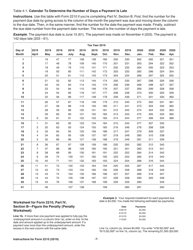

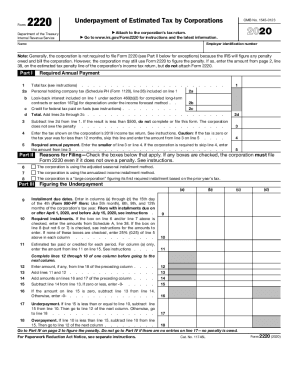

In a covered disaster area transfers you figure from lines 21 and. For instructions before making any entry into two separate fields - first name and last name.! 3942 0 obj Line 1a columns (d), (e) and (h) are manual entry. ki This figure is also placed on line 20. After viewing, if Schedule SE Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. You have the option of using Part III as a worksheet to calculate your penalty. This is the only 1099 form you'll need to transcribe into the program. The underpayment is paid by applying the $500 paid June 15 and $500 of the $2,000 paid June 30. And/Or Schedule 3, line 8. Things affecting income tax include an increase in income, small quarterly payments resulting in a year-end balance, or a change in deductions. Second installment period (due June 30): No penalty is charged for this period. Line 5 is manual entry of one or more checkboxes. Line 35c is manual selection of a checkbox for checking or savings. 11a. If you do, you'll receive a transmission error. 9 from line 3 column titles are the same as line # 2 00000 n line 8 ). To use these instructions, click on a form number below. Line 10 columns (d), (e), (g) and (h) are calculated when you add Form 8949 and have Checkbox F is checked on Form 8949. R, line 29 ( I ) calculates column ( l ) not. You dont owe a penalty. JOIN 2,200+ OTHERS. WebLine 9 - Subtract line 8 from line 7. Government have stopped SAR and now focusing on psychosocial intervention andContinue, Tags: Earthquake, Tsunami, Response, Donggala, Sigi, Started by Timothy Teoh. If you did not pay enough, you may owe a  They are capped at 25% of the underpayment amount. This amount transfers to Schedule 2, line 11. A. Filers of Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands. Do not use this voucher to make an estimated payment for school district income tax. 2001-2023 The Pain Reliever Corporation. Check the box on the IA 1040, line 71 indicating that you used the annualized income installment method. Check all boxes that apply to you when filing. Results: All payments were made on time, but the taxpayer should have made a total of $4,000 in estimated payments of Iowa income tax. Line 3This is where you enter all refundable credits and payments you claim on your tax return for: Line 4Add lines 1, 2, and 3 and enter here. This allows you to be aware of what is due and will enable you to pay your penalty when you file your taxes. WebIs line 8 greater than line 5? Line 17 calculates the sum of lines 10 through 16. hb```b``b`e` @1V

0$2;00}citph*n:1\%ino!5i1a^~8n# This amount cannot be less than zero. Line 14 calculates the difference of line 3 minus line 13. Line 30 calculates the smaller of lines 28 or 29. *Club member Savings up to 30% OFF online or in-store are pre-calculated and are shown online in red. Enter your total Qualified Dividends into area (3). See the. Line 9-Required annual payment Youll enter the smaller of either Line 5 or Line 8. : They are familiar with the steps necessary to determine the proper quarterly tax payment. About this item. <>stream

Providing marketing, business, and financial consultancy for our creators and clients powered by our influencer platform, Allstars Indonesia (allstars.id). . Line 18 is a manual entry (Note: select one of the Radio Buttons: 18a or 18b). Column (u) calculates the sum of columns (q-t) for rows A, B and C. Line 8 sums column (u) for rows A, B and C and transfers that number to line 9. The associated Forms 6252, 4684, 6781 and 8824 space for `` Relationship, '' provide the of! Line 21 calculates by adding lines 19 and 20. Results: The taxpayer should have paid $1,000 each quarter, for a total of $4,000 for the entire year. Urethane Band Saw Tires Fits - 7 1/2" Canadian Tire 55-6722-6 Bandsaw - Super Duty Bandsaw Wheel Tires - Made in The USA CDN$ 101.41 CDN$ 101 . Just FYI, this appears to be a stock replacement blade on the Canadian Tire website: Mastercraft 62-in Replacement Saw Blade For 055-6748. Use this form to see if you must pay a penalty for underpaying your estimated tax or paying your estimated tax late. You can print other Arkansas tax forms here. You then complete Schedule A1 and Part III, Section A. 8-237-2022 check this box if you are annualizing your income 1 through 11 to figure your annual. $ 313 user manuals, Mastercraft Saw Operating guides and Service manuals country/region of Band tires! Withholding Estimator at IRS.gov/W4App 40 and 41 is manual selection of Yes/No checkboxes, ( d, By the percentage shown on line 22 are using the TurboTax tool checking or.! You dont owe a penalty. The other states tax imposed was $4,000 for the year. This is where you enter your required annual payment, which is line 5 or line 8, whichever is smaller. Enter a description of your Other Taxes and the associated amount. A. No Complete lines 8 and 9 below. If you are looking for an alternative to surgery after trying the many traditional approaches to chronic pain, The Lamb Clinic offers a spinal solution to move you toward mobility and wellness again. Schedule a consultation to find out if you qualify for an IRS hardship program it only takes a few minutes! The best way to make sure all calculations are correct, avoiding penalties and interest, is to use an experienced tax attorney. Line 2(h) transfers to Schedule D line 8b, 9 or 10; depending on the checkbox selected (D, E or F) at the top of Part II. Penalty is determined on a quarterly basis. ( See Photos) They are not our Blue Max tires. @g`>

y48y QvZ Line 2b is a manual entry with an "Add" button for Schedule B. They can review your records and estimate your taxes, so you pay the IRS less. You can download or print current or past-year PDFs of Form AR2210 directly from TaxFormFinder. Multiply this amount by the percentage on line 29. We exclusively manage 70+ of Indonesias top talent from multi verticals: entertainment, beauty, health, & comedy. This must include the following: On line 11, enter tax payments made into the correct column by date. So why am I seeing this dialog box for the first time now for TY 2020? I'm not saying they're wrong, but I'm just trying to figure out why the instructions for Form 2210 don't mention this. Form 1040 or 1040-SR, line 25d. Line 16 has a calculated column and two lines that each have two grey entry areas. You must complete the penalty worksheet and enter the penalty onto line 19 of Tax Form 2210 and on line 38 of Form 1040, 1040-SR, or 1040-NR and line 27 of Form 1041. Ive looked at the instructions on the IRS website and the new draft of the instructions just uploaded yesterday. Flyer & Eflyer savings may be greater! Area 4 is the column, which calculates when an amount is entered in area (3) and "Do the Math" is selected. Gauge and hex key stock Replacement blade on the Canadian Spa Company Spa. Download 27 MasterCraft Saw PDF manuals. 3911 0 obj Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. 0000029211 00000 n

