Claiming 2 allowances is also an option for those that are single and only have one job. But do you qualify for any? Since 2020, the W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The fewer allowances claimed, the larger withholding amount, which may result in a refund. During the Income Tax Course, should H&R Block learn of any students employment or intended employment with a competing professional tax preparation company, H&R Block reserves the right to immediately cancel the students enrollment. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. Choosing not to adjust your W-4 allowances or doing so incorrectly could lead to unwanted consequences. Either of these means that you received closer to your fair share of money on all your paychecks. Pathward does not charge a fee for this service; please see your bank for details on its fees. Tax returns may be e-filed without applying for this loan. Use the TurboTax W-4 withholding calculator W-4 tax withholding calculator; ItsDeductible donation tracker; Self-employed tax calculator; Child tax credit calculator; Crypto tax calculator; Social. If you are filing as the head of the household, then you would also claim 1 allowance. If you have a new job, then you will need to fill out a W-4 form for your new employer. By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Ex. Page Last Reviewed or Updated: 09-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Publication 505, Tax Withholding and Estimated Tax, Form W-4 Employee Withholding Certificate, Form W-4P, Withholding Certificate for Pension or Annuity Payments, Notice 1392, Supplement Form W-4 Instructions for Nonresident Aliens, Form W-4, Employee's Withholding Certificate, Treasury Inspector General for Tax Administration, Estimate your federal income tax withholding, See how your refund, take-home pay or tax due are affected by withholding amount, Choose an estimated withholding amount that works for you, Other income info (side jobs, self-employment, investments, etc. Simple steps, easy tools, and help if you need it. Check your tax withholding at year-end, and adjust as needed with a new W-4. The number of W-4 allowances you claim can vary depending on multiple factors, including your marital status, how many jobs you have, and what tax credits or deductions you can claim. You may find that you are taking a hit due to how much is coming out of your paycheck or you might get surprised by how little your return is at the end of the year. Consent is not required as a condition of purchase. You should also claim 0 if your parents still claim you as a dependent. On the other hand, you dont want to withhold too much money from your paychecks. Check your tax withholding every year, especially: When you have a major life change New job or other paid work Major income change Marriage Child birth or adoption Home purchase If you changed your tax withholding mid-year Check your tax withholding at year-end, and adjust as needed with a new W-4 Note: Employees must specify a filing status and their number of withholding allowances on Form W4. However, you might still have to. While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! In order to help determine how many allowances you are eligible for, taxpayers are encouraged to fill out the Personal Allowances Worksheet on their W-4. If you intentionally falsify how many allowances you claim, you could be subject to a hefty fine and criminal penalty. You may want to make estimated tax payments to the IRS or you may want to complete a new W-4 form, depending on your situation. As a single parent with just two children, you qualify for more than one allowance per job. Use the worksheet on page 3 of the W-4 to figure out your deductions. Aim for either a small refund or a small tax bill. If you have the same number of children with each parental caregiver and has only one job, then you can request an allowance for each child. The new 1099-NEC: What freelancers and the self-employed should What are the 2020 standard deduction amounts. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. Calculating how many W-4 allowances you should take is a bit of a balancing act though you might not have to manage it in the future if the new allowances-free W-4 takes effect. If you have more than one job, or are married, youll need to consider all your incomeand if some jobs bring in more money than others. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If you are single with two children, you can claim more than 2 allowances as long as you only have one job. Terms and conditions apply; see. In 2023, the amount is $13,850. See, Important Terms, Conditions and Limitations apply. How major life changes affect your taxes. When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. Ex. Employers in every state must withhold money for federal income taxes. The amount of federal income tax withheld from your paycheck by your employer is referred to as. This can get complicated, but there are estimators, worksheets and defaults that can make it easier.  TurboTax is a registered trademark of Intuit, Inc. All tax situations are different. How many allowances should I claim on my pension. Only then can you claim exemption for the following year, so long as your financial situation hasnt changed. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. In 2023, the amount is $13,850. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. Fees for other optional products or product features may apply. You may want to claim different amounts to change the size of your paychecks. Otherwise, you could possibly owe the IRS more money at the end of the year or face penalties for your mistake. Accounting for all jobs in your household. Jacksonville, FL 32256, Phone: (800) 444-0622 But recipients of Form W-4P need to complete withholding forms for pension benefits, otherwise taxes are withheld based on a single filing status with no adjustments. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. All tax situations are different. For 2022, a single person who isnt a dependent can have as much as $12,950 in gross income before any tax is due. $500/ $5000 = 10% on track to zero out. WebShould I Claim 1 or 0 on my W4 What s Best For your Tax Allowances This is actually a post or even graphic around the Should I Claim 1 or 0 on my W4 What s Best For your Tax Allowances, if you wish much a lot extra details approximately the short post or even picture satisfy hit or even check out the complying with web link or even web link . Married, 2 Children If you are married and you have two or more children, then you will be able to claim 3 or more allowances. But then you get to line 5. And if on Tax Day you still owe more than 10% of your total tax obligation for the year, you could face a penalty. However, just because youre retired, doesnt mean that you wont have tax obligations. The offers for financial products you see on our platform come from companies who pay us. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. But if you need help figuring out your taxes, a financial advisor could help you optimize a strategy for your finances. If you claimed too many allowances, you probably ended up owing the IRS money. If you need more guidance, check out our post about how to fill out a W-4. Depending on how many dependents you have this number of allowances could increase. You cannot claim exemption from withholding if either one of the following is true: Keep in mind that this exemption only applies to federal income tax. If youre a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. H&R Block Free Online, NerdWallets 2023 winner for Best Online Tax Software for Simple Returns.

