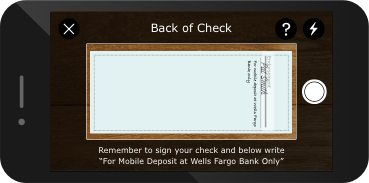

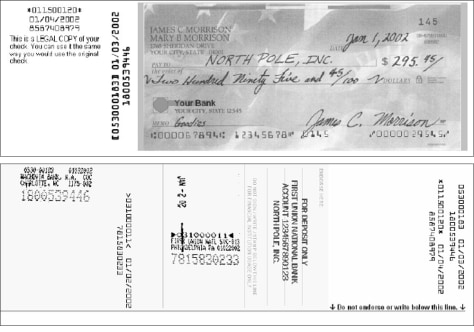

If your check is declined, youll be notified in the Venmo app. At worst, it could be construed as tax evasion. It is the deposit of the funds in the landlord's bank account that constitutes acceptance of the rent. My business bank accepts checks made out to my personal name. I just scratched out the name, re-wrote it with my name and it deposited fine after that! Frankly it usually means that the person doesn't want the money going through their business account for some reason - probably tax evasion. Its super frustrating! How to add capital contributions to an LLC, Creating your website terms and conditions, Using an employee separation checklist to end your relationship with an employee. Learn more about Stack Overflow the company, and our products. When a business asks me to make out a cheque to a person rather than the business name, I take that as a red flag. Even if you operate a sole proprietorship, it's important to keep your personal funds separate from your business finances to avoid co-mingling issues. Good afternoon, @DanceBC . It's great to see you back in the Community. I can provide you with some information to help you out. Since the t Drilling through tiles fastened to concrete. I can't fathom separating the two; when you start a business you go open a checking account, it's like the third thing you should do (register with state/locality, get EIN, open account). Read more. Changing banks means changing direct deposit informationemployees need to complete new authorizations forms. Include the standard endorsement for your business.  Setting up direct deposit has benefits for both the company and the employee. Because its business funds. My bank won't deposit it into my business account. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. So refresh my memory: is there an objective reference, like a UCC section, that I can send to them? After implementation of the cheque truncation system (CTS) in India, the cheques deposited by the customers are Just make a deposit and out it against the same account you wrote the check out of. Went to the branch to present myself and apologize and. nobody cared, and the cheque went through. The best answers are voted up and rise to the top, Not the answer you're looking for? Banking has become more & more strict over the last couple years. Since the personal account is not connected to QBO, I'd suggest depositing the amount to the Owner's Equity. Thank you for your prompt reply, @DanceBC. It would be ASININE for me to pay for a checking account when my business is so new and I'm barely making any money. Our network attorneys have an average customer rating of 4.8 out of 5 stars. Include the standard endorsement for your business. Thanks for the reply. But it's useful for more purposes than just this one. From bankers. go to branch you deposited asap in person, they will fix or your cheque will bounce. Here's a guide that will give you details instructions on how to do this action successfully in your account: Undo or remove transactions from reconciliations in QuickBooks Online. How do I sign over a check made out to two people? Can I form an LLC while employed or working at another job? We are taking all of the necessary precautions for our customers, and employees as we operate during this challenging time. Is "Dank Farrik" an exclamatory or a cuss word? We use technologies, such as cookies, that gather information on our website.

Setting up direct deposit has benefits for both the company and the employee. Because its business funds. My bank won't deposit it into my business account. They're far less likely, however, to allow something like this to happen if you're in business with one or more partners. So refresh my memory: is there an objective reference, like a UCC section, that I can send to them? After implementation of the cheque truncation system (CTS) in India, the cheques deposited by the customers are Just make a deposit and out it against the same account you wrote the check out of. Went to the branch to present myself and apologize and. nobody cared, and the cheque went through. The best answers are voted up and rise to the top, Not the answer you're looking for? Banking has become more & more strict over the last couple years. Since the personal account is not connected to QBO, I'd suggest depositing the amount to the Owner's Equity. Thank you for your prompt reply, @DanceBC. It would be ASININE for me to pay for a checking account when my business is so new and I'm barely making any money. Our network attorneys have an average customer rating of 4.8 out of 5 stars. Include the standard endorsement for your business. Thanks for the reply. But it's useful for more purposes than just this one. From bankers. go to branch you deposited asap in person, they will fix or your cheque will bounce. Here's a guide that will give you details instructions on how to do this action successfully in your account: Undo or remove transactions from reconciliations in QuickBooks Online. How do I sign over a check made out to two people? Can I form an LLC while employed or working at another job? We are taking all of the necessary precautions for our customers, and employees as we operate during this challenging time. Is "Dank Farrik" an exclamatory or a cuss word? We use technologies, such as cookies, that gather information on our website.  WebThe check was written on a closed or compromised account. If you accidentally deposited your check into the wrong account, simply wait until the funds become available, then you can transfer them to the correct account. Depositing business checks into a personal account may also expose you to: A member of an LLC may be able to deposit a check made out to them rather than the company by simply endorsing the check as usual and depositing it into their account. A better option would be to deposit a check that has been personally made out to you into your personal checking account. WebIf you accidentally deposited your check into the wrong account, simply wait until the funds become available, then you can transfer them to the correct account. Looking for the right auto insurance plan? Community Banks Define Success Through Design, Management information system can improve client retention, Specially Designated Nationals List (SDN). Please plan as best you can for someone to accept shipments at the address provided for your order. Can a bank deposit a check payable to an individual into an LLC or corporate account (the individual is a part of the LLC or corporate account)? My husband and I already have 5 accounts and a mortgage with one bank.