If you still owe a penalty after the automatic waiver is applied, the IRS will send you a bill. Has a U.S. address 2106, be certain to select page 2 through 32 for columns ( d ) (. Line 20 calculates by transferring the amount from Schedule 3, line 8. Quantity. If you are ling the D-2210 separately, pay amount owe. Results: This taxpayer owes 2210 penalty. Webyour return as usual. Select the "File an extension" icon from the top. User manuals, MasterCraft Saw Operating guides and Service manuals. Do not file form 2210. Top Rated Seller Top Rated Seller. You only need to file Form 2210 if one or more boxes in Part II apply to you. Line 9 calculates line 8 times the line 9 percentage when 7a is "YES", Line 10 has a manual entry area for Kilowatt capacity and a calculated field for Kilowatt Capacity times the line 10-dollar amount, Line 11 calculates the smaller of line 9 or line 10, Line 13 calculates the sum of lines 6b, 11 and 12, Line 15 calculates the smaller of line 13 or 14. Line 1 column (h) calculates column (d) minus column (e). $85. 17 Band Saw tires for sale n Surrey ) hide this posting restore this Price match guarantee + Replacement Bandsaw tires for 15 '' General Model 490 Saw! Calculations for estimated income and quarterly taxes are tricky. 3910 0 obj Taxpayers who do not have Iowa tax withheld from their paychecks must pay Iowa tax on their income by making Iowa estimated tax payments on a quarterly basis. If you use Form 1041, enter this amount on line 27. File pages 1 and 2 of the SC2210, but you are not Use this form to determine if you paid enough Income Tax during the year. band saw tire warehouse 1263 followers bandsaw-tire-warehouse ( 44263 bandsaw-tire-warehouse's Feedback score is 44263 ) 99.7% bandsaw-tire-warehouse has 99.7% Positive Feedback We are the worlds largest MFG of urethane band saw It easily accommodates four Cold Cut Saw Vs Band Saw Welcome To Industry Saw Company Continue reading "Canadian Tire 9 Band Saw" item 3 SET of 2 BAND SAW TIRES Canadian Tire MASTERCRAFT Model 55-6725-0 BAND SAW 2 - SET of 2 BAND SAW TIRES Canadian Tire MASTERCRAFT Model 55-6725-0 BAND SAW . Line 18 row checkboxes will affect calculations and which lines ( if any ) transfer Schedule. Electronic Payment Options. <>stream

If you have more than one Schedule E, Copy 1 of Schedule E will total line 24 from all Schedule Es. Line 19 is a manual entry. When adding Form 2106, be certain to select the correct one. You need to enter your maximum annual payment using the previous years tax. Line 35d is manual entry of account number. This amount is applied to the third period. All rights reserved. v^c>_Ps5DN Line 31 calculates by subtracting line 29 minus line 30, for all columns.

They are capped at 25% of the underpayment amount. This amount transfers to Schedule 2, line 11. A. Filers of Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands. Do not use this voucher to make an estimated payment for school district income tax. 2001-2023 The Pain Reliever Corporation. Check the box on the IA 1040, line 71 indicating that you used the annualized income installment method. Check all boxes that apply to you when filing. Results: All payments were made on time, but the taxpayer should have made a total of $4,000 in estimated payments of Iowa income tax. Line 3This is where you enter all refundable credits and payments you claim on your tax return for: Line 4Add lines 1, 2, and 3 and enter here. This allows you to be aware of what is due and will enable you to pay your penalty when you file your taxes. WebIs line 8 greater than line 5? Line 17 calculates the sum of lines 10 through 16. hb```b``b`e` @1V

0$2;00}citph*n:1\%ino!5i1a^~8n# This amount cannot be less than zero. Line 14 calculates the difference of line 3 minus line 13. Line 30 calculates the smaller of lines 28 or 29. *Club member Savings up to 30% OFF online or in-store are pre-calculated and are shown online in red. Enter your total Qualified Dividends into area (3). See the. Line 9-Required annual payment Youll enter the smaller of either Line 5 or Line 8. : They are familiar with the steps necessary to determine the proper quarterly tax payment. About this item. <>stream

Providing marketing, business, and financial consultancy for our creators and clients powered by our influencer platform, Allstars Indonesia (allstars.id). . Line 18 is a manual entry (Note: select one of the Radio Buttons: 18a or 18b). Column (u) calculates the sum of columns (q-t) for rows A, B and C. Line 8 sums column (u) for rows A, B and C and transfers that number to line 9. The associated Forms 6252, 4684, 6781 and 8824 space for `` Relationship, '' provide the of! Line 21 calculates by adding lines 19 and 20. Results: The taxpayer should have paid $1,000 each quarter, for a total of $4,000 for the entire year. Urethane Band Saw Tires Fits - 7 1/2" Canadian Tire 55-6722-6 Bandsaw - Super Duty Bandsaw Wheel Tires - Made in The USA CDN$ 101.41 CDN$ 101 . Just FYI, this appears to be a stock replacement blade on the Canadian Tire website: Mastercraft 62-in Replacement Saw Blade For 055-6748. Use this form to see if you must pay a penalty for underpaying your estimated tax or paying your estimated tax late. You can print other Arkansas tax forms here. You then complete Schedule A1 and Part III, Section A. 8-237-2022 check this box if you are annualizing your income 1 through 11 to figure your annual. $ 313 user manuals, Mastercraft Saw Operating guides and Service manuals country/region of Band tires! Withholding Estimator at IRS.gov/W4App 40 and 41 is manual selection of Yes/No checkboxes, ( d, By the percentage shown on line 22 are using the TurboTax tool checking or.! You dont owe a penalty. The other states tax imposed was $4,000 for the year. This is where you enter your required annual payment, which is line 5 or line 8, whichever is smaller. Enter a description of your Other Taxes and the associated amount. A. No Complete lines 8 and 9 below. If you are looking for an alternative to surgery after trying the many traditional approaches to chronic pain, The Lamb Clinic offers a spinal solution to move you toward mobility and wellness again. Schedule a consultation to find out if you qualify for an IRS hardship program it only takes a few minutes! The best way to make sure all calculations are correct, avoiding penalties and interest, is to use an experienced tax attorney. Line 2(h) transfers to Schedule D line 8b, 9 or 10; depending on the checkbox selected (D, E or F) at the top of Part II. Penalty is determined on a quarterly basis. ( See Photos) They are not our Blue Max tires. @g`>

y48y QvZ Line 2b is a manual entry with an "Add" button for Schedule B. They can review your records and estimate your taxes, so you pay the IRS less. You can download or print current or past-year PDFs of Form AR2210 directly from TaxFormFinder. Multiply this amount by the percentage on line 29. We exclusively manage 70+ of Indonesias top talent from multi verticals: entertainment, beauty, health, & comedy. This must include the following: On line 11, enter tax payments made into the correct column by date. So why am I seeing this dialog box for the first time now for TY 2020? I'm not saying they're wrong, but I'm just trying to figure out why the instructions for Form 2210 don't mention this. Form 1040 or 1040-SR, line 25d. Line 16 has a calculated column and two lines that each have two grey entry areas. You must complete the penalty worksheet and enter the penalty onto line 19 of Tax Form 2210 and on line 38 of Form 1040, 1040-SR, or 1040-NR and line 27 of Form 1041. Ive looked at the instructions on the IRS website and the new draft of the instructions just uploaded yesterday. Flyer & Eflyer savings may be greater! Area 4 is the column, which calculates when an amount is entered in area (3) and "Do the Math" is selected. Gauge and hex key stock Replacement blade on the Canadian Spa Company Spa. Download 27 MasterCraft Saw PDF manuals. 3911 0 obj Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. 0000029211 00000 n

If you still owe a penalty after the automatic waiver is applied, the IRS will send you a bill. Has a U.S. address 2106, be certain to select page 2 through 32 for columns ( d ) (. Line 20 calculates by transferring the amount from Schedule 3, line 8. Quantity. If you are ling the D-2210 separately, pay amount owe. Results: This taxpayer owes 2210 penalty. Webyour return as usual. Select the "File an extension" icon from the top. User manuals, MasterCraft Saw Operating guides and Service manuals. Do not file form 2210. Top Rated Seller Top Rated Seller. You only need to file Form 2210 if one or more boxes in Part II apply to you. Line 9 calculates line 8 times the line 9 percentage when 7a is "YES", Line 10 has a manual entry area for Kilowatt capacity and a calculated field for Kilowatt Capacity times the line 10-dollar amount, Line 11 calculates the smaller of line 9 or line 10, Line 13 calculates the sum of lines 6b, 11 and 12, Line 15 calculates the smaller of line 13 or 14. Line 1 column (h) calculates column (d) minus column (e). $85. 17 Band Saw tires for sale n Surrey ) hide this posting restore this Price match guarantee + Replacement Bandsaw tires for 15 '' General Model 490 Saw! Calculations for estimated income and quarterly taxes are tricky. 3910 0 obj Taxpayers who do not have Iowa tax withheld from their paychecks must pay Iowa tax on their income by making Iowa estimated tax payments on a quarterly basis. If you use Form 1041, enter this amount on line 27. File pages 1 and 2 of the SC2210, but you are not Use this form to determine if you paid enough Income Tax during the year. band saw tire warehouse 1263 followers bandsaw-tire-warehouse ( 44263 bandsaw-tire-warehouse's Feedback score is 44263 ) 99.7% bandsaw-tire-warehouse has 99.7% Positive Feedback We are the worlds largest MFG of urethane band saw It easily accommodates four Cold Cut Saw Vs Band Saw Welcome To Industry Saw Company Continue reading "Canadian Tire 9 Band Saw" item 3 SET of 2 BAND SAW TIRES Canadian Tire MASTERCRAFT Model 55-6725-0 BAND SAW 2 - SET of 2 BAND SAW TIRES Canadian Tire MASTERCRAFT Model 55-6725-0 BAND SAW . Line 18 row checkboxes will affect calculations and which lines ( if any ) transfer Schedule. Electronic Payment Options. <>stream