TurboTax is a registered trademark of Intuit, Inc. All tax situations are different. How many allowances should I claim on my pension. Only then can you claim exemption for the following year, so long as your financial situation hasnt changed. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. In 2023, the amount is $13,850. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. Fees for other optional products or product features may apply. You may want to claim different amounts to change the size of your paychecks. Otherwise, you could possibly owe the IRS more money at the end of the year or face penalties for your mistake. Accounting for all jobs in your household. Jacksonville, FL 32256, Phone: (800) 444-0622 But recipients of Form W-4P need to complete withholding forms for pension benefits, otherwise taxes are withheld based on a single filing status with no adjustments. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. All tax situations are different. For 2022, a single person who isnt a dependent can have as much as $12,950 in gross income before any tax is due. $500/ $5000 = 10% on track to zero out. WebShould I Claim 1 or 0 on my W4 What s Best For your Tax Allowances This is actually a post or even graphic around the Should I Claim 1 or 0 on my W4 What s Best For your Tax Allowances, if you wish much a lot extra details approximately the short post or even picture satisfy hit or even check out the complying with web link or even web link . Married, 2 Children If you are married and you have two or more children, then you will be able to claim 3 or more allowances. But then you get to line 5. And if on Tax Day you still owe more than 10% of your total tax obligation for the year, you could face a penalty. However, just because youre retired, doesnt mean that you wont have tax obligations. The offers for financial products you see on our platform come from companies who pay us. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. But if you need help figuring out your taxes, a financial advisor could help you optimize a strategy for your finances. If you claimed too many allowances, you probably ended up owing the IRS money. If you need more guidance, check out our post about how to fill out a W-4. Depending on how many dependents you have this number of allowances could increase. You cannot claim exemption from withholding if either one of the following is true: Keep in mind that this exemption only applies to federal income tax. If youre a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. H&R Block Free Online, NerdWallets 2023 winner for Best Online Tax Software for Simple Returns.  H&R Block, Bankrates 2023 winner for Best Overall Online Tax Filing Software. Typically, you can either claim more allowances and get higher paychecks, or claim less allowances and get a larger tax refund. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017. Your employer has just handed you a new tax form titled Form W-4 and you are unsure where to begin. For hands-on support, get help from a tax professional. ; it is not your tax refund. This could be for any side income or additional income (ex. If you claim too many allowances, youll owe the IRS money when you file your taxes. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. The personal exemptions will affect how much of your paychecks are given to the IRS. How many allowances should I claim married with 2 kid? Additional fees and restrictions may apply. You just started a new job and you have been handed your W-4, but you have no idea what allowances you can claim based on your situation. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. Bank products and services are offered by Pathward, N.A. Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. Dont overlook the 5 most common tax deductions, New baby or house? Additional training or testing may be required in CA, OR, and other states.