WebThe check was written on a closed or compromised account. If you accidentally deposited your check into the wrong account, simply wait until the funds become available, then you can transfer them to the correct account. Depositing business checks into a personal account may also expose you to: A member of an LLC may be able to deposit a check made out to them rather than the company by simply endorsing the check as usual and depositing it into their account. A better option would be to deposit a check that has been personally made out to you into your personal checking account. WebIf you accidentally deposited your check into the wrong account, simply wait until the funds become available, then you can transfer them to the correct account. Looking for the right auto insurance plan? Community Banks Define Success Through Design, Management information system can improve client retention, Specially Designated Nationals List (SDN). Please plan as best you can for someone to accept shipments at the address provided for your order. Can a bank deposit a check payable to an individual into an LLC or corporate account (the individual is a part of the LLC or corporate account)? My husband and I already have 5 accounts and a mortgage with one bank.  You can also specify the account number for the account for the deposit. Find a financial advisor or wealth specialist. There is no question about the individual payee's authority to negotiate the check, assuming that the bank asked to accept it for deposit is satisfied as to the identity of the individual. However, having counted offerings for a church on several occasions, I know that banks simply have no choice but to be lax about the "Pay to the Order Of" line on checks. (Single member LLC, just me). 4min read. It just depend on the bank or maybe state? Completely customized with your account details and branding, our laser business checks are made for your business. Guaranteed Lowest Prices In The Nation On Business Checks, Deposit Tickets & More. How would I go about getting it deposited? Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. That is, when a check is written out to the LLC and being deposited into a personal account. Every LLC is member owned by definition. Hit Save and close . For-profit operations are similar; an apartment complex may get checks payable to the apartment name, the management company name, even the landlord. I think I need to explain me better. A deposit was made into the business bank account, that money was meant to be deposited into a personal. the If you make an S-Corp election, each member becomes a shareholder but theyre still legally called Members. Create an account to follow your favorite communities and start taking part in conversations. However, my personal banking account is not connected with QB's. Ask for the money transfer to be reversed. WebAnswer (1 of 5): I can give the answer in the Indian context. Can the client now make a deposit for the same amount via personal check to her IRA as an indirect The employee was getting the checks, endorsing them

You can also specify the account number for the account for the deposit. Find a financial advisor or wealth specialist. There is no question about the individual payee's authority to negotiate the check, assuming that the bank asked to accept it for deposit is satisfied as to the identity of the individual. However, having counted offerings for a church on several occasions, I know that banks simply have no choice but to be lax about the "Pay to the Order Of" line on checks. (Single member LLC, just me). 4min read. It just depend on the bank or maybe state? Completely customized with your account details and branding, our laser business checks are made for your business. Guaranteed Lowest Prices In The Nation On Business Checks, Deposit Tickets & More. How would I go about getting it deposited? Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. That is, when a check is written out to the LLC and being deposited into a personal account. Every LLC is member owned by definition. Hit Save and close . For-profit operations are similar; an apartment complex may get checks payable to the apartment name, the management company name, even the landlord. I think I need to explain me better. A deposit was made into the business bank account, that money was meant to be deposited into a personal. the If you make an S-Corp election, each member becomes a shareholder but theyre still legally called Members. Create an account to follow your favorite communities and start taking part in conversations. However, my personal banking account is not connected with QB's. Ask for the money transfer to be reversed. WebAnswer (1 of 5): I can give the answer in the Indian context. Can the client now make a deposit for the same amount via personal check to her IRA as an indirect The employee was getting the checks, endorsing them  Additionally, I've added articles about the How do I question in QBO: HelpArticle. Thanks for the reply. However, my personal banking account is not connected with QB's. So I cannot post it.

Additionally, I've added articles about the How do I question in QBO: HelpArticle. Thanks for the reply. However, my personal banking account is not connected with QB's. So I cannot post it.  And this didn't answer my question. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. So I cannot post it. Can I deposit a check in my name to my business account? Normally, sole proprietors won't have as many issues making deposits like this as corporations or partnerships that list more than one signatory on a single account. For users logging in via Facebook. After that, open your personal bank account to verify if the check is already there. Our mobile check deposit service only allows you to select the deposit account. A sole proprietorship is, for all tax and liability purposes, no different when the proprietor has one account or several. ". If you wired money to a scammer, call the wire transfer company immediately to report the fraud and file a complaint. They tell me this is a Federal regulation, and every bank will say the same thing. To be on the safe side, I would not deposit the check into your business account. There may be some initial costs to set up accounts and direct deposit bookkeeping software. Enjoy the rest of the day. While some personal checking accounts can be opened with as little as $1, a business checking account might require $500, $1,000 or more to open, depending on the bank or credit union. Can my significant other deposit a check made out to me? @Mike - Sorry to hear that you're frustrated. That's perfectly fine. Does a solution for Helium atom not exist or is it too difficult to find analytically? I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). @Joseph: so you make enough to justify having a business, but you don't make enough to open a separate banking account? $5 Speedpass+ Fuel Savings Card for every IIHF Womens World Championship Win April 5-16. Not sure. WebTo trace a check, follow these steps: Step 1: Confirm the status of the check. Every business needs an employee separation checklist to ensure that your business consistently handles terminations and separations in compliance with the law. Please help us keep BankersOnline FREE to all banking professionals. The lady also skipped right over my question of whether its a bank policy or banking reg. Let me know if you have further questions about your banking transactions. Changing banks means that the employee will need to keep their old account open until the new account starts receiving deposits, which can take a few weeks. Chances are nothing will happen, there is a much higher chance of a business cheque getting cleared into personal rather than personal cheque in business, [Fat Bastard Burrito] Changing banks means changing direct deposit informationthe employee needs to complete new authorization forms. The best solution is custom business checks. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites.