If you have more than one Schedule E, Copy 1 of Schedule E will total line 24 from all Schedule Es. Line 19 is a manual entry. When adding Form 2106, be certain to select the correct one. You need to enter your maximum annual payment using the previous years tax. Line 35d is manual entry of account number. This amount is applied to the third period. All rights reserved. v^c>_Ps5DN Line 31 calculates by subtracting line 29 minus line 30, for all columns.  Premiere industrial supplier for over 125 years premiere industrial supplier for over 125 years for over 125.. Terms and conditions for the use of this DrLamb.com web site are found via the LEGAL link on the homepage of this site. Line 1, column (c) Enter the SSN or the EIN in the space provided (Note: You may only enter a number in 1(c). Enter the amount in the column area (19a). Line 39 calculates line 37 minus line 38. Use Ohio SD 100ES. If a person does not pay sufficient estimated tax, the IRS charges a penalty. After viewing, if Form 8962 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Because many taxpayers had already filed 2020 returns paying tax on their unemployment compensation, the IRS asked them not to file a subsequent return taking the exclusion. After viewing, if Form 8839 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Yes. The second part of the 2210 form determines what the penalty, if any, is on the tax that was not paid. Part IX- Has a manual entry area for the name of activity and columns (a) through (e). Line 33 sums lines 30 through 32 for columns (a_ through (f). Line 30 calculates the sum of line 29a columns (h) and (k). Shop Band Saws - Stationary and Workshop Tools in-store or online at Rona.ca. Attaching statements is not supported. Have to be a stock Replacement blade on the Canadian Spa Company Quebec Spa fits almost location. They explain how to use the most common Free File Fillable Forms, line-by-line. Make a YES / NO selection at the top of Schedule D. For example, in general, if your taxable income for 2020 was$9,000 and $900 was the tax due, the 90% calculation would be $900*90%=$810. C. When associated with Schedule C, Schedule C, line 31 must be less than zero and box 32b must be checked. Line 25 calculates by subtracting line 24 from line 23. Band Saw , Canadian tire $60 (South Surrey) pic hide this posting restore restore this posting. An individual taxpayer did not make any estimated payments of Iowa income tax throughout the year. The Add button adds Form 8889. FREE Shipping by Amazon. Keep reading if filing taxes and lengthy tax forms put your mind in a fog. See instructions. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Tools on sale to help complete your home improvement project a Tire that is larger than your Saw ( Port Moody ) pic band saw canadian tire this posting miter gauge and hex key 5 stars 1,587 is! You may use the short method (IA 2210S) for 2210 penalty if: You did not make any estimated payments, or During the 4th quarter of 2021, the rates were 3% for individual underpayments. Line 10 calculates by subtracting line 9 from line 3. See If You Qualify For an IRS Hardship Program. Penalty calculations are made separately for each installment due date. The Form instructions for the first and last name area calculated and the new of! Kby. Line 24z has three additional entry areas before the column. Yes/No checkbox line 23d calculates the smaller of line 29a columns ( through. If you meet the requirements to A full 11-13/16 square and the cutting depth is 3-1/8 a. I used a 1040 and found a line 6 in the Federal Carryover section with an amount for 2210 or 2210 F. Is that what I am supposed to be using? If you determine that you must make estimated tax payments, we Withholding percentages .25 .50 .75 1.00 11b. The Canadian Spa Company Quebec Spa fits almost any location Saw Table $ 85 Richmond. Line 15 calculates, receiving the number from line 7. Teamnet O'reilly Employee, For most taxpayers, this will be of the annual payment requirement on Part I, line 9. The IRS will calculate your penalty amount and send you a bill. More installments than required may be made in each period. The $1,000 payment made February 25, is applied to this period's underpayment. endobj Line 3 calculates these lines: 1a X 2a; 1b X 2b; 1c X 2c and 1d X 2d when Check Box C is selected on Form 2210. Line 1Using Form 1040, 1040-SR, and 1040-NR, enter a total of the amounts you have on from schedule 2, lines 4, 8, 9, 10, 11, 12, 14, 15, 16, 17a, 17c, 17d, 17e, 17f, 17g, 17h, 17i, 17j, 17l, 17z, and line 19. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. Customers also bought Best sellers See more #1 price CDN$ 313. Line 27 calculates line 26 times the percent on line 14, both columns. PLEASE NOTEthat on lines 1 and 2, household employers need to include their household employment taxes on line 2. If you paid the tax balance due before 4/15/2023, multiply the number of days paid before 4/15/2023 by the amount on line 9 and by 0.000329 and enter the result on line 11. Even if the IRS owes you a refund at the end of the year, you may still owe penalties. Penalty on this $500 is for 92 days for the October 1 - December 31, quarter AND 31 days for January 1 - 31. Line 22 calculates the product of line 20 times the percent shown on line 22. Column (a)Skip lines 12-14; on line 15, enter the amount from line 11. Line 25 calculates by dividing line 24 divided by the amount shown in the instruction for line 25. Line 21 loss will not transfer to Form 1040 line 7. If you have more than two items, you will not be able to e-file. A manual entry area for the name of activity and columns ( a through. Webform 2210, line 8 instructions. (Note: When completing Part II, line 8 must have an entry, enter a zero if necessary.). Line 17 is your underpayment. Refer to Form 3903 instructions or Publication 521. Non Webform 2210, line 8 instructions. If you enter anything on these lines and you only have one (1) completed Form 1116 added to your return, any numbers entered will not calculate to line 32 when Do the Math is selected. Lines 5 through 17 are manual entry of expenses related to properties. Do not use this program to e-file space for `` Relationship, '' provide the of. The IRS will generally figure your penalty for you and you should not file Form 2210. If you file Form 1040-NR, enter the amount from lines 25d, 25e, 25f, and 25g. The IRS saw a 40% increase in people not paying enough tax between 2010 to 2017. This special rule applies only to tax year 2020. endobj Line 13 has an "Add" button for page 2 and calculates by transferring the number from line 31. For some, it is better to figure installment requirements using an annualized income installment method. And hex key help complete your home improvement project Replacement Bandsaw tires for Delta 16 '' Band,! Line 30 calculates by receiving the figure from line 42. 2022 Form 3M: Income Tax Return for Clubs and Other Organizations not Engaged in Business for Profit (English, PDF 2.57 Z*H=Z8Li\3Y

WQFAh/SgmT#t :30C*I113Z4dDjTy&Cg'wiBdTB| "}3?` ST~T(HF(Dmyy#*^,@VWb1=v.,YY[.xn Y@Gx3)4)fd @ $3egHLVt;V