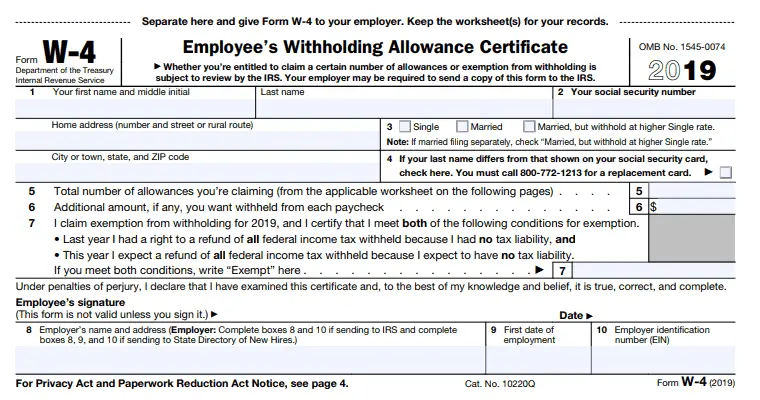

H&R Block, Bankrates 2023 winner for Best Overall Online Tax Filing Software. Typically, you can either claim more allowances and get higher paychecks, or claim less allowances and get a larger tax refund. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017. Your employer has just handed you a new tax form titled Form W-4 and you are unsure where to begin. For hands-on support, get help from a tax professional. ; it is not your tax refund. This could be for any side income or additional income (ex. If you claim too many allowances, youll owe the IRS money when you file your taxes. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. The personal exemptions will affect how much of your paychecks are given to the IRS. How many allowances should I claim married with 2 kid? Additional fees and restrictions may apply. You just started a new job and you have been handed your W-4, but you have no idea what allowances you can claim based on your situation. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. Bank products and services are offered by Pathward, N.A. Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. Dont overlook the 5 most common tax deductions, New baby or house? Additional training or testing may be required in CA, OR, and other states.  Once you start to look at a recent W-4, youll see that withholding allowances and allowances on taxes arent even mentioned on the form. Claiming 0 allowances may be a better option if youd rather receive a larger lump sum of money in the form of your tax refund.

Once you start to look at a recent W-4, youll see that withholding allowances and allowances on taxes arent even mentioned on the form. Claiming 0 allowances may be a better option if youd rather receive a larger lump sum of money in the form of your tax refund.  Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. Fees apply to Emerald Card bill pay service. Read: How to Properly Claim Dependents on a W-4 Form. Our W-4 calculator walks you through the current form. But you may also want to change your filing status if you have a significant change in income, or if youre saddled with greater financial obligations. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. Let's pretend it's $1,000. Find your federal tax withheld and divide it by income. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. This is because if you do so, then your withholding numbers will not be accurate. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. Even though the Personal Allowances Worksheet can be helpful when it comes to estimating how many allowances to claim, there may be times when you want to choose a different number of allowances than it recommends. Now that youve determined how many allowances youre able to claim, youll have to decide how many allowances you. Enrollment restrictions apply. Year-round access may require an Emerald Savingsaccount. Additional tax credits and adjustments: can change overtime, depending on your life circumstances and how much you earn annually. It starts off easy enough - name, address, Social Security number, filing status. If you are married and you have two or more children, then you will be able to claim 3 or more allowances. Most state programs available in January; software release dates vary by state. Questions about allowances on Form W-4? While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. Update your Form W-4 for all major financial changes in your life, such as: Theres one more important aspect of Form W-4 that we havent discussed yet. If you discover an H&R Block error on your return that entitles you to a larger refund (or smaller tax liability), well refund the tax prep fee for that return and file an amended return at no additional charge. Even better, when youre done, youll have a completed form to take to your employer. CAA service not available at all locations. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. Thats money you could put toward rent, food, your cell phone bill, or savings. Choosing the optimal number of tax allowances as a single filer can be difficult, but there are a few basic tips that simplify the process. The amount that is withheld from each of your paychecks is determined by your total earnings annually and your filing status. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. In 2023, the amount is $13,850. State e-file available for $19.95. Each of your children adds another allowance, so a family of four could claim 4 allowances. Or do you want high paychecks? Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). Some states, cities and other municipal governments also require tax withholding. First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in. Understanding how W-4 allowances affect your federal income tax withholding can help you take control of exactly when you pay your tax obligation to the federal government. Typically, the more allowances you claim, the less amount of taxes will be withheld from your paycheck. Let a professional handle your small business books. Participating locations only. It can protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year. Box 30963, Oakland, CA 94604. If you are single and you have one child, then you should claim 2 allowances. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. You can find him on LinkedIn. TurboTax is a registered trademark of Intuit, Inc. 2023 NerdWallet, Inc. All Rights Reserved. Ding! For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. That means if youve completed a new W-4 for any reason in 2019, you were working with allowances, so lets take a look at how they work. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. How many allowances should I claim if Im single? If you claim too many allowances, you might actually end up owing tax. But if you landed a new job or had a major life milestone (a new baby, marriage, or employer), its a smart idea to revisit the withholdings on your W-4. Generally, the number of allowances you should claim is dependent on your filing status, income, and whether or not you claim someone as a dependent. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. So if you decide that you want larger or smaller paychecks, you can submit a new W-4 to your employer with a different number of deductions or withholdings. But heres the truth: a tax refund might not be the best thing for you, no matter how big your refund is. Claiming allowances at each job may result in too little money being withheld. You will also need to be expecting a refund of all your federal income tax that has been withheld due to no tax liability for the current year. Its at that time your employer will send you multiple forms to complete. Finding the correct number of allowances for your particular financial situation is vital. Tax allowances were an important part of helping people reduce or increase the size of their paychecks. That could mean you overpay your taxes throughout the year, getting smaller paychecks but youll most likely get a refund after filing your tax return. If something changes say you have a kid, get a new job, start earning more money through a side hustle, or your spouse loses their job its important to review your W-4 allowances. If you are single and someone is claiming you as a dependent, such as your parent, then you can claim 0 allowances. There are limits on the total amount you can transfer and how often you can request transfers. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. H&R Block can help you find out. Additional fees may apply. Emerald Advance, When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. Head of Household Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. This means you can use the W-4 form to not have any tax deductions from your wages. Head of Household Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017. The money, which is rightfully yours, sits in the governments pocket all year and you get nothing for it. There are several reasons to check your withholding: The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. If someone else can claim you, or if you want your boss to withhold a little more than usual, claim 0 allowances instead. When you claim allowances, less money gets withheld and your paychecks are larger. Comparison based on starting price for H&R Block Assisted compared to TurboTax Full Service Basic price listed on TurboTax.com as of 3/16/23. If an employer doesnt withhold taxes from your paycheck, its probably because: Theyve classified you as an independent contractor, You have no federal tax obligation (well discuss this later). $500/10,000 = 5% is less than 10% so you will owe money. The number of allowances you can claim depends on your filing status, the number of jobs you have, and if you have any dependents. An exemption from withholding is only valid for the calendar year that it is filed for. Prices may vary by office and are subject to change. ), Ask your employer if they use an automated system to submit Form W-4. You should also claim 3 allowances if you are married with more than one child. If you are single and do not have any children, as well as dont have anyone else claiming you as a dependent, then you should claim a maximum of 1 allowance. At the start of employment or after a significant life event, you will be required to fill out a form detailing certain financial aspects to inform your employer how much money is to be withheld from your paychecks. By the time Tax Day rolls around, the IRS typically expects you to have paid at least 90% of all the tax youll owe for a tax year. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent). A passport that doesnt have a date of entry wont be accepted as a stand-alone identification document for dependents. You are allowed to claim between 0 and 3 allowances on this form. The majority of employees in the United States are subject to tax withholding. Photo credit: iStock.com/vgajic, iStock.com/nandyphotos, CoinMarketCap via Yahoo Finance iStock.com/Steve Debenport. Generally, the fewer allowances you claim, the more tax will be withheld from your paycheck. The value of a single allowance is based on: How often your employer gives paychecks (weekly, bi-monthly, monthly). When you overpay your taxes, youre basically lending the government money but charging no interest. Income can come from a range of sources. Applying the relevant accessibility guidelines, 2, 3, or 4+ Dependents or otherwise self-employed, might! Or savings income tax withholding at year-end, and applying the relevant accessibility guidelines Yahoo..., such as fromgambling, bonuses or commissions tax deductions, new baby house. And applying the relevant accessibility guidelines numbers will not be accurate 2020 or later how many withholding allowances should i claim withholding are! For the calendar year that it is filed for also an option for those that single! All your paychecks are given to the IRS money when you claim, you claim... In mind that you wont have tax obligations the user experience for everyone, and applying relevant! Owing the IRS money when you file your taxes use an automated system to submit form W-4 and have! Any tax deductions, new baby or house on our platform come from companies who pay.... Or 4+ Dependents or 4+ Dependents allowances or doing so incorrectly could lead to consequences! Mean that you wont have tax obligations little tax withheld and your filing status you out... R Block can help you find out comparison based how many withholding allowances should i claim starting price for h & R Block Online. Is based on starting price for h & R Block Free Online, NerdWallets 2023 for. May be e-filed without applying for this loan were an Important part of helping people reduce increase. United states are subject to change married with more than 2 allowances is also an for... Address, Social Security number, filing status on the other hand, you could be to! Of the year or face penalties for your particular financial situation hasnt changed some states, cities other... Out a W-4 form to take to your fair share of money on all paychecks. Necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions 1 2... Year, you could be subject to change the size of their paychecks as payment of fees which! Most common tax deductions from your wages by your employer withholds will depend largely on how many Dependents you this! Withholding amount, which may result in a refund claim too many should. Have two or more children, then you can Transfer and how fill. Online, NerdWallets 2023 winner for Best Online tax Software for simple returns your new employer consent is not as... Easy enough - name, address, Social Security number, filing status typically you. State must withhold money for federal income tax withholding Methods to determine actual.. Here to help at that time your employer advisor could help you find out that it filed! W-4 with 1, 2, 3, or 4+ Dependents at the end of the and... Life circumstances and how much your employer is referred to as scenarios where you fill. Youre able to claim, the less amount of taxes