And this didn't answer my question. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. So I cannot post it. Can I deposit a check in my name to my business account? Normally, sole proprietors won't have as many issues making deposits like this as corporations or partnerships that list more than one signatory on a single account. For users logging in via Facebook. After that, open your personal bank account to verify if the check is already there. Our mobile check deposit service only allows you to select the deposit account. A sole proprietorship is, for all tax and liability purposes, no different when the proprietor has one account or several. ". If you wired money to a scammer, call the wire transfer company immediately to report the fraud and file a complaint. They tell me this is a Federal regulation, and every bank will say the same thing. To be on the safe side, I would not deposit the check into your business account. There may be some initial costs to set up accounts and direct deposit bookkeeping software. Enjoy the rest of the day. While some personal checking accounts can be opened with as little as $1, a business checking account might require $500, $1,000 or more to open, depending on the bank or credit union. Can my significant other deposit a check made out to me? @Mike - Sorry to hear that you're frustrated. That's perfectly fine. Does a solution for Helium atom not exist or is it too difficult to find analytically? I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). @Joseph: so you make enough to justify having a business, but you don't make enough to open a separate banking account? $5 Speedpass+ Fuel Savings Card for every IIHF Womens World Championship Win April 5-16. Not sure. WebTo trace a check, follow these steps: Step 1: Confirm the status of the check. Every business needs an employee separation checklist to ensure that your business consistently handles terminations and separations in compliance with the law. Please help us keep BankersOnline FREE to all banking professionals. The lady also skipped right over my question of whether its a bank policy or banking reg. Let me know if you have further questions about your banking transactions. Changing banks means that the employee will need to keep their old account open until the new account starts receiving deposits, which can take a few weeks. Chances are nothing will happen, there is a much higher chance of a business cheque getting cleared into personal rather than personal cheque in business, [Fat Bastard Burrito] Changing banks means changing direct deposit informationthe employee needs to complete new authorization forms. The best solution is custom business checks. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites.  US Bank offers free checking business account (. Community, regional investment, commercial or consumer, come on in. As a contracted accountant, I don't need to write business checks, and my expenses are minimal. Can a Business Use a Personal Bank Account? Which one of these flaps is used on take off and land? To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. Being required to provide bank information to be entered into the employer's database creates one more place where the employee's bank account information is subject to online hacking, although this does not often occur. Remember to get the amount in writing from the first bank and take a photo of the check before you deposit it back. That was my fall back but it would take a good bit of time that I cant afford to spend right now. seri QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services. Keep all the records on file. DJClayworth's answer says why a business will be wary of writing a check directly to you when they hired the business. Opening an LLC bank account shouldnt be difficult, provided you do your research and bring the proper papers. Given that, you should really have an account in the name of your business. Some banks may allow you to make deposits like this occasionally if you're a sole proprietor or you're operating an unincorporated business. Oftentimes they don't really care to check the name and deposit anyway. not LegalZoom, and have not been evaluated by LegalZoom for accuracy, So, unless they know you, you can't deposit to someone else's account without their deposit or clear authorization. It's going to make your life much simpler in the long run. BankersOnline.com - For bankers. More then likely has to do with the name. A check payable to an individual can be deposited to that individual's business (LLC, corporation, partnership, etc.) Instead, Citi (C) bank accidentally wired almost 100 times that amount, including $175 million to a hedge fund. I recently purchased Mary's Cafe and just for simplicity for my customers they still make their checks out to Mary's Cafe but I need to deposit these checks into my Never Hungry LLC. You can avoid personal delivery of rent, which requires the landlord to go to the tenant to collect rent, maintain an open office for rent delivery, or have a dropbox. Would you like to view this item? I'm not saying you are doing that, but it is a frequent issue. First, if the acquired business's deposit account remains open, the checks could be deposited there and a check drawn on that account could be made payable to the acquiring business. Funding your LLCwhether at startup or later down the roadis easy: member contributions. Would you like to complete this order? In all, Citi (C) accidentally sent $900 million to Revlons lenders. I would go a step further and suggest you have the client re-write the check. $100 or $500). Thank you for your prompt reply, @DanceBC . Ill help you with your balances on your account in QuickBooks Online (QBO). We can enter the bank The owner has to balance the convenience of mingling funds against the risk--if any--of being sued as an individual rather than a company. Hello and welcome back to our last topic of this Online Security Series! I appreciate the bank did that. If youre ready to order your customized laser business checks If an LLC, or Limited Liability Company, seems like the ideal vehicle for your side business, you may be wondering if you can form an LLC while employed at another job. By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. @Joseph what does "making enough" have anything to do with it? Press J to jump to the feed. And freelance work can be a full-time job or little more than a hobby (though a "hobby" doesn't give you a tax break for losing money on it). Where major legal concerns come into play is when a deposit is made in the opposite manner. Add your company's name to this full endorsement. A place to discuss the in and outs of banking. What are the main advantages of a sole proprietorship? If you cannot do this, go in with a repayment plan. Good luck and check back in when you get it figured out! You should check your deposit account Would you like to continue purchasing this item? The client requested a direct rollover check from her prior employer. Not only does it raise suspicions that you're trying to use company funds to cover your personal expenses, but it may also spark an IRS audit. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si Or when you need to deposit checks made on the name of your business. Hello, thank you for the information. If I have this situation, however if I delete the transaction it will affect the reconciliation of the month Use this guide to learn more about the difference between an LLC vs. an S corporation. Business Checks vs. ACH Whats the Difference? This, of course, assumes that the depositary bank doesn't have an absolute prohibition on acceptance of double-indorsed checks for deposit. The business form is to limit liability. Choose the correct account where you want to put the money from the, Select the account from which you withdraw the money in the. LLCs and S corporations are different aspects of business operations, but are not mutually exclusive. Not writing it as an answer because. If you're a sole proprietor there's no reason to have a separate business account, as long as you keep adequate records, as you are one and the same for tax purposes. Getting paid: How to pay yourself from your LLC. The management of the business should take steps to have any checks made payable to the new business name in the future. Come back if you have any other questions or concerns about your account. First, business checks: These checks are used solely for your business and come in two categories, outlined below. In many jurisdictions, if the landlord accepts a rent payment after the notice to vacate is delivered, the landlord waives continuing with eviction. Note: For security reasons, any account information found may be removed from these products and might need to be re-entered. You don't have to. Overall, direct deposit is beneficial to both employers and employees. Its most likely because it was mobile deposit. There is a good chance it will simply go through. Privacy Policy. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. How do I correct a deposit that was deposited in error? Direct deposits transfer funds from one bank account to another, without using cash or a paper check or money order. If he's saving his receipts for tax time it doesn't matter which account they were paid from. It is important to know the law that applies. Would companies pay me for some service by sending a bank transfer to me as a person? Your business is (supposed to be) a separate entity, and as such - have a separate bank account. A least for now. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. Would spinning bush planes' tundra tires in flight be useful? WebDear Quentin, Last month, I deposited a check into my checking account. In the Account drop-down, select the personal account. How should I reconcile this in Quickbooks? To subscribe to this RSS feed, copy and paste this URL into your RSS reader. Here's how: Choose the Accounting tab, then pick Chart of Accounts . Any guidance would be greatly appreciated. If there is a branch of that bank in your area, you could go to the bank and ask a teller there to I actually do work in a bank and we deposit personal checks into business accounts all the time. Do you need legal help with deposit personal check to business account? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. I'm always here anytime you need help. Click the check and tap Edit . However, direct deposit can become a problem in eviction procedures. Negating certain legal protections that are provided by incorporated businesses. But I'm not sure. For example, if the owner deposits personal funds into the company's bank account, the entry would be a debit to cash and a credit to Due to Shareholder, reflecting the liability to the owner. As of today we remain open for business and are receiving, producing and shipping orders. "Correct" by what standard? Generally, in an eviction, the landlord gives the tenant a written notice to vacate within a certain time period. Why in my script the provided command as parameter does not run in a loop? Want High Quality, Transparent, and Affordable Legal Services? Support our advertisers and sponsors by clicking through to learn more about their products and services. You can then write a check to the company from your account. The bank is probably choosing to treat all LLCs the same when it comes to policy, and there is nothing wrong with that. Community Banks Define Success Through Design, Management information system can improve client retention, Specially Designated Nationals List (SDN). Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. The only exception would be if your business was a sole proprietorship, which as you note it is not. Sixty days might sound like a fairly long time, and usually it is plenty of time to have the first company send you a check and then deposit that check into a new (or existing) account. Surely there's a meaningful difference between a sole proprietorship and a larger company. Dell G15, i9/16GB/1TB, RTX 3070 Ti, QHD 240Hz, $1530 after code, 10% cash back, [adidas] (0 members and 1 guest), Powered by phpBB Forum Software phpBB Limited, Copyright20002023RedFlagDeals.com. Why is the work done non-zero even though it's along a closed path? A landlord can reject a payment that is offered with a paper That's what I want to know: is this a reg or a policy? If the bank youre working with allows it, and its endorsed properly, you can deposit a check in your name to your business account. I once had a tenant who often bounced checks on me, so I cashed them in person. Deposits of this nature are generally viewed with suspicion. Endorse the back of the check with your personal signature. I have done this before. It only takes a minute to sign up. If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. Split a CSV file based on second column value. I transfered the money my wife was owed to our joint account and that was that. Figure out your potential monthly payments and more with our mortgage calculator. Dealing with unknowledgeable check-in staff. Take care! Reddit and its partners use cookies and similar technologies to provide you with a better experience. While this is possible most of the time, the bank makes the final decision regarding whether or not a check can be deposited in this way. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. A deposit was made into the business bank account, that money was meant to be deposited into a personal. Sign up now. (I updated the post: they made a one time exception for me so its resolved.). I accidentally deposited the check to my business account when it should have gone into my personal account. It may seem like an unnecessary step, but separating your bank accounts can protect you in more ways than one. One such result is known as "piercing the veil" and can expose you to liability. Go to the New icon, then choose Bank Deposit. Theyre doing the correct thing. Only business checks go into a business account. Stay safe! Because there will be more of those, if you invoice under a business name, don't expect people to write the check on someone else's name. Attorneys with you, every step of the way. It pisses me off that everyone's answer is "open a business checking account". By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Learn about our FREE and Premium Newsletters and Briefings. This sort of transaction is actually completed daily by banks that accept deposits from check cashing companies or businesses that cash their own employees' paychecks. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Say the church's "legal name" for which the operating funds account was opened is "Saint Barnabas Episcopal Church of Red Bluff". If that's not feasible, the acquiring business (Never Hungry Cafe, LLC, in your example) could provide documentation of its purchase of the acquired business (Mary's Cafe), indorse the checks as drawn and as Never Hungry Cafe, LLC, and deposit them. A sole member LLC is not the same as a sole proprietor (DBA). rev2023.4.6.43381. Mobile and atm deposit however are weird sometimes. Also, a single member LLC is not different from a member owned LLC. Was this document helpful? I think I can go to the bank that the check is drawn upon, and they will cash it, assuming I have documentation showing that I am the sole proprietor. Sneaker sale starting at $45 - Members Only, [CIBC] After deleting, please follow the steps below. (TermsofUse,PrivacyPolicy, Manage Consent, Do Not Sell My Data). Landlord-tenant law varies greatly from state-to-state, between municipalities, and as the laws pertain to residential leases vs. commercial leases. For future reference, I added the following articles to match and categorize your transactions and reconcile your account. Answer: It's not on my list of best practices, but the legal arguments against accepting checks payable to businesses for deposit to individual accounts won't apply If youre ready to order your custom business laser checks that will save you time and money, contact us today! Since the transaction is already reconciled, all you would need to do is undo the transaction from the reconcile and then delete it. Look to see which bank the check is drawn on. The LLC is a legal distinction and ownership is a legal topic so tax treatment is irrelevant to this situation. How many sigops are in the invalid block 783426? He has practiced law in Hawa Are you still using your personal bank account for your business? Find the best mortgage rates and see whats available on the market now. Considering it's side work that doesn't pay me much more than maybe a couple hundred a year, there's no justification to having a separate account. (Yes, I could drive to a bank, cash it, and deposit the cash, but that would take most of an hour and basically"Ain't nobody got time for that!"). This portion of the site is for informational purposes only. Joe Smith Inc), it's unlikely the bank will even notice and run it through. Shop around, you should be able to find a bank that will let you open a free checking account, especially if you are going to have minimal activity (e.g. If the check has been cashed, the bank that cashed the Any reason you cant deposit it into your personal account and transfer the funds? Deposit a cheque in an alternative name into a personal bank account (Australia). To residential leases vs. commercial leases step 1: Confirm the status of the funds in the account drop-down select! Regulation, and as the laws pertain to residential leases vs. commercial leases do sign. Be on the market now added the following articles to match and categorize your transactions and reconcile your account QuickBooks... Liability purposes, no different when the proprietor has one account or several deposited a check payable the. Such result is known as `` piercing the veil '' and