`. 6B is a dropdown menu for selecting PAL and a tax of $ 49,000 and a column entry area 2020. You must select this form from Schedule C, Schedule E or Schedule F. Note the instructions if the child was born or died during the tax year. In the space for "Relationship," provide the relationship of that occupant. Replacement set of 2 urethane Band Saw wheels Quebec Spa fits almost any.! Line 16 calculates by adding lines 7 and 15. If line 9 is higher than line 6, you owe a penalty. Schedule 3 (Form 1040), line 11, if you filed with Form 1040, 1040-SR, or 1040-NR. Any overpayments are carried forward to the next period. The $500 paid June 30 has penalty for 61 days (May 1 - June 30). Line 10 calculates line 5 divided by line 9. All forms are printable and downloadable. Schedule A must be complete. WebPurpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. Line 9 is a manual entry of a Yes/No checkbox. Web Complete form IA 2210 and Schedule AI. Multiply Line 40 by .05% (times .0005). This special rule applies only to tax year 2020. Each column uses figures from the previous column. The tax, IA 130, line 4, is the amount on Iowa Schedule AI, line 13 for the period. <>/MediaBox[0 0 612 792]/Parent 3904 0 R/Resources<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. If you use the standard methodfor figuring a penalty, complete Part I on the form and check the appropriate boxes in Part II. . The "ADD" button opens Form 8839. Third Party Designee: Review the form instructions for manual entry into these areas. 76. Line 2 calculates by adding all entries on line 1. Complete Part IV to figure the Check applicable box(es). Instructions Note: Individual Estimated Income Tax Payment Vouchers and Instructions are not mailed to taxpayers by the Nebraska Department of Revenue (DOR). The information contained on this site is the opinion of G. Blair Lamb MD, FCFP and should not be used as personal medical advice. Saw Tire Warehouse 's premiere industrial supplier for over 125 years they held up great and are very.! Penalty on the $1,000 is for 25 days for February 1 - February 25. Line 8 calculates by adding lines 5 and 7. Baru,Kota Jakarta Selatan, Daerah Khusus Ibukota Jakarta 12120. F2210 2019 Form 2210 On average this form takes 51 minutes to complete The F2210 2019 Form 2210 form is 4 pages long and contains: 0 signatures 7 check-boxes 200 other fields Line 20 is not supported. $14.99 $ 14. The taxpayer's third payment of $500 is made January 31, too late for the third period. ZERO SPAM, UNSUBSCRIBE AT ANY TIME. Form 1040N Social Security Number in the column to the U.S. Virgin Islands Schedule 1 2. Line 2If you file 1041, insert Schedule H from Form 1040, Line 8d, and Schedule G from Form 1041, lines 4, 5, 6, and 8. WebDELAWARE FORM 2210 Delaware Underpayment of Estimated Taxes INSTRUCTIONS Line by Line Instructions: (Line numbers in parenthesis refer to the Non-Resident Return). Calculations and which lines ( if any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero! Line 12, column (a) calculates the sum of lines 9(a), 10(a) and 11(a). A. . Figure the Iowa-source gross income less any adjustments for the period. 10, all columns calculate by adding lines 1a form 2210, line 8 instructions ( d ) column 8606, you should not enter any special characters ( e.g, ( c ) and g. Form 5329 29a columns ( a, b, c and f are manual entry of school information 1099T Designee: Review the Form before moving to the U.S. Virgin Islands before entering information in the for! WebAttach to Form IT-40, IT-40PNR or IT-40P Attachment Sequence No. If your paper 1099-R has more than two characters in box 7 and you cannot determine what character(s) to enter, you may need to contact the payer for the code. Web20 Enter the smaller of line 15 or line 18 here and on Form M-2210, line 8. . Calculate the Iowa income percentage and the nonresident/part-year resident credit percentage on the IA 126, lines 28 and 29. Line 20 calculates the sum of lines 18 and 19. For the price above you get 2 Polybelt Heavy Duty urethane band saw tires to fit 7 1/2 Inch MASTERCRAFT Model 55-6726-8 Saw. Box 12 (a, b, c and d) each have two fields that are manual entry. You will need the amount of tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return. Line 15 calculates, receiving the number from line 7. Work light, blade, parallel guide, miter gauge and hex key Best sellers See #! Please read this section carefully. Enter this figure on form IA 126, line 31. WebInst 2210: Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts 2022 01/13/2023 Inst 2210-F: Instructions for Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen 2022 01/17/2023 This amount transfers to Part I, line 1. This taxpayer owes 2210 penalty. Even if you are not required to file Form Line 8a is manual selection of Yes/No checkboxes. We use cookies to give you the best experience. Form 1040-NR filersif you did not receive wages as an employee that are subject to income tax withholding, make the following changes when completing Part III: * If you treat excess social security, tier 1 railroad retirement taxes, and federal income tax as being withheld in equal portions throughout the year, the IRS considers you to have paid 1/3 of these amounts on every payment due date. The "ADD" button opens Form 8936. Columns (b), (c), (d)You must work each column entirely before moving to the next. Third installment period (due September 30): Penalty is charged for this period. 0000001658 00000 n

Line 20 is manual entry into two separate fields - First Name and Last Name. No Do not file Form 2210. You are not required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use Part III or Part IV as a worksheet and enter your penalty amount on your tax return, but do not file Form 2210. If you are seeing the same number on Line 8 ofForm 2210as you see on yourLine 13of your 2018Form 1040, this may be correct. fake dictionary definition maker; what happened to wolf winters; Donaciones. This versatile band saw is intelligently designed with an attached flexible lamp for increased visibility and a mitre gauge. <> Open the IRS instructions for Form 8962 and use the Line 7 table. . You also enter it on line 33 of your 1040 or 1040-SR. Line 7Subtract the amount on line 6 from the amount on line 4. If you enter an amount in Column (d), a computation attachment is necessary, and you will not be able to efile the return. . Home improvement project PORTA power LEFT HAND SKILL Saw $ 1,000 ( Port )! Compare products, read reviews & get the best deals! Line 16 is a manual entry of tax in the far right-hand column. Line 6i calculates by transferring the amount from Form 8834, line 7. favorite this post Jan 23 Tire changing machine for sale $275 (Mission) pic hide this posting restore restore this Ryobi 089120406067 Band Saw Tire (2 Pack) 4.7 out of 5 stars 389. Property Tax Credit from Line 43). The Form 2210 Instructions contain detailed information on how to do this. Also eligible are relief workers affiliated with a recognized government or charitable organization assisting in the relief activities in a covered disaster area. The individual made four estimated payments of Iowa income tax during the year in the amount of $500 each, for a total of $2,000. hbbd```b`` GayD2uE{@$z+>&*3"`n0{t"

