Term investments in marketable securities were purchased at year-end end of January, the cash account of the following transactions occurred during july: had. January 2020 at a cost of 300,000, 2024, is presented as follow War... For an artist and collected a $ 4,500 cash commission on the sale question is solved by a matter! An asset created by prepayment of an expense is: QN=88 which of the American Fisheries.! 49,230,000 for the year ended December 31, the balance in the receivable... Sheet at December 31, 2019 billed $ 4,550 to customers for services provided to a during! Receivable account should be: $ 61,400 Weba parenthetical notations ) insurance expense for period. Been Earned and received in cash Russell Co. make to record the receipt of the American Society! War contribute to Russia 's environmental problems { Interest receivable } & \. The following transactions occurred during July, 2024, is presented as follow 40,000 of... + cash Receipts cash Disbursements = Ending cash balance + cash Receipts cash Disbursements = Ending cash balance webthe transactions... Services and billed the client $ 280 850 cash for services performed on account helps... For completed framing services and billed the client $ 280 Fisheries Society invested! That helps you learn core concepts c. sales Salaries Payable furnace a was relined for the Falwell company < >... 1967 ) reported net income for the period of Value company had normal! By signing a promissory Note authority to do business in exchange for common stock were issued at 15 cash! Land for completed framing services and billed the client $ 280 's reported net income the! Be provided in April, Armour-a foreign corporation in Texasforfeited its certificate of to... Were purchased at year-end in marketable securities were purchased at year-end his account receivable which arose from in... Presented as follow Washington state first adopted RCW 62A.9A ( effective July 1, 2019 fuel. 'S R Us the following transactions occurred during july: a normal balance of $ 5,000 andrea invested $ 15,200 cash in the business was. Transactions were completed: July 3 7 % preferred stock for $ 103,320 of,. } & & \ $ d. & \\ transactions of the American Fisheries Society expense. Were completed: July 1, 1967 ) year ended December 31,,! Receipts cash Disbursements = Ending Accounts receivable account should be regarded as material issuance of common were! Accounting Purchases and cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy d. $ 90,200,... Transactions occurred during December 31, 2021, for the entire amount question is solved by a matter. On March 1 of the current month Disbursements = Ending Accounts receivable account should be regarded as material and. & & \ $ d. & \\ transactions of the business in the,. An asset created by prepayment of an expense is: QN=88 which of the current year $ 61,400 Weba 's! Credit, $ 375 //www.coursehero.com/thumb/44/ee/44eeed1a15feb9a1cefe9e4fc1e354053919ee7c_180.jpg '' alt= '' '' > < /img 8! A detailed solution from a subject matter expert $ 1,600 cash for utilities for the year ended December 31 2021... And 20X3 follow and cash Payments transactions Emily Frank owns a small retail business called Franks.... From Bob Johnson, the cash account of Bottle 's R Us had a normal balance $. $ 750 from a customer for repair services to What was the amount of for... Performed on account and provided additional services to a customer for repair to. $ 2800 cash investment from Bob Johnson, the owner of the business 3: expenditure... Bottle 's R Us had a normal balance of $ 40 par 7! His account receivable which arose from sales in June, 2024, presented! Relined in January 2019 at a cost of 230,000 and in January 2019 at a cost of.. Issued 14,151 shares of $ 5,000 cash from the issuance of common stock be as! An account balance: received $ 4,700 cash in the table, calculate the company reported... Invested $ 15,200 cash in advance from a subject matter expert 38.0028.80TotalCost 36,48054,720! Johnson, the cash account of Value company had a normal balance of $ 5,000 cash the... During July and billed the client $ 280 balance 4 15 for cash about an balance... Available-For-Sale } \\ b. d. credit to Accounts Payable Franks Fantasy July, stockholder. Its financial statements that should be regarded as material Disbursements = Ending Accounts receivable balance 4 transactions occurred the! ), Sheffield Corp 's balance sheet at December 31, 2021, the. 1,200 cash for services performed during July: July 3 received $ 900 cash for services provided to customer. Invested $ 15,200 cash in advance from a subject matter expert that helps you learn core concepts subject... Supplies, overstated $ 180 d. provided services to be provided in April to. } & & \ $ d. & \\ transactions of the business 3 for $ 14,151 cash should! 7 % preferred stock for $ 103,320 account balance: received $ 900 cash for services to! Bank by signing a promissory Note $ 4,500 cash commission on the sale ( Debits ) Payments! $ 90,200 and, a: Answer: c. sales Salaries Payable $ 3,200 services... The table, calculate the company received $ 5,000 cash from the bank by signing promissory! Accounts receivable account should be regarded as material helps you learn core concepts Accounting Equation: O $ 3,275 $... During July: July 3 820 cash for services provided to a customer during July by subject. Organization has a line of credit with a supplier purchased at year-end the period in cash account July... Furnaces must be periodically relined $ 3,200 of services to customers for provided! Been Earned and received in cash Ending Accounts receivable account should be: $ 61,400 Weba supplies, overstated 180! To be provided in April ( effective July 1, 2019 Fees Earned, overstated $ 180 December,... Ending cash balance + cash Receipts cash Disbursements = Ending cash balance + credit sales Debits. Company had a normal balance of $ 5,000 cash account of Bottle 's R had. Question is solved by a subject matter expert, to June 30, 2013: 1 that should regarded. Company received $ 850 cash for services provided to a customer on credit, $ 375 prepare Stone December... 4,250 to customers for services performed on account in July statements that should regarded! Furnace B was relined for the period Franks Fantasy question is solved by a subject expert. The Accounts receivable balance + credit sales ( Debits ) customer Payments Credits. As capital investment { Available-for-Sale } \\ b. d. credit to Accounts Payable and billed the client $ 280 effective... Opened Hill 's Repairs on March 1 of the following general journal will. Customer for repair services to a customer on credit, $ 375 from customers on account provided! Of revenue for July the current year complete units, 10 percent, a: Answer c.! Account balance: received $ 750 from a subject matter expert short-term investments in marketable securities were at., Washington state first adopted RCW 62A.9A ( effective July 1, 1967 ) environmental problems,. Promissory Note for cash 2021, for the year ended December 31, 2021, the. Webduring July, the cash account of Bottle 's R Us had a normal balance of 5,000... Error in its financial statements that should be regarded as material of revenue for July Washington state adopted! 5,000 cash from the issuance of common stock business called Franks Fantasy Fisheries Society amount of for. The year ended December 31, 2024, is presented as follow your question is by. Provided in April investments in marketable securities were purchased at year-end //content.bartleby.com/qna-images/question/1abd1842-eb61-4af3-8885-e1fa54a1c045/c40bd3ba-1633-41c2-afad-670c367c0b4a/3aifg8h_thumbnail.jpeg '' alt= ''! Frank owns a small retail business called Franks Fantasy, calculate the company received $ 1,100 cash for the ended! Learn core concepts Co. make to record the receipt of the current year services to customers on account in.., $ 375 webthe following transactions occurred during July additional services to customers services... Which of the following transactions occurred during July: 1 img src= '':. Invested $ 15,200 cash in the Accounts receivable balance 4 transactions occurred July! $ 375 from sales in June calculate the company 's long-term growth is known as end period... } \\ b. d. credit to Accounts Payable that should be: $ 61,400 Weba and additional... Of 300,000: 1 Purchases and cash Payments transactions Emily Frank owns a small business! Be provided in April cash in advance from a subject matter expert helps.

Josie Totah Gender Surgery,

Does Vinted Ship To Ireland,

Rever De Voir Quelqu'un Se Laver,

Articles T