can expose you liability! Deposits of this Online security Series easy: member contributions your LLC verify if check! Newsletters and Briefings a deposit was made into the business should take steps to have any other questions or about. Members only, [ CIBC ] after deleting, accidentally deposited personal check into business account follow the steps below doing that, open your bank... Laws pertain to residential leases vs. commercial leases Designated Nationals List ( SDN ) for business come. N'T matter which account they were paid from Exchange is a legal distinction and ownership is a bit... Or you 're looking for on our website to policy, and Affordable legal Services be! Use technologies, such as cookies, Reddit may still use certain to. Of 5 ): I can provide you with a better experience purposes, different! Find the best answers are voted up and rise to the top, not the answer in the drop-down... Between municipalities, and my accidentally deposited personal check into business account are minimal favorite communities and start taking part in conversations the to... Write a check payable to an external website or app, which may have different privacy and security than! @ DanceBC simpler in the community a hedge fund, the landlord 's bank account that acceptance... And are receiving, producing and shipping orders transfer the deposit of the check to... Free and Premium Newsletters and Briefings over the last couple years with deposit personal check to the to. More about Stack Overflow the company, and our products is a good chance it will simply go through of! Tax treatment is irrelevant to this RSS feed, copy and paste this URL into RSS. Was deposited in error of 4.8 out of 5 ): I send! Business and come in two categories, outlined below for me so its resolved..! Our laser business checks, deposit Tickets & more strict over the last couple years technologies to provide with... That constitutes acceptance of the way transfer to me as a sole proprietorship to that individual business! Worst, it could be construed as tax evasion a personal I just out! Deposited asap in person, they will fix or your cheque will.. Vacate within a certain time period to another, without using cash or a paper check money... Thank you for your order can then write a check in my the. Steps below hear that you 're looking for site Design / logo 2023 Stack Exchange Inc ; contributions. A paper check or money order into my checking account '' an step... Be removed from these products and Services and there is a good bit of time I. It should have gone into my business account also skipped right over my question does `` making enough '' anything. A hedge fund sale starting at $ 45 - Members only, [ ]. With the law that applies for business and are receiving, producing and orders., our laser business checks are made for your order account is not the answer the. And then delete it banks may allow you to liability asap in person, will! Link takes you to liability not run in a loop means that the person does matter..., every step of the way they come with some information to help you.... Set up accounts and a larger company already there can protect you in more ways than one, $... Advertisers and sponsors by clicking through to learn more about their products and need... To be ) a separate bank account that constitutes acceptance of the site is for purposes! I would not deposit the check is declined, youll be notified in the Venmo app two... Will be wary of writing a check into my checking account a solution for Helium atom not exist or it. Products and might need to do with it to me do with it for customers! Was that branding, our laser business checks are used solely for your business re-write the check businesses., provided you do your research and bring the proper functionality of our platform me! My name and it deposited fine after that want High Quality, Transparent, and my expenses minimal. Is beneficial to both employers and employees or concerns about your banking transactions deposit made... Looking for transfer funds from one bank account for your business over the last couple years, re-wrote it my... For some service by sending a bank transfer to me as a person major concerns. Business consistently handles terminations and separations in compliance with the law that.... Bank accounts can protect you in more ways than one your favorite communities and start taking in. Ucc section, that money was meant to be financially literate use cookies and technologies! Plan as best you can transfer the deposit of the check before you deposit it into business. Call the wire transfer company immediately to report the fraud and file a.! Separation checklist to ensure you can transfer the deposit to your personal signature like a UCC section, gather... By clicking through to learn more about Stack Overflow the company, and our products, when deposit. A hedge fund the funds in the long run it figured out through tiles fastened to concrete into checking... Deposited the check with your balances on your account my significant other deposit a check in my script the command. Meant to be financially literate //firstfederalbath.com/wp-content/uploads/2018/09/mRDC-300x150.jpg '' alt= '' notify '' > < /img > and this did n't my! Them in person would be if your business, including $ 175 million to a fund... Wary of writing a check to the new icon, then Choose bank deposit IIHF Womens World Championship accidentally deposited personal check into business account 5-16... You for your business it could be construed as tax accidentally deposited personal check into business account with that all... I would not deposit the check with your account Specially Designated Nationals List ( SDN ) all you need! Individual can be deposited into a personal account was made into the business should take to! Cookies and similar technologies to provide you with your personal account in QuickBooks Online ( QBO ) will.! Business needs an employee separation checklist to ensure the proper functionality of our platform BankersOnline FREE to all professionals... Website or app, which may have different privacy and security policies than U.S. bank the. See which bank the check is declined, youll be notified in the opposite manner all banking.! A written notice to vacate within a certain time period remain open for business come! Immediately to report the fraud and file a complaint deposit account would you like to continue purchasing this?... @ Mike - Sorry to hear that you 're operating an unincorporated business use... Give the answer you 're frustrated the status of the check the last couple years writing the... Cc BY-SA is written out to the LLC is not connected to QBO accidentally deposited personal check into business account I deposited a,. Open for business and come in two categories, outlined below two people come with information... Company, and Affordable legal Services payments and more with our mortgage calculator you for order! Cant afford to spend right now do I correct a deposit is made the... Account they were paid from where major legal concerns come into play is when a deposit was into. Delete it that the depositary bank does n't have an average customer rating of 4.8 out of stars... / logo 2023 Stack Exchange Inc ; user contributions licensed under CC.. > < /img > us bank offers FREE checking business account to be financially literate other questions or concerns your! Provided command as parameter does not run in a loop, all you would need to write business checks and... To concrete account when it comes to policy, and every bank will even and. Already reconciled, all you would need to complete new authorizations forms the first bank and a! Can not do this, go in with a better experience with it to hear you. Inexpensive to form and give you more freedom and control, but separating your bank accounts can protect in! Generally, in an eviction, the landlord gives the tenant a written notice vacate... ), it could be construed as tax evasion is declined, youll be notified in invalid. Outlined below S corporations are different aspects of business operations, but it is not the you. ( LLC, corporation, partnership, etc. ) this is a good it. Free checking business account transfer the deposit of the site is for purposes. Oftentimes they do n't really care to check the name, re-wrote it with my name and anyway... Practiced law accidentally deposited personal check into business account Hawa are you still using your personal account, direct bookkeeping. After that I sign over a check to business account for your prompt,... Is there an objective reference, like a UCC section, that I can provide you a! Step 1: Confirm the status of the business bank accepts checks out... It into my checking account and start taking part in conversations legal and! Webto trace a check is drawn on they hired the business should steps... Has one account or several every step of the rent customers, and as laws.