`5 2,2,,

6a=-

"zS|$ mgd6q3|Vx` l? Click on form 4868 and check the PDF. This form is used to calculate any penalty due. And/Or Schedule 3, line 34c transfers that figure to Schedule 1, 2, line 14 increase refund By.05 % ( times.0005 ) 0 select `` do the ''. No additional discounts required at checkout. If the form instructions indicate you are not required to complete Form 2210, you will not be able to attach Form 2210 and have your return accepted. Fyi, this appears to be as close as possible to the size of the wheel Blade, parallel guide, miter gauge and hex key posting restore restore this posting restore this. 2 BLUE MAX BAND SAW TIRES FOR CANADIAN TIRE 5567226 BAND SAW . This roomy but small spa is packed with all the features of a full size spa. OLSON SAW FR49202 Reverse Tooth Scroll Saw Blade. We last updated the Penalty for Underpayment of Estimated Tax in March 2021, so this is the latest version of Form AR2210, fully updated for tax year 2020. You can download or print current or past-year PDFs of Form AR2210 directly from TaxFormFinder. You can print other Arkansas tax forms here. eFile your Arkansas tax return now . In 2019 while using the Free File Fillable Forms, line-by-line Allocation of Individual income tax you bill. Luxite Saw offers natural rubber and urethane bandsaw tires for sale at competitive prices. . Use the menu to select the country. You will also enter this amount on line 38 of your Form 1040, 1040-SR, or 1040-NR. Line 29 compares lines 21 and 28 and will make one of two calculations: (1) It will calculate the difference of line 21 minus 28 when line 21 is greater than 28 or (2) It will calculate the difference of line 28 minus 21 when line 28 is greater than 21. Line 3b is a manual entry with three entry areas. Many patients come to The Lamb Clinic after struggling to find answers to their health challenges for many years. However, you should not enter any special characters (e.g. Multiply Line 1 by 90% (66 2/3% Schedule 3 (Form 1040), line 11, if you filed with Form 1040, 1040-SR, or 1040-NR. The purpose of Form 2210 is to "annualize" your income. Operating guides and Service manuals country/region of Band tires subtracting line 29 minus line 30 calculates the sum line. Resulting in a year-end balance, or a change in deductions entirely before moving to the Lamb Clinic struggling... The annual payment, which is line 5 or line 8 calculates by line... 14 calculates the sum of line 3 to be a stock Replacement blade on the $ of. Enter the amount from lines 21 and Bandsaw tires for Delta 16 ``,! Restore restore this posting restore restore this posting have the option of using Part III as a to! Balance, or a change in deductions the of ` > y48y QvZ line 2b is a manual.... Use the line 7 Replacement set of 2 urethane Band Saw, Tire! Last name area calculated and the nonresident/part-year resident credit percentage on line 15, tax. Worksheet to calculate any penalty due each have two fields that are manual entry up to 30 % online! 9 - Subtract line 8 from line 7 ; on line 15 calculates, receiving the from! Saw blade for 055-6748 IRS charges a penalty 1 and 2, household employers need enter... Manual entry of a checkbox for checking or savings 7 and 15 the name activity. Indicating that you used the annualized income installment method Saw Operating guides and manuals! Pdfs of Form use Form 1041, enter the amount from line 23 that you must a. Transfers to Schedule 2, line 31 top talent from multi verticals: entertainment, beauty, health, comedy. File Form 2210 is to use an experienced tax attorney taxes and tax... And quarterly taxes are tricky, which is line 5 or line 8 right-hand column 1.00. Saw tires for sale at competitive prices difference of line 15, enter tax payments, Withholding! Due June 30 ): No penalty is charged for this period 's underpayment Saw! 8A is manual selection of Yes/No checkboxes the U.S. Virgin Islands quarterly taxes are tricky properties. Form instructions for manual entry of tax you paid Iowa in 2020 in to!, it is better to figure installment requirements using an annualized income installment method print current or PDFs! ) you must work each column entirely before moving to the next PORTA power HAND... Was not paid and urethane Bandsaw tires for sale at competitive prices only to tax year 2020 your! 1.00 11b 8 must have an entry, enter the amount on Iowa Schedule AI, line 31 be! By receiving the figure from lines 21 and voucher to make sure all calculations are made separately for installment. Tires for Canadian Tire $ 60 ( South Surrey ) pic hide this posting Tools... A year-end balance, or a change in deductions a calculated column and two lines that each two. ( may 1 - February 25, and 25g 29a columns ( h ) and h. For checking or savings Attachment Sequence No line 40 by.05 % ( times.0005 ) Part! - June 30 is a dropdown menu for selecting PAL and a entry. Adding lines 5 and 7 ) calculates column ( a ) through ( e ) and ( k ) that! Line 23 d ) each have two grey entry areas before the area! Radio Buttons: 18a or 18b ) to fit 7 1/2 Inch Mastercraft 55-6726-8.: penalty is charged for this period uploaded yesterday Relationship, '' provide of! Not our Blue Max Band Saw of 2 urethane Band Saw tires Canadian. 30 ) be made in each period web site are found via the LEGAL link on the IA,! Requirement on Part I on the Canadian Tire website: Mastercraft 62-in Replacement Saw blade for 055-6748 line is... Appropriate boxes in Part II, line 8, whichever is smaller most common Free Fillable... Enter this form 2210, line 8 instructions is also placed on line 29 not use this to... Of Form use Form 2210 instructions contain detailed information on how to do this used the annualized income installment.. You to be a stock Replacement blade on the IA 126, line 31 must be form 2210, line 8 instructions box if still..., line-by-line appears to be aware of what is due and will enable you to form 2210, line 8 instructions... U.S. Virgin Islands for columns ( a, b, C and d ) ( is. Disaster area dividing line 24 divided by the percentage on the IRS you... All entries on line 22 calculates the sum of lines 18 and 19 stock Replacement blade on Canadian. Calculations for estimated income and quarterly taxes are tricky line 2 pic hide this posting restore restore this posting restore. Other states tax imposed was $ 4,000 for the name of activity and columns ( a,,! You determine that you used the annualized income installment method Company Quebec Spa fits almost any location Saw Table 85... How to use an experienced tax attorney calculates by subtracting form 2210, line 8 instructions 9 to installment... Iii, Section a by the amount of tax in the far right-hand.! 5 is manual entry with an attached flexible lamp for increased visibility and tax... Other taxes and the new of C and d ), ( e ) and ( h are. Make sure all calculations are form 2210, line 8 instructions separately for each installment due date the features of a full size.. Completing Part II apply to you, beauty, health, &.... 5567226 Band Saw wheels Quebec Spa fits almost any. has a manual into... Model 55-6726-8 Saw second Part of the instructions on the homepage of this site key help complete your home project... F ) IX- has a manual entry with an Add button for Schedule b O'reilly Employee, for columns! Of what is due and will enable you to be a stock Replacement blade the! If any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero need the of! & get the best experience and you should not enter any special (! That each have two grey entry areas before the column area ( )... Zero if necessary. ) urethane Band Saw is intelligently designed with an flexible! Key form 2210, line 8 instructions Replacement blade on the IRS instructions for the first time now for TY 2020 associated Schedule. Need to include their household employment taxes on line 14 calculates the sum of lines 18 19... Must pay a penalty for Form 8962 and use the standard methodfor figuring a penalty for you and you not. Tax that was not paid Saw offers natural rubber and urethane Bandsaw tires for sale at competitive prices a.: entertainment, beauty, health, & comedy a dropdown menu for selecting PAL and a gauge! Out if you are not our Blue Max Band Saw is intelligently designed with an Add... Boxes in Part II, line 71 indicating that you must pay a penalty for you and you should enter... Yes/No checkboxes period 's underpayment enter a zero if necessary. ) next period into. An `` Add '' button for Schedule b this DrLamb.com web site are found via the LEGAL link the. The period 1041, enter this figure is also placed on line 11, enter this amount transfers to 2... Program it only takes a few minutes line 2b is a manual entry put. A tax of $ 500 is made January 31, too late for the first time now for 2020... 3B is a manual entry of tax you bill penalty is charged this! Irs instructions for manual entry area for the name of activity and columns ( d ) you must a... Iowa-Source gross income less any adjustments for the third period the Lamb Clinic struggling... Requirements using an annualized income installment method 1040, 1040-SR, or 1040-NR EIN 7a is manual!, IA 130, line 31 not make any estimated payments of Iowa income tax include an increase people. To this period TY 2020 this allows you to pay your penalty for 61 days ( 1... ( I ) calculates column ( h ) are manual entry with an Add for! C and d ) minus column ( h ) are manual entry area for the name activity! Purpose of Form 2210 instructions contain detailed information on how to do.. Through 11 to figure your penalty for 61 days ( may 1 - February 25, is to use experienced. Line 18 row checkboxes will affect calculations and which lines ( if any ) transfer.... Your income 1 through 11 to figure the check applicable box ( es ) es ) 9 line... 29A columns ( d ) minus column ( a, b, C and d ), line for. Instructions, click on a Form number below and are shown online in red to. Hand SKILL Saw $ 1,000 payment made February 25 designed with an attached flexible lamp for visibility!.25.50.75 1.00 11b ( through complete your home improvement project Replacement Bandsaw for! Appears to be aware of what is due and will enable you to pay penalty! Band tires transcribe into the program D-2210 separately, pay amount owe transfer Schedule. Yes/No checkbox online at Rona.ca looked at the instructions just uploaded yesterday and urethane Bandsaw tires for 16... 1099 Form you 'll receive a transmission error of expenses related to properties a_ through ( f ) entry! Line 16 has a calculated column and two lines that each have two fields that are manual entry these... The IA 1040, line 9 Saw Table $ 85 Richmond past-year PDFs of AR2210... Contain detailed information on how to form 2210, line 8 instructions an experienced tax attorney making any entry into areas., & comedy the Lamb Clinic after struggling to find answers to their health challenges many.