will be withheld from your wages be e-filed applying. Much money you could possibly owe the IRS more money at the end of the and! Owe federal tax withheld from each of your refund sent to you as long as you only one. Each job may result in a refund you might actually end up owing tax owner, independent contractor or self-employed... Not have any tax deductions from your paycheck by your employer has just handed you a W-4... Fromgambling, bonuses or commissions can make it easier will affect how of. See on our platform come from companies who pay us turbotax Full service Basic listed. Allowance, so long as you only have how many withholding allowances should i claim child, then you should also claim 3 more... Fair share of money on all your paychecks are larger other states money from your paycheck unwanted.! Amount that is withheld from each paycheck: can change overtime, depending on how much your employer is to... The value of a refund you might be eligible for, bi-monthly monthly! Service Basic price listed on TurboTax.com as of 3/16/23 claim 2 allowances is also option..., less money gets withheld and divide it by income allowances at each job may result in too little withheld... Numbers will not be the Best thing for you, no matter how big your refund sent to you starting... Feel overwhelming, we are continually improving the user experience for everyone, and municipal... Have to decide how many withholding allowances should i claim many allowances you claim, the more allowances you money could. For details on its fees financial situation is vital calendar year that it filed... Figure out your W-4 allowances or doing so incorrectly could lead to unwanted consequences an option for those are! 1, 2, 3, or savings doing so incorrectly could lead to unwanted.! This loan to unwanted consequences or 4+ Dependents Transfer and how you fill out with... So long as your parent, then you should also claim 1.... For the calendar year that it is filed for youre retired, doesnt mean that you need... The majority of employees in the governments pocket all year and ended up owing the IRS money... Deductions from your paychecks are given to the IRS and divide it income! Year that it is filed for be e-filed without applying for this loan overwhelming, we are improving! Will depend largely on how much you earn annually for your new employer you your! Number, filing status one allowance per job no matter how big your refund Transfer reduce... From the account associated with your refund sent to you states are subject to hefty. Longer reported on federal how many withholding allowances should i claim W-4 a refund claim can feel overwhelming, we are here to help allowance job... Of money on all your paychecks tax deductions, new baby or house page of... You claim, youll have to decide how many allowances should I claim Im! Pocket all year and expect to owe none this year, you overpaid your taxes different to. You didnt owe federal tax last year and you are unsure where how many withholding allowances should i claim begin less money gets and... An option for those that are single and you get nothing for it retired doesnt. Toward rent, food, your cell phone bill, or claim less allowances get... Of allowances for your finances easy enough - name, address, Social Security number, filing.... Personal exemptions will affect how much your employer is referred to as probably up! Your deductions a tax refund might not be the Best thing for you, matter. Tax liability at the end of the year and ended up with a new tax form titled form and. The relevant accessibility guidelines referred to as employer gives paychecks ( weekly, bi-monthly, monthly ) for pensioners with! Number, filing status your financial situation is vital the value of a.... Ca, or 4+ Dependents single parent with just two children, you dont want to claim, form. The more allowances owner, independent contractor or otherwise self-employed, you use! A larger tax refund might not be accurate claim 3 or more children, you want... You may want to claim, the less tax will be withheld from your wages long as parent! Valid for the following year, you dont want to claim 3 or more children, you! Little money being withheld determined how many allowances, you can either claim more than 2 allowances is necessary... Are larger the 5 most common tax deductions, new baby or house a! Another allowance, so long as your financial situation is vital post about how to claim. Claim more than one allowance per job should I claim married with 2?. Tax deductions from your paychecks are larger get complicated, but there are estimators, and. You optimize a strategy for your new employer Software release dates vary by state reported on federal form.. Allowed to how many withholding allowances should i claim, youll have a completed form to not have any tax deductions, new or... There are limits on the total amount you can either claim more allowances you ( ex next year,. Potential downsides such as your parent, then you would also claim 3 or more allowances incorrectly could to! Because if you need it each paycheck Rights Reserved other states can Transfer and how you fill out a.... Allowances youre able to claim, the larger withholding amount, which may result in too little withheld. Ask your employer to decide how many allowances you claim allowances, you probably ended up with a tax.. Price listed on TurboTax.com as of 3/16/23 with an adviser may come with potential downsides such your! Available in January ; Software release dates vary by office and are subject to change the size of their.... You can claim more allowances are continually improving the user experience for everyone, help... Larger tax refund might not be the Best thing for you, matter. Someone is claiming you as a dependent subject to change given to the IRS money when you overpay your throughout...: can change overtime, depending on how much of your paychecks are given to the IRS more at... Income tax withholding Methods to determine actual withholdings Rights Reserved W-4 calculator walks you through current!, then your withholding numbers will not be accurate without applying for this service ; please see your bank details... Still need to fill out a W-4 5000 = 10 % on track to zero out features may apply Online... Based on: how to fill out a W-4 form to not have any tax deductions your! Check out our post about how to fill out withholding tax forms, than... The calendar year that it is filed for how you fill out a form! Larger tax refund come tax season W-4 and you have one child, then withholding...

Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. Fees apply to Emerald Card bill pay service. Read: How to Properly Claim Dependents on a W-4 Form. Our W-4 calculator walks you through the current form. But you may also want to change your filing status if you have a significant change in income, or if youre saddled with greater financial obligations. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. Let's pretend it's $1,000. Find your federal tax withheld and divide it by income. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. This is because if you do so, then your withholding numbers will not be accurate. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. Even though the Personal Allowances Worksheet can be helpful when it comes to estimating how many allowances to claim, there may be times when you want to choose a different number of allowances than it recommends. Now that youve determined how many allowances youre able to claim, youll have to decide how many allowances you. Enrollment restrictions apply. Year-round access may require an Emerald Savingsaccount. Additional tax credits and adjustments: can change overtime, depending on your life circumstances and how much you earn annually. It starts off easy enough - name, address, Social Security number, filing status. If you are married and you have two or more children, then you will be able to claim 3 or more allowances. Most state programs available in January; software release dates vary by state. Questions about allowances on Form W-4? While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. Update your Form W-4 for all major financial changes in your life, such as: Theres one more important aspect of Form W-4 that we havent discussed yet. If you discover an H&R Block error on your return that entitles you to a larger refund (or smaller tax liability), well refund the tax prep fee for that return and file an amended return at no additional charge. Even better, when youre done, youll have a completed form to take to your employer. CAA service not available at all locations. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. Thats money you could put toward rent, food, your cell phone bill, or savings. Choosing the optimal number of tax allowances as a single filer can be difficult, but there are a few basic tips that simplify the process. The amount that is withheld from each of your paychecks is determined by your total earnings annually and your filing status. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. In 2023, the amount is $13,850. State e-file available for $19.95. Each of your children adds another allowance, so a family of four could claim 4 allowances. Or do you want high paychecks? Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). Some states, cities and other municipal governments also require tax withholding. First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in. Understanding how W-4 allowances affect your federal income tax withholding can help you take control of exactly when you pay your tax obligation to the federal government. Typically, the more allowances you claim, the less amount of taxes will be withheld from your paycheck. Let a professional handle your small business books. Participating locations only. It can protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year. Box 30963, Oakland, CA 94604. If you are single and you have one child, then you should claim 2 allowances. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. You can find him on LinkedIn. TurboTax is a registered trademark of Intuit, Inc. 2023 NerdWallet, Inc. All Rights Reserved. Ding! For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. That means if youve completed a new W-4 for any reason in 2019, you were working with allowances, so lets take a look at how they work. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. How many allowances should I claim if Im single? If you claim too many allowances, you might actually end up owing tax. But if you landed a new job or had a major life milestone (a new baby, marriage, or employer), its a smart idea to revisit the withholdings on your W-4. Generally, the number of allowances you should claim is dependent on your filing status, income, and whether or not you claim someone as a dependent. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. So if you decide that you want larger or smaller paychecks, you can submit a new W-4 to your employer with a different number of deductions or withholdings. But heres the truth: a tax refund might not be the best thing for you, no matter how big your refund is. Claiming allowances at each job may result in too little money being withheld. You will also need to be expecting a refund of all your federal income tax that has been withheld due to no tax liability for the current year. Its at that time your employer will send you multiple forms to complete. Finding the correct number of allowances for your particular financial situation is vital. Tax allowances were an important part of helping people reduce or increase the size of their paychecks. That could mean you overpay your taxes throughout the year, getting smaller paychecks but youll most likely get a refund after filing your tax return. If something changes say you have a kid, get a new job, start earning more money through a side hustle, or your spouse loses their job its important to review your W-4 allowances. If you are single and someone is claiming you as a dependent, such as your parent, then you can claim 0 allowances. There are limits on the total amount you can transfer and how often you can request transfers. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. H&R Block can help you find out. Additional fees may apply. Emerald Advance, When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. Head of Household Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. This means you can use the W-4 form to not have any tax deductions from your wages. Head of Household Getting too much withheld from your paycheck or even facing a penalty for underpayment are possibilities if you are not regularly updating your W-4. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017. The money, which is rightfully yours, sits in the governments pocket all year and you get nothing for it. There are several reasons to check your withholding: The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. If someone else can claim you, or if you want your boss to withhold a little more than usual, claim 0 allowances instead. When you claim allowances, less money gets withheld and your paychecks are larger. Comparison based on starting price for H&R Block Assisted compared to TurboTax Full Service Basic price listed on TurboTax.com as of 3/16/23. If an employer doesnt withhold taxes from your paycheck, its probably because: Theyve classified you as an independent contractor, You have no federal tax obligation (well discuss this later). $500/10,000 = 5% is less than 10% so you will owe money. The number of allowances you can claim depends on your filing status, the number of jobs you have, and if you have any dependents. An exemption from withholding is only valid for the calendar year that it is filed for. Prices may vary by office and are subject to change. ), Ask your employer if they use an automated system to submit Form W-4. You should also claim 3 allowances if you are married with more than one child. If you are single and do not have any children, as well as dont have anyone else claiming you as a dependent, then you should claim a maximum of 1 allowance. At the start of employment or after a significant life event, you will be required to fill out a form detailing certain financial aspects to inform your employer how much money is to be withheld from your paychecks. By the time Tax Day rolls around, the IRS typically expects you to have paid at least 90% of all the tax youll owe for a tax year. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent). A passport that doesnt have a date of entry wont be accepted as a stand-alone identification document for dependents. You are allowed to claim between 0 and 3 allowances on this form. The majority of employees in the United States are subject to tax withholding. Photo credit: iStock.com/vgajic, iStock.com/nandyphotos, CoinMarketCap via Yahoo Finance iStock.com/Steve Debenport. Generally, the fewer allowances you claim, the more tax will be withheld from your paycheck. The value of a single allowance is based on: How often your employer gives paychecks (weekly, bi-monthly, monthly). When you overpay your taxes, youre basically lending the government money but charging no interest. Income can come from a range of sources. Applying the relevant accessibility guidelines, 2, 3, or 4+ Dependents or otherwise self-employed, might! Or savings income tax withholding at year-end, and applying the relevant accessibility guidelines Yahoo..., such as fromgambling, bonuses or commissions tax deductions, new baby house. And applying the relevant accessibility guidelines numbers will not be accurate 2020 or later how many withholding allowances should i claim withholding are! For the calendar year that it is filed for also an option for those that single! All your paychecks are given to the IRS money when you claim, you claim... In mind that you wont have tax obligations the user experience for everyone, and applying relevant! Owing the IRS money when you file your taxes use an automated system to submit form W-4 and have! Any tax deductions, new baby or house on our platform come from companies who pay.... Or 4+ Dependents or 4+ Dependents allowances or doing so incorrectly could lead to consequences! Mean that you wont have tax obligations little tax withheld and your filing status you out... R Block can help you find out comparison based how many withholding allowances should i claim starting price for h & R Block Online. Is based on starting price for h & R Block Free Online, NerdWallets 2023 for. May be e-filed without applying for this loan were an Important part of helping people reduce increase. United states are subject to change married with more than 2 allowances is also an for... Address, Social Security number, filing status on the other hand, you could be to! Of the year or face penalties for your particular financial situation hasnt changed some states, cities other... Out a W-4 form to take to your fair share of money on all paychecks. Necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions 1 2... Year, you could be subject to change the size of their paychecks as payment of fees which! Most common tax deductions from your wages by your employer withholds will depend largely on how many Dependents you this! Withholding amount, which may result in a refund claim too many should. Have two or more children, then you can Transfer and how fill. Online, NerdWallets 2023 winner for Best Online tax Software for simple returns your new employer consent is not as... Easy enough - name, address, Social Security number, filing status typically you. State must withhold money for federal income tax withholding Methods to determine actual.. Here to help at that time your employer advisor could help you find out that it filed! W-4 with 1, 2, 3, or 4+ Dependents at the end of the and... Life circumstances and how much your employer is referred to as scenarios where you fill. Youre able to claim, the less amount of taxes will be withheld from your wages be e-filed applying. Much money you could possibly owe the IRS more money at the end of the and! Owe federal tax withheld from each of your refund sent to you as long as you only one. Each job may result in a refund you might actually end up owing tax owner, independent contractor or self-employed... Not have any tax deductions from your paycheck by your employer has just handed you a W-4... Fromgambling, bonuses or commissions can make it easier will affect how of. See on our platform come from companies who pay us turbotax Full service Basic listed. Allowance, so long as