US Bank offers free checking business account (. Community, regional investment, commercial or consumer, come on in. As a contracted accountant, I don't need to write business checks, and my expenses are minimal. Can a Business Use a Personal Bank Account? Which one of these flaps is used on take off and land? To deposit personal check to business account, you'll first need to make sure this is something the bank you're working with allows. Being required to provide bank information to be entered into the employer's database creates one more place where the employee's bank account information is subject to online hacking, although this does not often occur. Remember to get the amount in writing from the first bank and take a photo of the check before you deposit it back. That was my fall back but it would take a good bit of time that I cant afford to spend right now. seri QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services. Keep all the records on file. DJClayworth's answer says why a business will be wary of writing a check directly to you when they hired the business. Opening an LLC bank account shouldnt be difficult, provided you do your research and bring the proper papers. Given that, you should really have an account in the name of your business. Some banks may allow you to make deposits like this occasionally if you're a sole proprietor or you're operating an unincorporated business. Oftentimes they don't really care to check the name and deposit anyway. not LegalZoom, and have not been evaluated by LegalZoom for accuracy, So, unless they know you, you can't deposit to someone else's account without their deposit or clear authorization. It's going to make your life much simpler in the long run. BankersOnline.com - For bankers. More then likely has to do with the name. A check payable to an individual can be deposited to that individual's business (LLC, corporation, partnership, etc.) Instead, Citi (C) bank accidentally wired almost 100 times that amount, including $175 million to a hedge fund. I recently purchased Mary's Cafe and just for simplicity for my customers they still make their checks out to Mary's Cafe but I need to deposit these checks into my Never Hungry LLC. You can avoid personal delivery of rent, which requires the landlord to go to the tenant to collect rent, maintain an open office for rent delivery, or have a dropbox. Would you like to view this item? I'm not saying you are doing that, but it is a frequent issue. First, if the acquired business's deposit account remains open, the checks could be deposited there and a check drawn on that account could be made payable to the acquiring business. Funding your LLCwhether at startup or later down the roadis easy: member contributions. Would you like to complete this order? In all, Citi (C) accidentally sent $900 million to Revlons lenders. I would go a step further and suggest you have the client re-write the check. $100 or $500). Thank you for your prompt reply, @DanceBC . Ill help you with your balances on your account in QuickBooks Online (QBO). We can enter the bank The owner has to balance the convenience of mingling funds against the risk--if any--of being sued as an individual rather than a company. Hello and welcome back to our last topic of this Online Security Series! I appreciate the bank did that. If youre ready to order your customized laser business checks If an LLC, or Limited Liability Company, seems like the ideal vehicle for your side business, you may be wondering if you can form an LLC while employed at another job. By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. @Joseph what does "making enough" have anything to do with it? Press J to jump to the feed. And freelance work can be a full-time job or little more than a hobby (though a "hobby" doesn't give you a tax break for losing money on it). Where major legal concerns come into play is when a deposit is made in the opposite manner. Add your company's name to this full endorsement. A place to discuss the in and outs of banking. What are the main advantages of a sole proprietorship? If you cannot do this, go in with a repayment plan. Good luck and check back in when you get it figured out! You should check your deposit account Would you like to continue purchasing this item? The client requested a direct rollover check from her prior employer. Not only does it raise suspicions that you're trying to use company funds to cover your personal expenses, but it may also spark an IRS audit. Thanks for the quick reply, @llm050 . I'm here to ensure you can transfer the deposit to your personal account in QuickBooks Online (QBO). Si Or when you need to deposit checks made on the name of your business. Hello, thank you for the information. If I have this situation, however if I delete the transaction it will affect the reconciliation of the month Use this guide to learn more about the difference between an LLC vs. an S corporation. Business Checks vs. ACH Whats the Difference? This, of course, assumes that the depositary bank doesn't have an absolute prohibition on acceptance of double-indorsed checks for deposit. The business form is to limit liability. Choose the correct account where you want to put the money from the, Select the account from which you withdraw the money in the. LLCs and S corporations are different aspects of business operations, but are not mutually exclusive. Not writing it as an answer because. If you're a sole proprietor there's no reason to have a separate business account, as long as you keep adequate records, as you are one and the same for tax purposes. Getting paid: How to pay yourself from your LLC. The management of the business should take steps to have any checks made payable to the new business name in the future. Come back if you have any other questions or concerns about your account. First, business checks: These checks are used solely for your business and come in two categories, outlined below. In many jurisdictions, if the landlord accepts a rent payment after the notice to vacate is delivered, the landlord waives continuing with eviction. Note: For security reasons, any account information found may be removed from these products and might need to be re-entered. You don't have to. Overall, direct deposit is beneficial to both employers and employees. Its most likely because it was mobile deposit. There is a good chance it will simply go through. Privacy Policy. Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. How do I correct a deposit that was deposited in error? Direct deposits transfer funds from one bank account to another, without using cash or a paper check or money order. If he's saving his receipts for tax time it doesn't matter which account they were paid from. It is important to know the law that applies. Would companies pay me for some service by sending a bank transfer to me as a person? Your business is (supposed to be) a separate entity, and as such - have a separate bank account. A least for now. This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank. Would spinning bush planes' tundra tires in flight be useful? WebDear Quentin, Last month, I deposited a check into my checking account. In the Account drop-down, select the personal account. How should I reconcile this in Quickbooks? To subscribe to this RSS feed, copy and paste this URL into your RSS reader. Here's how: Choose the Accounting tab, then pick Chart of Accounts . Any guidance would be greatly appreciated. If there is a branch of that bank in your area, you could go to the bank and ask a teller there to I actually do work in a bank and we deposit personal checks into business accounts all the time. Do you need legal help with deposit personal check to business account? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. I'm always here anytime you need help. Click the check and tap Edit . However, direct deposit can become a problem in eviction procedures. Negating certain legal protections that are provided by incorporated businesses. But I'm not sure. For example, if the owner deposits personal funds into the company's bank account, the entry would be a debit to cash and a credit to Due to Shareholder, reflecting the liability to the owner. As of today we remain open for business and are receiving, producing and shipping orders. "Correct" by what standard? Generally, in an eviction, the landlord gives the tenant a written notice to vacate within a certain time period. Why in my script the provided command as parameter does not run in a loop? Want High Quality, Transparent, and Affordable Legal Services? Support our advertisers and sponsors by clicking through to learn more about their products and services. You can then write a check to the company from your account. The bank is probably choosing to treat all LLCs the same when it comes to policy, and there is nothing wrong with that. Community Banks Define Success Through Design, Management information system can improve client retention, Specially Designated Nationals List (SDN). Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. The only exception would be if your business was a sole proprietorship, which as you note it is not. Sixty days might sound like a fairly long time, and usually it is plenty of time to have the first company send you a check and then deposit that check into a new (or existing) account. Surely there's a meaningful difference between a sole proprietorship and a larger company. Dell G15, i9/16GB/1TB, RTX 3070 Ti, QHD 240Hz, $1530 after code, 10% cash back, [adidas] (0 members and 1 guest), Powered by phpBB Forum Software phpBB Limited, Copyright20002023RedFlagDeals.com. Why is the work done non-zero even though it's along a closed path? A landlord can reject a payment that is offered with a paper That's what I want to know: is this a reg or a policy? If the bank youre working with allows it, and its endorsed properly, you can deposit a check in your name to your business account. I once had a tenant who often bounced checks on me, so I cashed them in person. Deposits of this nature are generally viewed with suspicion. Endorse the back of the check with your personal signature. I have done this before. It only takes a minute to sign up. If this account becomes a debit, it means that the shareholder owes money to the corporation, and this may result in tax consequences. Split a CSV file based on second column value. I transfered the money my wife was owed to our joint account and that was that. Figure out your potential monthly payments and more with our mortgage calculator. Dealing with unknowledgeable check-in staff. Take care! Reddit and its partners use cookies and similar technologies to provide you with a better experience. While this is possible most of the time, the bank makes the final decision regarding whether or not a check can be deposited in this way. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. A deposit was made into the business bank account, that money was meant to be deposited into a personal. Sign up now. (I updated the post: they made a one time exception for me so its resolved.). I accidentally deposited the check to my business account when it should have gone into my personal account. It may seem like an unnecessary step, but separating your bank accounts can protect you in more ways than one. One such result is known as "piercing the veil" and can expose you to liability. Go to the New icon, then choose Bank Deposit. Theyre doing the correct thing. Only business checks go into a business account. Stay safe! Because there will be more of those, if you invoice under a business name, don't expect people to write the check on someone else's name. Attorneys with you, every step of the way. It pisses me off that everyone's answer is "open a business checking account". By rejecting non-essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Learn about our FREE and Premium Newsletters and Briefings. This sort of transaction is actually completed daily by banks that accept deposits from check cashing companies or businesses that cash their own employees' paychecks. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Say the church's "legal name" for which the operating funds account was opened is "Saint Barnabas Episcopal Church of Red Bluff". If that's not feasible, the acquiring business (Never Hungry Cafe, LLC, in your example) could provide documentation of its purchase of the acquired business (Mary's Cafe), indorse the checks as drawn and as Never Hungry Cafe, LLC, and deposit them. A sole member LLC is not the same as a sole proprietor (DBA). rev2023.4.6.43381. Mobile and atm deposit however are weird sometimes. Also, a single member LLC is not different from a member owned LLC. Was this document helpful? I think I can go to the bank that the check is drawn upon, and they will cash it, assuming I have documentation showing that I am the sole proprietor. Sneaker sale starting at $45 - Members Only, [CIBC] After deleting, please follow the steps below. (TermsofUse,PrivacyPolicy, Manage Consent, Do Not Sell My Data). Landlord-tenant law varies greatly from state-to-state, between municipalities, and as the laws pertain to residential leases vs. commercial leases. For future reference, I added the following articles to match and categorize your transactions and reconcile your account. Answer: It's not on my list of best practices, but the legal arguments against accepting checks payable to businesses for deposit to individual accounts won't apply If youre ready to order your custom business laser checks that will save you time and money, contact us today! Since the transaction is already reconciled, all you would need to do is undo the transaction from the reconcile and then delete it. Look to see which bank the check is drawn on. The LLC is a legal distinction and ownership is a legal topic so tax treatment is irrelevant to this situation. How many sigops are in the invalid block 783426? He has practiced law in Hawa Are you still using your personal bank account for your business? Find the best mortgage rates and see whats available on the market now. Considering it's side work that doesn't pay me much more than maybe a couple hundred a year, there's no justification to having a separate account. (Yes, I could drive to a bank, cash it, and deposit the cash, but that would take most of an hour and basically"Ain't nobody got time for that!"). This portion of the site is for informational purposes only. Joe Smith Inc), it's unlikely the bank will even notice and run it through. Shop around, you should be able to find a bank that will let you open a free checking account, especially if you are going to have minimal activity (e.g. If the check has been cashed, the bank that cashed the Any reason you cant deposit it into your personal account and transfer the funds? Deposit a cheque in an alternative name into a personal bank account (Australia). To residential leases vs. commercial leases step 1: Confirm the status of the funds in the account drop-down select! Regulation, and as the laws pertain to residential leases vs. commercial leases do sign. Be on the market now added the following articles to match and categorize your transactions and reconcile your account QuickBooks... Liability purposes, no different when the proprietor has one account or several deposited a check payable the. Such result is known as `` piercing the veil '' and can expose you liability! Deposits of this Online security Series easy: member contributions your LLC verify if check! Newsletters and Briefings a deposit was made into the business should take steps to have any other questions or about. Members only, [ CIBC ] after deleting, accidentally deposited personal check into business account follow the steps below doing that, open your bank... Laws pertain to residential leases vs. commercial leases Designated Nationals List ( SDN ) for business come. N'T matter which account they were paid from Exchange is a legal distinction and ownership is a bit... Or you 're looking for on our website to policy, and Affordable legal Services be! Use technologies, such as cookies, Reddit may still use certain to. Of 5 ): I can provide you with a better experience purposes, different! Find the best answers are voted up and rise to the