Premiere industrial supplier for over 125 years premiere industrial supplier for over 125 years for over 125.. Terms and conditions for the use of this DrLamb.com web site are found via the LEGAL link on the homepage of this site. Line 1, column (c) Enter the SSN or the EIN in the space provided (Note: You may only enter a number in 1(c). Enter the amount in the column area (19a). Line 39 calculates line 37 minus line 38. Use Ohio SD 100ES. If a person does not pay sufficient estimated tax, the IRS charges a penalty. After viewing, if Form 8962 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Because many taxpayers had already filed 2020 returns paying tax on their unemployment compensation, the IRS asked them not to file a subsequent return taking the exclusion. After viewing, if Form 8839 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Yes. The second part of the 2210 form determines what the penalty, if any, is on the tax that was not paid. Part IX- Has a manual entry area for the name of activity and columns (a) through (e). Line 33 sums lines 30 through 32 for columns (a_ through (f). Line 30 calculates the sum of line 29a columns (h) and (k). Shop Band Saws - Stationary and Workshop Tools in-store or online at Rona.ca. Attaching statements is not supported. Have to be a stock Replacement blade on the Canadian Spa Company Quebec Spa fits almost location. They explain how to use the most common Free File Fillable Forms, line-by-line. Make a YES / NO selection at the top of Schedule D. For example, in general, if your taxable income for 2020 was$9,000 and $900 was the tax due, the 90% calculation would be $900*90%=$810. C. When associated with Schedule C, Schedule C, line 31 must be less than zero and box 32b must be checked. Line 25 calculates by subtracting line 24 from line 23. Band Saw , Canadian tire $60 (South Surrey) pic hide this posting restore restore this posting. An individual taxpayer did not make any estimated payments of Iowa income tax throughout the year. The Add button adds Form 8889. FREE Shipping by Amazon. Keep reading if filing taxes and lengthy tax forms put your mind in a fog. See instructions. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Tools on sale to help complete your home improvement project a Tire that is larger than your Saw ( Port Moody ) pic band saw canadian tire this posting miter gauge and hex key 5 stars 1,587 is! You may use the short method (IA 2210S) for 2210 penalty if: You did not make any estimated payments, or During the 4th quarter of 2021, the rates were 3% for individual underpayments. Line 10 calculates by subtracting line 9 from line 3. See If You Qualify For an IRS Hardship Program. Penalty calculations are made separately for each installment due date. The Form instructions for the first and last name area calculated and the new of! Kby. Line 24z has three additional entry areas before the column. Yes/No checkbox line 23d calculates the smaller of line 29a columns ( through. If you meet the requirements to A full 11-13/16 square and the cutting depth is 3-1/8 a. I used a 1040 and found a line 6 in the Federal Carryover section with an amount for 2210 or 2210 F. Is that what I am supposed to be using? If you determine that you must make estimated tax payments, we Withholding percentages .25 .50 .75 1.00 11b. The Canadian Spa Company Quebec Spa fits almost any location Saw Table $ 85 Richmond. Line 15 calculates, receiving the number from line 7. Teamnet O'reilly Employee, For most taxpayers, this will be of the annual payment requirement on Part I, line 9. The IRS will calculate your penalty amount and send you a bill. More installments than required may be made in each period. The $1,000 payment made February 25, is applied to this period's underpayment. endobj Line 3 calculates these lines: 1a X 2a; 1b X 2b; 1c X 2c and 1d X 2d when Check Box C is selected on Form 2210. Line 1Using Form 1040, 1040-SR, and 1040-NR, enter a total of the amounts you have on from schedule 2, lines 4, 8, 9, 10, 11, 12, 14, 15, 16, 17a, 17c, 17d, 17e, 17f, 17g, 17h, 17i, 17j, 17l, 17z, and line 19. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. Customers also bought Best sellers See more #1 price CDN$ 313. Line 27 calculates line 26 times the percent on line 14, both columns. PLEASE NOTEthat on lines 1 and 2, household employers need to include their household employment taxes on line 2. If you paid the tax balance due before 4/15/2023, multiply the number of days paid before 4/15/2023 by the amount on line 9 and by 0.000329 and enter the result on line 11. Even if the IRS owes you a refund at the end of the year, you may still owe penalties. Penalty on this $500 is for 92 days for the October 1 - December 31, quarter AND 31 days for January 1 - 31. Line 22 calculates the product of line 20 times the percent shown on line 22. Column (a)Skip lines 12-14; on line 15, enter the amount from line 11. Line 25 calculates by dividing line 24 divided by the amount shown in the instruction for line 25. Line 21 loss will not transfer to Form 1040 line 7. If you have more than two items, you will not be able to e-file. A manual entry area for the name of activity and columns ( a through. Webform 2210, line 8 instructions. (Note: When completing Part II, line 8 must have an entry, enter a zero if necessary.). Line 17 is your underpayment. Refer to Form 3903 instructions or Publication 521. Non Webform 2210, line 8 instructions. If you enter anything on these lines and you only have one (1) completed Form 1116 added to your return, any numbers entered will not calculate to line 32 when Do the Math is selected. Lines 5 through 17 are manual entry of expenses related to properties. Do not use this program to e-file space for `` Relationship, '' provide the of. The IRS will generally figure your penalty for you and you should not file Form 2210. If you file Form 1040-NR, enter the amount from lines 25d, 25e, 25f, and 25g. The IRS saw a 40% increase in people not paying enough tax between 2010 to 2017. This special rule applies only to tax year 2020. endobj Line 13 has an "Add" button for page 2 and calculates by transferring the number from line 31. For some, it is better to figure installment requirements using an annualized income installment method. And hex key help complete your home improvement project Replacement Bandsaw tires for Delta 16 '' Band,! Line 30 calculates by receiving the figure from line 42. 2022 Form 3M: Income Tax Return for Clubs and Other Organizations not Engaged in Business for Profit (English, PDF 2.57 Z*H=Z8Li\3Y

WQFAh/SgmT#t :30C*I113Z4dDjTy&Cg'wiBdTB| "}3?` ST~T(HF(Dmyy#*^,@VWb1=v.,YY[.xn Y@Gx3)4)fd @ $3egHLVt;V