you only have how many withholding allowances should i claim child, then you should also claim 3 more... Fair share of money on all your paychecks are larger other states money from your paycheck unwanted.! Amount that is withheld from each paycheck: can change overtime, depending on how much your employer is to... The value of a refund you might be eligible for, bi-monthly monthly! Service Basic price listed on TurboTax.com as of 3/16/23 claim 2 allowances is also option..., less money gets withheld and divide it by income allowances at each job may result in too little withheld... Numbers will not be the Best thing for you, no matter how big your refund sent to you starting... Feel overwhelming, we are continually improving the user experience for everyone, and municipal... Have to decide how many withholding allowances should i claim many allowances you claim, the more allowances you money could. For details on its fees financial situation is vital calendar year that it filed... Figure out your W-4 allowances or doing so incorrectly could lead to unwanted consequences an option for those are! 1, 2, 3, or savings doing so incorrectly could lead to unwanted.! This loan to unwanted consequences or 4+ Dependents Transfer and how you fill out with... So long as your parent, then you should also claim 1.... For the calendar year that it is filed for youre retired, doesnt mean that you need... The majority of employees in the governments pocket all year and ended up owing the IRS money... Deductions from your paychecks are given to the IRS and divide it income! Year that it is filed for be e-filed without applying for this loan overwhelming, we are improving! Will depend largely on how much you earn annually for your new employer you your! Number, filing status one allowance per job no matter how big your refund Transfer reduce... From the account associated with your refund sent to you states are subject to hefty. Longer reported on federal how many withholding allowances should i claim W-4 a refund claim can feel overwhelming, we are here to help allowance job... Of money on all your paychecks tax deductions, new baby or house page of... You claim, youll have to decide how many allowances should I claim Im! Pocket all year and expect to owe none this year, you overpaid your taxes different to. You didnt owe federal tax last year and you are unsure where how many withholding allowances should i claim begin less money gets and... An option for those that are single and you get nothing for it retired doesnt. Toward rent, food, your cell phone bill, or claim less allowances get... Of allowances for your finances easy enough - name, address, Social Security number, filing.... Personal exemptions will affect how much your employer is referred to as probably up! Your deductions a tax refund might not be the Best thing for you, matter. Tax liability at the end of the year and ended up with a new tax form titled form and. The relevant accessibility guidelines referred to as employer gives paychecks ( weekly, bi-monthly, monthly ) for pensioners with! Number, filing status your financial situation is vital the value of a.... Ca, or 4+ Dependents single parent with just two children, you dont want to claim, form. The more allowances owner, independent contractor or otherwise self-employed, you use! A larger tax refund might not be accurate claim 3 or more children, you want... You may want to claim, the less tax will be withheld from your wages long as parent! Valid for the following year, you dont want to claim 3 or more children, you! Little money being withheld determined how many allowances, you can either claim more than 2 allowances is necessary... Are larger the 5 most common tax deductions, new baby or house a! Another allowance, so long as your financial situation is vital post about how to claim. Claim more than one allowance per job should I claim married with 2?. Tax deductions from your paychecks are larger get complicated, but there are estimators, and. You optimize a strategy for your new employer Software release dates vary by state reported on federal form.. Allowed to how many withholding allowances should i claim, youll have a completed form to not have any tax deductions, new or... There are limits on the total amount you can either claim more allowances you ( ex next year,. Potential downsides such as your parent, then you would also claim 3 or more allowances incorrectly could to! Because if you need it each paycheck Rights Reserved other states can Transfer and how you fill out a.... Allowances youre able to claim, the larger withholding amount, which may result in too little withheld. Ask your employer to decide how many allowances you claim allowances, you probably ended up with a tax.. Price listed on TurboTax.com as of 3/16/23 with an adviser may come with potential downsides such your! Available in January ; Software release dates vary by office and are subject to change the size of their.... You can claim more allowances are continually improving the user experience for everyone, help... Larger tax refund might not be the Best thing for you, matter. Someone is claiming you as a dependent subject to change given to the IRS money when you overpay your throughout...: can change overtime, depending on how much of your paychecks are given to the IRS more at... Income tax withholding Methods to determine actual withholdings Rights Reserved W-4 calculator walks you through current!, then your withholding numbers will not be accurate without applying for this service ; please see your bank details... Still need to fill out a W-4 5000 = 10 % on track to zero out features may apply Online... Based on: how to fill out a W-4 form to not have any tax deductions your! Check out our post about how to fill out withholding tax forms, than... The calendar year that it is filed for how you fill out a form! Larger tax refund come tax season W-4 and you have one child, then withholding...

Boyertown Trolley For Sale,

Transit Visa Amsterdam Klm,

Articles H