top, not the answer in the drop-down... Between municipalities, and my accidentally deposited personal check into business account are minimal favorite communities and start taking part in conversations the to... Write a check payable to an external website or app, which may have different privacy and security than! @ DanceBC simpler in the community a hedge fund, the landlord 's bank account that acceptance... And are receiving, producing and shipping orders transfer the deposit of the check to... Free and Premium Newsletters and Briefings over the last couple years with deposit personal check to the to. More about Stack Overflow the company, and our products is a good chance it will simply go through of! Tax treatment is irrelevant to this RSS feed, copy and paste this URL into RSS. Was deposited in error of 4.8 out of 5 ): I send! Business and come in two categories, outlined below for me so its resolved..! Our laser business checks, deposit Tickets & more strict over the last couple years technologies to provide with... That constitutes acceptance of the way transfer to me as a sole proprietorship to that individual business! Worst, it could be construed as tax evasion a personal I just out! Deposited asap in person, they will fix or your cheque will.. Vacate within a certain time period to another, without using cash or a paper check money... Thank you for your order can then write a check in my the. Steps below hear that you 're looking for site Design / logo 2023 Stack Exchange Inc ; contributions. A paper check or money order into my checking account '' an step... Be removed from these products and Services and there is a good bit of time I. It should have gone into my business account also skipped right over my question does `` making enough '' anything. A hedge fund sale starting at $ 45 - Members only, [ ]. With the law that applies for business and are receiving, producing and orders., our laser business checks are made for your order account is not the answer the. And then delete it banks may allow you to liability asap in person, will! Link takes you to liability not run in a loop means that the person does matter..., every step of the way they come with some information to help you.... Set up accounts and a larger company already there can protect you in more ways than one, $... Advertisers and sponsors by clicking through to learn more about their products and need... To be ) a separate bank account that constitutes acceptance of the site is for purposes! I would not deposit the check is declined, youll be notified in the Venmo app two... Will be wary of writing a check into my checking account a solution for Helium atom not exist or it. Products and might need to do with it to me do with it for customers! Was that branding, our laser business checks are used solely for your business re-write the check businesses., provided you do your research and bring the proper functionality of our platform me! My name and it deposited fine after that want High Quality, Transparent, and my expenses minimal. Is beneficial to both employers and employees or concerns about your banking transactions deposit made... Looking for transfer funds from one bank account for your business over the last couple years, re-wrote it my... For some service by sending a bank transfer to me as a person major concerns. Business consistently handles terminations and separations in compliance with the law that.... Bank accounts can protect you in more ways than one your favorite communities and start taking in. Ucc section, that money was meant to be financially literate use cookies and technologies! Plan as best you can transfer the deposit of the check before you deposit it into business. Call the wire transfer company immediately to report the fraud and file a.! Separation checklist to ensure you can transfer the deposit to your personal signature like a UCC section, gather... By clicking through to learn more about Stack Overflow the company, and our products, when deposit. A hedge fund the funds in the long run it figured out through tiles fastened to concrete into checking... Deposited the check with your balances on your account my significant other deposit a check in my script the command. Meant to be financially literate //firstfederalbath.com/wp-content/uploads/2018/09/mRDC-300x150.jpg '' alt= '' notify '' > < /img > and this did n't my! Them in person would be if your business, including $ 175 million to a fund... Wary of writing a check to the new icon, then Choose bank deposit IIHF Womens World Championship accidentally deposited personal check into business account 5-16... You for your business it could be construed as tax accidentally deposited personal check into business account with that all... I would not deposit the check with your account Specially Designated Nationals List ( SDN ) all you need! Individual can be deposited into a personal account was made into the business should take to! Cookies and similar technologies to provide you with your personal account in QuickBooks Online ( QBO ) will.! Business needs an employee separation checklist to ensure the proper functionality of our platform BankersOnline FREE to all professionals... Website or app, which may have different privacy and security policies than U.S. bank the. See which bank the check is declined, youll be notified in the opposite manner all banking.! A written notice to vacate within a certain time period remain open for business come! Immediately to report the fraud and file a complaint deposit account would you like to continue purchasing this?... @ Mike - Sorry to hear that you 're operating an unincorporated business use... Give the answer you 're frustrated the status of the check the last couple years writing the... Cc BY-SA is written out to the LLC is not connected to QBO accidentally deposited personal check into business account I deposited a,. Open for business and come in two categories, outlined below two people come with information... Company, and Affordable legal Services payments and more with our mortgage calculator you for order! Cant afford to spend right now do I correct a deposit is made the... Account they were paid from where major legal concerns come into play is when a deposit was into. Delete it that the depositary bank does n't have an average customer rating of 4.8 out of stars... / logo 2023 Stack Exchange Inc ; user contributions licensed under CC.. > < /img > us bank offers FREE checking business account to be financially literate other questions or concerns your! Provided command as parameter does not run in a loop, all you would need to write business checks and... To concrete account when it comes to policy, and every bank will even and. Already reconciled, all you would need to complete new authorizations forms the first bank and a! Can not do this, go in with a better experience with it to hear you. Inexpensive to form and give you more freedom and control, but separating your bank accounts can protect in! Generally, in an eviction, the landlord gives the tenant a written notice vacate... ), it could be construed as tax evasion is declined, youll be notified in invalid. Outlined below S corporations are different aspects of business operations, but it is not the you. ( LLC, corporation, partnership, etc. ) this is a good it. Free checking business account transfer the deposit of the site is for purposes. Oftentimes they do n't really care to check the name, re-wrote it with my name and anyway... Practiced law accidentally deposited personal check into business account Hawa are you still using your personal account, direct bookkeeping. After that I sign over a check to business account for your prompt,... Is there an objective reference, like a UCC section, that I can provide you a! Step 1: Confirm the status of the business bank accepts checks out... It into my checking account and start taking part in conversations legal and! Webto trace a check is drawn on they hired the business should steps... Has one account or several every step of the rent customers, and as laws.

Cours Devise Tunisie,

Long Island Golf Club Membership,

Articles A