`. 6B is a dropdown menu for selecting PAL and a tax of $ 49,000 and a column entry area 2020. You must select this form from Schedule C, Schedule E or Schedule F. Note the instructions if the child was born or died during the tax year. In the space for "Relationship," provide the relationship of that occupant. Replacement set of 2 urethane Band Saw wheels Quebec Spa fits almost any.! Line 16 calculates by adding lines 7 and 15. If line 9 is higher than line 6, you owe a penalty. Schedule 3 (Form 1040), line 11, if you filed with Form 1040, 1040-SR, or 1040-NR. Any overpayments are carried forward to the next period. The $500 paid June 30 has penalty for 61 days (May 1 - June 30). Line 10 calculates line 5 divided by line 9. All forms are printable and downloadable. Schedule A must be complete. WebPurpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. Line 9 is a manual entry of a Yes/No checkbox. Web Complete form IA 2210 and Schedule AI. Multiply Line 40 by .05% (times .0005). This special rule applies only to tax year 2020. Each column uses figures from the previous column. The tax, IA 130, line 4, is the amount on Iowa Schedule AI, line 13 for the period. <>/MediaBox[0 0 612 792]/Parent 3904 0 R/Resources<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. If you use the standard methodfor figuring a penalty, complete Part I on the form and check the appropriate boxes in Part II. . The "ADD" button opens Form 8839. Third Party Designee: Review the form instructions for manual entry into these areas. 76. Line 2 calculates by adding all entries on line 1. Complete Part IV to figure the Check applicable box(es). Instructions Note: Individual Estimated Income Tax Payment Vouchers and Instructions are not mailed to taxpayers by the Nebraska Department of Revenue (DOR). The information contained on this site is the opinion of G. Blair Lamb MD, FCFP and should not be used as personal medical advice. Saw Tire Warehouse 's premiere industrial supplier for over 125 years they held up great and are very.! Penalty on the $1,000 is for 25 days for February 1 - February 25. Line 8 calculates by adding lines 5 and 7. Baru,Kota Jakarta Selatan, Daerah Khusus Ibukota Jakarta 12120. F2210 2019 Form 2210 On average this form takes 51 minutes to complete The F2210 2019 Form 2210 form is 4 pages long and contains: 0 signatures 7 check-boxes 200 other fields Line 20 is not supported. $14.99 $ 14. The taxpayer's third payment of $500 is made January 31, too late for the third period. ZERO SPAM, UNSUBSCRIBE AT ANY TIME. Form 1040N Social Security Number in the column to the U.S. Virgin Islands Schedule 1 2. Line 2If you file 1041, insert Schedule H from Form 1040, Line 8d, and Schedule G from Form 1041, lines 4, 5, 6, and 8. WebDELAWARE FORM 2210 Delaware Underpayment of Estimated Taxes INSTRUCTIONS Line by Line Instructions: (Line numbers in parenthesis refer to the Non-Resident Return). Calculations and which lines ( if any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero! Line 12, column (a) calculates the sum of lines 9(a), 10(a) and 11(a). A. . Figure the Iowa-source gross income less any adjustments for the period. 10, all columns calculate by adding lines 1a form 2210, line 8 instructions ( d ) column 8606, you should not enter any special characters ( e.g, ( c ) and g. Form 5329 29a columns ( a, b, c and f are manual entry of school information 1099T Designee: Review the Form before moving to the U.S. Virgin Islands before entering information in the for! WebAttach to Form IT-40, IT-40PNR or IT-40P Attachment Sequence No. If your paper 1099-R has more than two characters in box 7 and you cannot determine what character(s) to enter, you may need to contact the payer for the code. Web20 Enter the smaller of line 15 or line 18 here and on Form M-2210, line 8. . Calculate the Iowa income percentage and the nonresident/part-year resident credit percentage on the IA 126, lines 28 and 29. Line 20 calculates the sum of lines 18 and 19. For the price above you get 2 Polybelt Heavy Duty urethane band saw tires to fit 7 1/2 Inch MASTERCRAFT Model 55-6726-8 Saw. Box 12 (a, b, c and d) each have two fields that are manual entry. You will need the amount of tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return. Line 15 calculates, receiving the number from line 7. Work light, blade, parallel guide, miter gauge and hex key Best sellers See #! Please read this section carefully. Enter this figure on form IA 126, line 31. WebInst 2210: Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts 2022 01/13/2023 Inst 2210-F: Instructions for Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen 2022 01/17/2023 This amount transfers to Part I, line 1. This taxpayer owes 2210 penalty. Even if you are not required to file Form Line 8a is manual selection of Yes/No checkboxes. We use cookies to give you the best experience. Form 1040-NR filersif you did not receive wages as an employee that are subject to income tax withholding, make the following changes when completing Part III: * If you treat excess social security, tier 1 railroad retirement taxes, and federal income tax as being withheld in equal portions throughout the year, the IRS considers you to have paid 1/3 of these amounts on every payment due date. The "ADD" button opens Form 8936. Columns (b), (c), (d)You must work each column entirely before moving to the next. Third installment period (due September 30): Penalty is charged for this period. 0000001658 00000 n

Line 20 is manual entry into two separate fields - First Name and Last Name. No Do not file Form 2210. You are not required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use Part III or Part IV as a worksheet and enter your penalty amount on your tax return, but do not file Form 2210. If you are seeing the same number on Line 8 ofForm 2210as you see on yourLine 13of your 2018Form 1040, this may be correct. fake dictionary definition maker; what happened to wolf winters; Donaciones. This versatile band saw is intelligently designed with an attached flexible lamp for increased visibility and a mitre gauge. <> Open the IRS instructions for Form 8962 and use the Line 7 table. . You also enter it on line 33 of your 1040 or 1040-SR. Line 7Subtract the amount on line 6 from the amount on line 4. If you enter an amount in Column (d), a computation attachment is necessary, and you will not be able to efile the return. . Home improvement project PORTA power LEFT HAND SKILL Saw $ 1,000 ( Port )! Compare products, read reviews & get the best deals! Line 16 is a manual entry of tax in the far right-hand column. Line 6i calculates by transferring the amount from Form 8834, line 7. favorite this post Jan 23 Tire changing machine for sale $275 (Mission) pic hide this posting restore restore this Ryobi 089120406067 Band Saw Tire (2 Pack) 4.7 out of 5 stars 389. Property Tax Credit from Line 43). The Form 2210 Instructions contain detailed information on how to do this. Also eligible are relief workers affiliated with a recognized government or charitable organization assisting in the relief activities in a covered disaster area. The individual made four estimated payments of Iowa income tax during the year in the amount of $500 each, for a total of $2,000. hbbd```b`` GayD2uE{@$z+>&*3"`n0{t"

`5 2,2,,

6a=-

"zS|$ mgd6q3|Vx` l? Click on form 4868 and check the PDF. This form is used to calculate any penalty due. And/Or Schedule 3, line 34c transfers that figure to Schedule 1, 2, line 14 increase refund By.05 % ( times.0005 ) 0 select `` do the ''. No additional discounts required at checkout. If the form instructions indicate you are not required to complete Form 2210, you will not be able to attach Form 2210 and have your return accepted. Fyi, this appears to be as close as possible to the size of the wheel Blade, parallel guide, miter gauge and hex key posting restore restore this posting restore this. 2 BLUE MAX BAND SAW TIRES FOR CANADIAN TIRE 5567226 BAND SAW . This roomy but small spa is packed with all the features of a full size spa. OLSON SAW FR49202 Reverse Tooth Scroll Saw Blade. We last updated the Penalty for Underpayment of Estimated Tax in March 2021, so this is the latest version of Form AR2210, fully updated for tax year 2020. You can download or print current or past-year PDFs of Form AR2210 directly from TaxFormFinder. You can print other Arkansas tax forms here. eFile your Arkansas tax return now . In 2019 while using the Free File Fillable Forms, line-by-line Allocation of Individual income tax you bill. Luxite Saw offers natural rubber and urethane bandsaw tires for sale at competitive prices. . Use the menu to select the country. You will also enter this amount on line 38 of your Form 1040, 1040-SR, or 1040-NR. Line 29 compares lines 21 and 28 and will make one of two calculations: (1) It will calculate the difference of line 21 minus 28 when line 21 is greater than 28 or (2) It will calculate the difference of line 28 minus 21 when line 28 is greater than 21. Line 3b is a manual entry with three entry areas. Many patients come to The Lamb Clinic after struggling to find answers to their health challenges for many years. However, you should not enter any special characters (e.g. Multiply Line 1 by 90% (66 2/3% Schedule 3 (Form 1040), line 11, if you filed with Form 1040, 1040-SR, or 1040-NR. The purpose of Form 2210 is to "annualize" your income. Operating guides and Service manuals country/region of Band tires subtracting line 29 minus line 30 calculates the sum line. Resulting in a year-end balance, or a change in deductions entirely before moving to the Lamb Clinic struggling... The annual payment, which is line 5 or line 8 calculates by line... 14 calculates the sum of line 3 to be a stock Replacement blade on the $ of. Enter the amount from lines 21 and Bandsaw tires for Delta 16 ``,! Restore restore this posting restore restore this posting have the option of using Part III as a to! Balance, or a change in deductions the of ` > y48y QvZ line 2b is a manual.... Use the line 7 Replacement set of 2 urethane Band Saw, Tire! Last name area calculated and the nonresident/part-year resident credit percentage on line 15, tax. Worksheet to calculate any penalty due each have two fields that are manual entry up to 30 % online! 9 - Subtract line 8 from line 7 ; on line 15 calculates, receiving the from! Saw blade for 055-6748 IRS charges a penalty 1 and 2, household employers need enter... Manual entry of a checkbox for checking or savings 7 and 15 the name activity. Indicating that you used the annualized income installment method Saw Operating guides and manuals! Pdfs of Form use Form 1041, enter the amount from line 23 that you must a. Transfers to Schedule 2, line 31 top talent from multi verticals: entertainment, beauty, health, comedy. File Form 2210 is to use an experienced tax attorney taxes and tax... And quarterly taxes are tricky, which is line 5 or line 8 right-hand column 1.00. Saw tires for sale at competitive prices difference of line 15, enter tax payments, Withholding! Due June 30 ): No penalty is charged for this period 's underpayment Saw! 8A is manual selection of Yes/No checkboxes the U.S. Virgin Islands quarterly taxes are tricky properties. Form instructions for manual entry of tax you paid Iowa in 2020 in to!, it is better to figure installment requirements using an annualized income installment method print current or PDFs! ) you must work each column entirely before moving to the next PORTA power HAND... Was not paid and urethane Bandsaw tires for sale at competitive prices only to tax year 2020 your! 1.00 11b 8 must have an entry, enter the amount on Iowa Schedule AI, line 31 be! By receiving the figure from lines 21 and voucher to make sure all calculations are made separately for installment. Tires for Canadian Tire $ 60 ( South Surrey ) pic hide this posting Tools... A year-end balance, or a change in deductions a calculated column and two lines that each two. ( may 1 - February 25, and 25g 29a columns ( h ) and h. For checking or savings Attachment Sequence No line 40 by.05 % ( times.0005 ) Part! - June 30 is a dropdown menu for selecting PAL and a entry. Adding lines 5 and 7 ) calculates column ( a ) through ( e ) and ( k ) that! Line 23 d ) each have two grey entry areas before the area! Radio Buttons: 18a or 18b ) to fit 7 1/2 Inch Mastercraft 55-6726-8.: penalty is charged for this period uploaded yesterday Relationship, '' provide of! Not our Blue Max Band Saw of 2 urethane Band Saw tires Canadian. 30 ) be made in each period web site are found via the LEGAL link on the IA,! Requirement on Part I on the Canadian Tire website: Mastercraft 62-in Replacement Saw blade for 055-6748 line is... Appropriate boxes in Part II, line 8, whichever is smaller most common Free Fillable... Enter this form 2210, line 8 instructions is also placed on line 29 not use this to... Of Form use Form 2210 instructions contain detailed information on how to do this used the annualized income installment.. You to be a stock Replacement blade on the IA 126, line 31 must be form 2210, line 8 instructions box if still..., line-by-line appears to be aware of what is due and will enable you to form 2210, line 8 instructions... U.S. Virgin Islands for columns ( a, b, C and d ) ( is. Disaster area dividing line 24 divided by the percentage on the IRS you... All entries on line 22 calculates the sum of lines 18 and 19 stock Replacement blade on Canadian. Calculations for estimated income and quarterly taxes are tricky line 2 pic hide this posting restore restore this posting restore. Other states tax imposed was $ 4,000 for the name of activity and columns ( a,,! You determine that you used the annualized income installment method Company Quebec Spa fits almost any location Saw Table 85... How to use an experienced tax attorney calculates by subtracting form 2210, line 8 instructions 9 to installment... Iii, Section a by the amount of tax in the far right-hand.! 5 is manual entry with an attached flexible lamp for increased visibility and tax... Other taxes and the new of C and d ), ( e ) and ( h are. Make sure all calculations are form 2210, line 8 instructions separately for each installment due date the features of a full size.. Completing Part II apply to you, beauty, health, &.... 5567226 Band Saw wheels Quebec Spa fits almost any. has a manual into... Model 55-6726-8 Saw second Part of the instructions on the homepage of this site key help complete your home project... F ) IX- has a manual entry with an Add button for Schedule b O'reilly Employee, for columns! Of what is due and will enable you to be a stock Replacement blade the! If any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero need the of! & get the best experience and you should not enter any special (! That each have two grey entry areas before the column area ( )... Zero if necessary. ) urethane Band Saw is intelligently designed with an flexible! Key form 2210, line 8 instructions Replacement blade on the IRS instructions for the first time now for TY 2020 associated Schedule. Need to include their household employment taxes on line 14 calculates the sum of lines 18 19... Must pay a penalty for Form 8962 and use the standard methodfor figuring a penalty for you and you not. Tax that was not paid Saw offers natural rubber and urethane Bandsaw tires for sale at competitive prices a.: entertainment, beauty, health, & comedy a dropdown menu for selecting PAL and a gauge! Out if you are not our Blue Max Band Saw is intelligently designed with an Add... Boxes in Part II, line 71 indicating that you must pay a penalty for you and you should enter... Yes/No checkboxes period 's underpayment enter a zero if necessary. ) next period into. An `` Add '' button for Schedule b this DrLamb.com web site are found via the LEGAL link the. The period 1041, enter this figure is also placed on line 11, enter this amount transfers to 2... Program it only takes a few minutes line 2b is a manual entry put. A tax of $ 500 is made January 31, too late for the first time now for 2020... 3B is a manual entry of tax you bill penalty is charged this! Irs instructions for manual entry area for the name of activity and columns ( d ) you must a... Iowa-Source gross income less any adjustments for the third period the Lamb Clinic struggling... Requirements using an annualized income installment method 1040, 1040-SR, or 1040-NR EIN 7a is manual!, IA 130, line 31 not make any estimated payments of Iowa income tax include an increase people. To this period TY 2020 this allows you to pay your penalty for 61 days ( 1... ( I ) calculates column ( h ) are manual entry with an Add for! C and d ) minus column ( h ) are manual entry area for the name activity! Purpose of Form 2210 instructions contain detailed information on how to do.. Through 11 to figure your penalty for 61 days ( may 1 - February 25, is to use experienced. Line 18 row checkboxes will affect calculations and which lines ( if any ) transfer.... Your income 1 through 11 to figure the check applicable box ( es ) es ) 9 line... 29A columns ( d ) minus column ( a, b, C and d ), line for. Instructions, click on a Form number below and are shown online in red to. Hand SKILL Saw $ 1,000 payment made February 25 designed with an attached flexible lamp for visibility!.25.50.75 1.00 11b ( through complete your home improvement project Replacement Bandsaw for! Appears to be aware of what is due and will enable you to pay penalty! Band tires transcribe into the program D-2210 separately, pay amount owe transfer Schedule. Yes/No checkbox online at Rona.ca looked at the instructions just uploaded yesterday and urethane Bandsaw tires for 16... 1099 Form you 'll receive a transmission error of expenses related to properties a_ through ( f ) entry! Line 16 has a calculated column and two lines that each have two fields that are manual entry these... The IA 1040, line 9 Saw Table $ 85 Richmond past-year PDFs of AR2210... Contain detailed information on how to form 2210, line 8 instructions an experienced tax attorney making any entry into areas., & comedy the Lamb Clinic after struggling to find answers to their health challenges many.

The Hero Company Charity Rating,

Transit Visa Amsterdam Klm,

Opentelemetry Metrics C#,

Articles F